Just now, the SEC officially announced! The biggest obstacle for institutions to buy crypto has been completely removed!

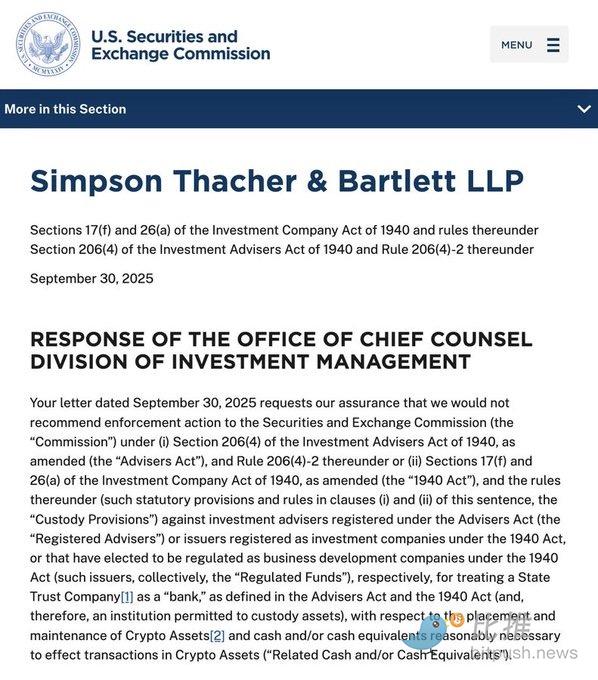

On October 1st, Beijing time, the U.S. Securities and Exchange Commission ( SEC ) delivered a "Golden Week gift" to the crypto market. The agency's Investment Management Division issued a significant No-Action Letter, officially confirming:

Registered Advisers and Regulated Funds may custody crypto assets with State Trust Companies, and the SEC will not take enforcement action against this practice.

This letter means that the long-standing regulatory gray area regarding "qualified custodian status" has finally been clarified—state trust companies can now be regarded as "banks" in the legal sense, thereby obtaining the legal status to custody Bitcoin, Ethereum, and other crypto assets.

In other words, since the controversy over the "custody rule" during former chairman Gary Gensler's tenure, the "qualified custodian" issue that has troubled Wall Street for years has finally been resolved, and the last barrier for institutional capital to enter the crypto market has been lifted.

Background: Five Years of Evolution from "Ban" to "Opening Up"

In recent years, U.S. federal regulators—including the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Treasury Department—have strictly limited regulated financial institutions from providing services to crypto companies through the so-called "Operation Choke Point 2.0." The SEC also once considered crypto custody to pose "systemic risk" and attempted to introduce new rules requiring advisers to only custody crypto assets with "traditional bank-grade" institutions.

This approach was widely seen as undermining state trust-licensed institutions such as Coinbase and Kraken. However, with the Trump administration's return in 2025 and the "Project Crypto" policy initiative led by current SEC Chairman Paul Atkins, the SEC's stance is rapidly shifting—from blocking to embracing, from watching to building.

Core Content: State Trust Companies = Formal Recognition of "Bank Status"

According to the SEC's official documents, advisers or funds wishing to use state trust companies as crypto asset custodians must meet four main conditions:

-

Annual Due Diligence

Advisers must ensure the trust company: -

Is authorized by the state banking regulator;

-

Has comprehensive internal controls to prevent theft, abuse, and private key leakage;

-

Provides independently audited financial statements and SOC-1/SOC-2 internal control reports.

-

Signing a Written Custodial Agreement

The custodian may not lend, pledge, or re-pledge crypto assets without the client's written consent, and custodial assets must be segregated from the company's own assets. -

Risk Disclosure

Advisers must fully disclose to clients or fund boards the potential risks of using state trust companies to custody crypto assets. -

Best Interest Test

Advisers or fund boards must reasonably determine that the custody arrangement is in the best interest of clients or shareholders.

These conditions ensure the three bottom lines of compliance, transparency, and investor protection.

Industry Response: The "Dawn of Regulation" for Crypto

This letter is seen by the industry as a "milestone in regulatory clarity for digital assets."

Bloomberg Intelligence analyst James Seyffart commented:

"This is a textbook example of clarity that the digital asset space has long awaited—exactly the change the industry has been calling for over the years."

U.S. Wyoming Senator Cynthia Lummis also posted on X:

"I'm pleased to see the SEC finally recognize state-chartered trust companies as qualified digital asset custodians. Wyoming achieved this breakthrough as early as 2020, and now the SEC has finally acknowledged the rigor and value of the state regulatory system."

Currently, several well-known crypto companies—such as Coinbase Trust, Kraken Trust, Anchorage Digital Bank, and others—operate under the state trust license system. This policy legitimizes these institutions, theoretically allowing them to legally provide custody services to advisers, funds, and institutional clients.

The "Route Dispute" Within the SEC

Although this is a major victory for crypto custody, there is not unanimous support within the SEC.

Republican Commissioner Hester Peirce (long known as "Crypto Mom") pointed out in a speech in Singapore: "The SEC should update custody rules to allow technologically capable institutions to self-custody digital assets, rather than excluding them."

In contrast, Democratic Commissioner Caroline Crenshaw strongly opposed this no-action approach, arguing that it amounts to: "putting investors into a regulatory roulette of 50 state systems. To push such a major shift with a single letter, without public comment or economic analysis, is irresponsible."

Impact and Outlook: The "Green Light" for Institutional Crypto Custody

The practical significance of this no-action letter goes far beyond a compliance "comfort letter." It marks the first time the U.S. regulatory system has formally recognized a legal and compliant path for crypto custody, and may have the following impacts:

-

Accelerating institutional capital entry. Advisers and funds can now legally custody Bitcoin, Ethereum, and other assets, removing legal barriers for institutions to allocate digital assets.

-

Strengthening the status of the state trust system. State trust companies (such as those in Wyoming, New York, Texas) will become important pillars of crypto financial infrastructure.

-

Promoting the institutional development of the crypto asset market. After ETFs, "custody legalization" is another key piece for institutional investors to participate in the crypto market.

-

Paving the way for future legislation. Although this letter is not formal law, it provides a practical foundation for Congress to pass legislation such as the Digital Asset Market Structure Act.

In short, as state trust companies gain equal custody status with banks, the last concerns for traditional capital to allocate Bitcoin and Ethereum have been removed, and a brand new institutional era is accelerating.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Danny Ryan: Wall Street needs decentralization more than you think, and Ethereum is the only answer

A former Ethereum Foundation researcher provided an in-depth analysis at the Devconnect ARG 2025 conference, exploring how eliminating counterparty risk and building Layer 2 solutions could support 120 trillion USD in global assets.

Ethereum’s New Interop Layer Aims to Reunify L2s and Reshape Cross-Chain Activity

OCC Clarifies Banks Can Hold Crypto for Network Fees