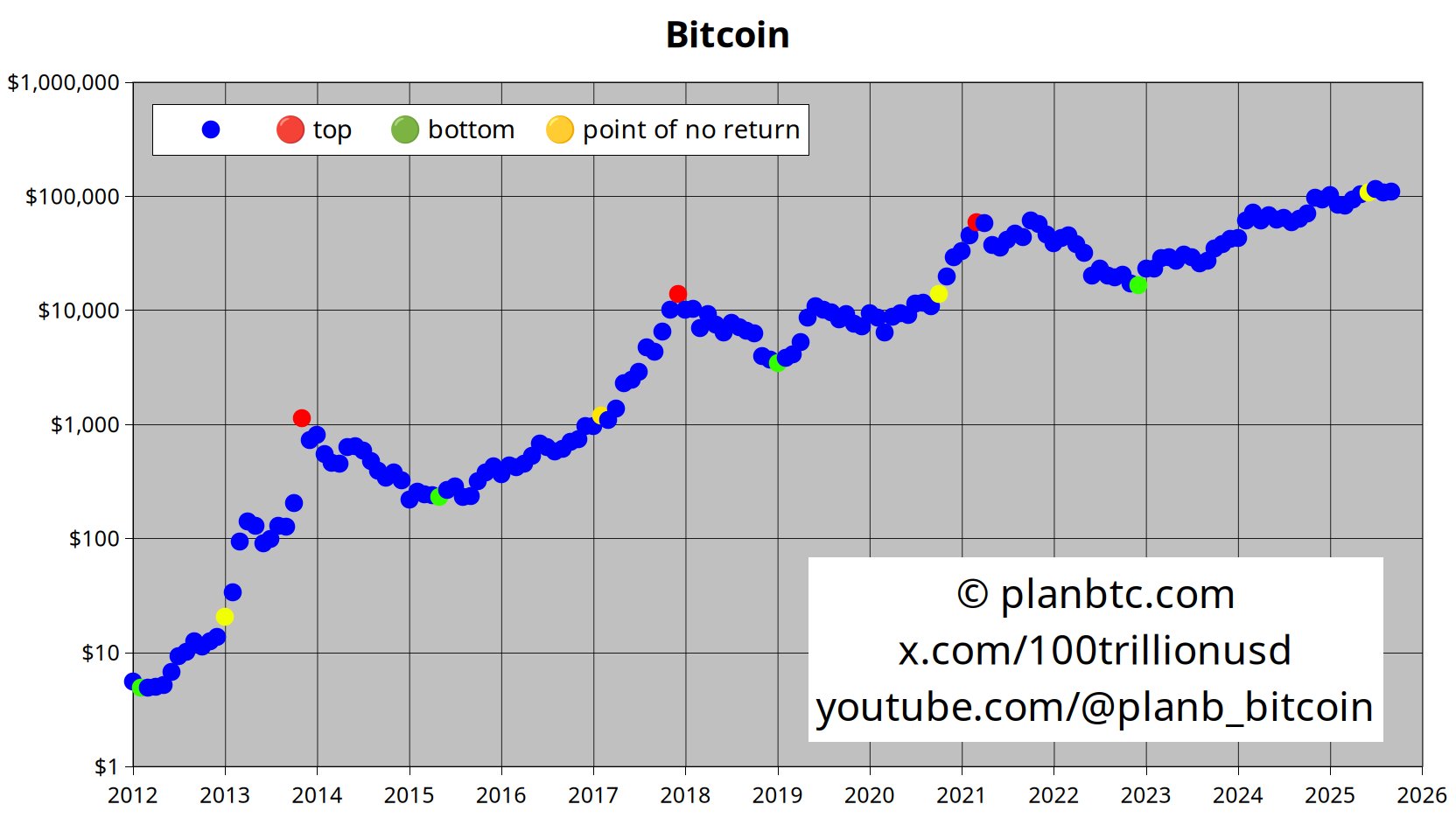

Quant Analyst PlanB Says Bitcoin Now at Point of ‘No Return,’ Similar to 2020, 2017 and 2013 Bull Markets

A popular crypto analyst thinks the Bitcoin ( BTC ) bull market isn’t over yet.

The pseudonymous trader PlanB tells his 2.1 million X followers that BTC has passed the “point of no return.”

“I think [the] Bitcoin bull market has not ended and will continue. I don’t know until when, or how high. It could also be a long, steady uptrend, without FOMO+crash. IMO, we passed the point of no return (yellow dots) in June 2025, similar to October 2020, February 2017 and January 2013.”

Source: PlanB/X

Source: PlanB/X

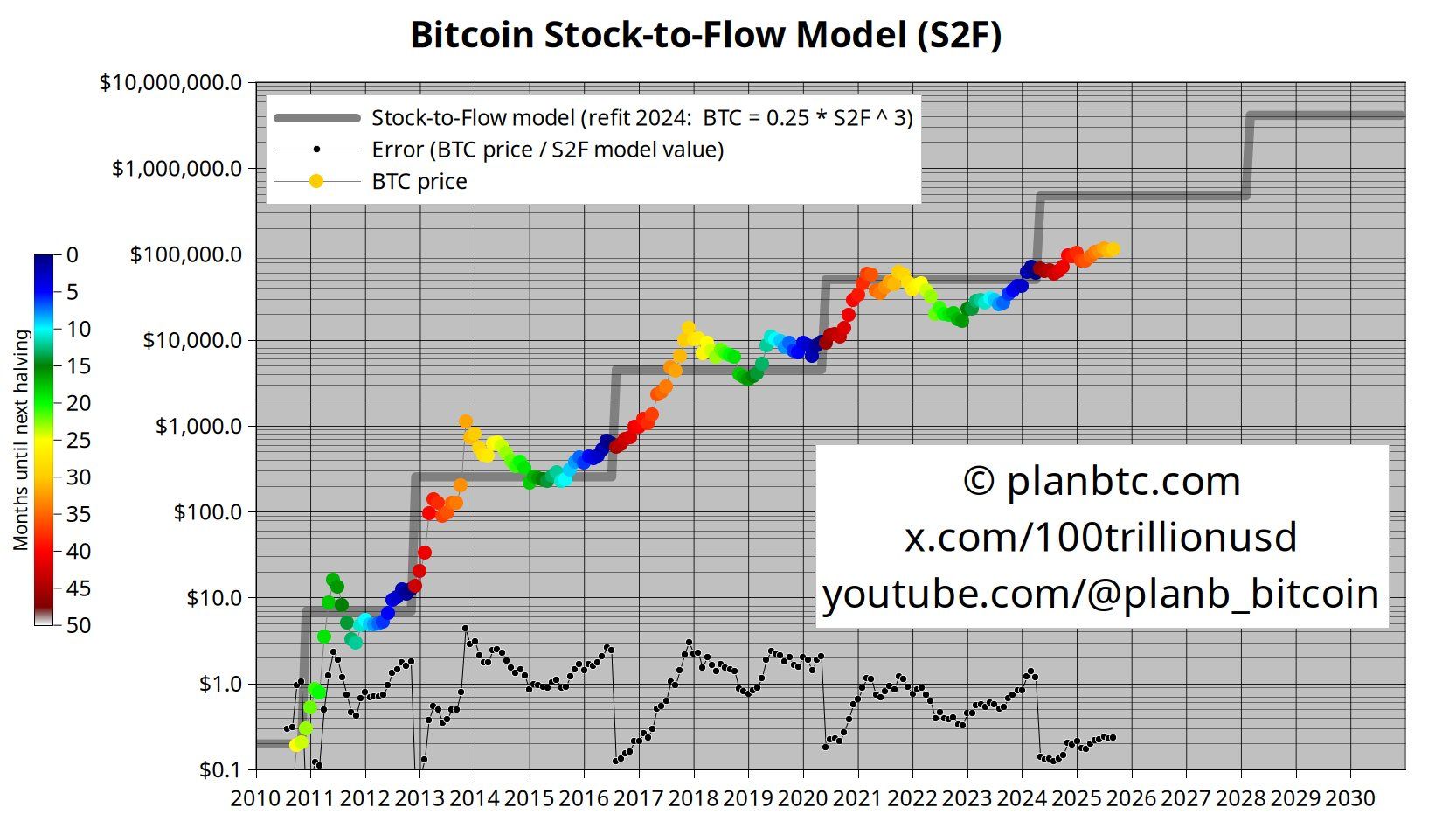

PlanB also shares a graph of the stock-to-flow model, a predictive tool that assumes the scarcity of a commodity drives its price.

“Whether you like it or not, Bitcoin’s value is very much linked to its scarcity. Fiat will be printed, Bitcoin will rise.”

Source: PlanB/X

Source: PlanB/X

While the stock-to-flow model was originally created to track traditional commodities, PlanB was one of the first analysts to apply it to Bitcoin.

Earlier this month, the crypto analyst argued that all asset prices – including gold, BTC, and the S&P 500 – have been rising during the last decade due to the Fed printing money.

“How will there be diminishing returns when debasement is exponential? All asset prices increased exponentially last 10 years (driven by money printing): -Gold 3x (~$1,000 to ~$3,000) -S&P 3x (~$2,000 to ~$6,000) -Bitcoin 250x (~$400 to ~$100,000). In my opinion, it is a unit of account phenomenon.”

BTC is trading at $114,471 at time of writing. The top-ranked crypto asset by market cap is up nearly 2% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Experiences 150% Price Jump and Growing Institutional Interest: Examining Blockchain’s Strength During Economic Uncertainty

- DASH surged 150% in June 2025 driven by tech upgrades, institutional interest, and favorable policies. - Platform 2.0 enhanced scalability and token support, positioning DASH as a competitive blockchain platform. - Institutional adoption grew in 2025 Q3-Q4 via merchant integrations in emerging markets and decentralized governance. - Macroeconomic factors like Fed policies and M2 growth boosted liquidity, while volatility persisted due to tightening markets. - Future growth depends on 2026 regulatory clar

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.

Cryptos losing momentum among American investors: what the FINRA study reveals

Is Worldcoin (WLD) Poised for a Breakout? This Key Bullish Pattern Suggest So!