Base Leads the NFT Market with 1.27 Million Transactions in a Month

In September, the Base network (Coinbase’s Ethereum solution) made an unexpected breakthrough in the NFT universe. Fueled by the game DX Terminal, the ecosystem surpassed its rivals in number of sales. A sign that a mix of creativity, AI and fun can awaken a market generally losing momentum.

In brief

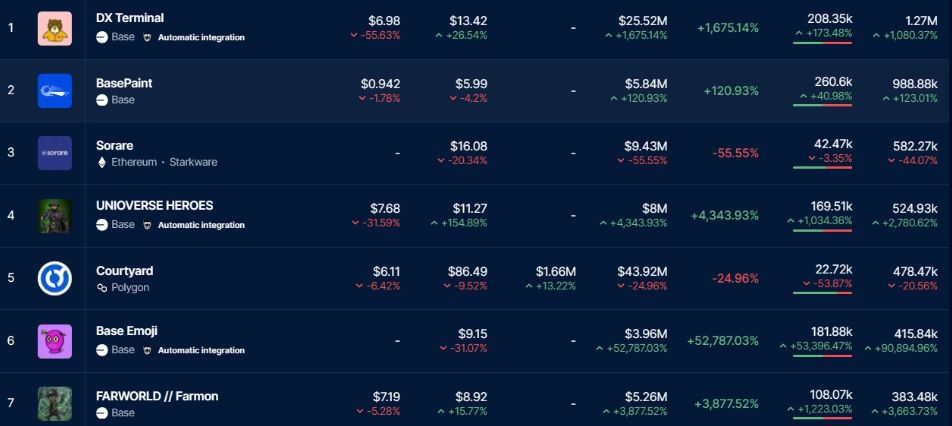

- DX Terminal propelled the Base network to the top of NFT sales in September with more than 1.27 million transactions, an increase of over 1000% in one month.

- While the overall NFT market falls sharply, only projects related to gaming like DX Terminal and Guild of Guardians show growth, unlike major traditional collections such as BAYC or CryptoPunks.

Base takes the lead with DX Terminal

With 1.27 million sales, DX Terminal climbed to first place in the ranking. That’s over 1,000% growth in one month. Alongside it, other projects like BasePaint allowed Base to place five collections in the Top 10. Clearly, this is no longer just a one-off success.

However, in terms of financial volumes, Polygon and Ethereum maintain the NFT advantage. Courtyard (Polygon) leads with $43.9 million, followed by Moonbirds and CryptoPunks (Ethereum). DX Terminal, despite its success, ranks fourth with $25.5 million but marks a record 1,700% increase. Base is making noise in sales, even if the big money still flows elsewhere.

DX Terminal’s success mainly comes from its concept. Each NFT is an autonomous character controlled by an AI, immersed in a sort of retro-futuristic simulation. These characters interact, battle, and evolve based on players’ choices. It’s lively, unpredictable, and above all, entertaining.

The top NFT collections sold in September. Source: DappRadar

The top NFT collections sold in September. Source: DappRadar

Unlike classic NFT games, there’s no promise of financial gains. No “play-to-earn” where you earn tokens to resell. Here, the game currency, called WEBCOIN, is off-chain and has no real value. The team insists: any external token claiming to be official is a scam.

This choice changes everything. Players stay for fun and curiosity, not for speculation. The AI creates unique stories, making the experience more engaging than the repetitive mechanics of many P2E projects.

A declining NFT market, except for games

September was tough for major NFT collections . CryptoPunks, BAYC, and Pudgy Penguins saw their trading volume plunge by 50 to 60%. Even Courtyard and Moonbirds, though leading in volume, fell about 25% and 13% respectively.

In this context, only two projects stand out positively: DX Terminal and Guild of Guardians Heroes (an RPG on Immutable). Both are linked to video gaming, proof that the gaming sector resists general fatigue better.

Interest is shifting. There’s less attraction for mere prestige images but more desire to participate in interactive experiences. And that’s exactly where DX Terminal hits the mark.

Base emerges as a new creative scene for NFTs. Thus, DX Terminal proves it is possible to attract audiences without promising financial gain, simply with a fun experience driven by AI.

The overall market remains dominated by Ethereum and Polygon in terms of volumes, but the trend is clear. Interactive and playful projects attract attention while “blue chips” stagnate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coins Achieve Recognition as Institutional Investors and ETFs Drive Market Changes for 2025

- WLFI's acquisition of Solana-based meme coin SPSC triggered a 139.8% price surge, highlighting institutional interest in meme tokens. - Binance's listing of Dank Penguin and BNBHolder boosted their market caps past $5 million, showcasing exchange-driven momentum in meme coin ecosystems. - Dogecoin's ETF debut via Bitwise's BWOW and Grayscale's GDOG signals growing institutional validation, despite mixed initial performance compared to Solana/XRP ETFs. - 2025 could solidify meme coins and altcoin ETFs as

Bitcoin News Today: Bitcoin Whale Bets $84 Million—Sign of Faith or Disaster Looming?

- A Bitcoin whale opened an $84.19M 3x leveraged long on Hyperliquid after securing $10M in profits, amplifying market volatility and liquidity risks. - Other whales added 20x-25x leveraged positions totaling $75M in BTC/ETH, reflecting heightened confidence in short-term price resilience amid December 2025's 3.64% BTC and 3.79% ETH gains. - Analysts debate the rally's sustainability, citing weak Sharpe ratios (-36% Bull-Bear Index), 30% drawdown from peaks, and structural liquidity challenges favoring ran

Hyperliquid News Today: Avici Soars 1,700%—Is It MoonPay Buzz or Genuine Market Movement?

- Avici (AVICI) surged 1,700% amid speculation of a MoonPay partnership, now valued at $90.7M with $2.5M liquidity. - Analysts highlight its neobank narrative, competing with projects like Cypher while facing $50–$500 price targets implying $1B–$5B valuations. - Security risks persist, exemplified by Upbit's $36M hack and Trezor CEO's warnings on exchange vulnerabilities. - Avici's success hinges on balancing innovation with compliance, regulatory clarity, and execution amid a crowded crypto debit card mar

Bitcoin News Today: Bitcoin Recognized as a Mainstream Asset as Nasdaq Lists IBIT Alongside Leading ETFs

- Nasdaq's ISE proposes tripling Bitcoin options limits for BlackRock's IBIT to 1 million contracts, aligning it with major ETFs like EEM and GLD . - The move reflects IBIT's dominance as the largest Bitcoin options market by open interest, driven by institutional demand for hedging and speculation. - Analysts highlight the normalization of Bitcoin as a tradable asset class, with unlimited FLEX options and JPMorgan's structured notes signaling broader institutional adoption. - Regulatory alignment with gol