Wisconsin bill to introduce licensing exemptions for certain crypto activitiesWhat is Assembly Bill 471?

A new Wisconsin bill introduced in the state legislature wants to exempt individuals and businesses from having to obtain a money transmitter license for activities such as exchanging digital assets, staking, and crypto mining.

- Wisconsin lawmakers introduced Assembly Bill 471 to exempt crypto mining, staking, and non-fiat digital asset transactions from money transmitter licenses.

- The bill, backed by nine Republicans and one Democrat, has been referred to the Committee on Financial Institutions for review.

On Sep. 30, Wisconsin lawmakers introduced Assembly Bill 471, which, if passed, would define exemptions for crypto-focused businesses within the state’s financial framework in a bid to fast-track innovation, reduce regulatory uncertainty, and support the growth of blockchain-based services.

What is Assembly Bill 471?

As per the document, the bill proposes that individuals and companies engaging in mining, staking, blockchain software development, or digital asset transactions that do not involve conversion to legal tender would not be required to hold a license from the Department of Financial Institutions.

Under the current regulatory framework, Wisconsin regulators require businesses to obtain a money transmitter license in order to be able to serve locals. Crypto payment gateway, MoonPay, which secured its own money transmitter license from the Wisconsin Department of Financial Institutions earlier this year, was among the latest companies to expand into the state under the existing framework.

However, since it is a custodial service provider that facilitates the conversion of digital assets into legal tender, it would not fall under the proposed exemptions outlined in Assembly Bill 471.

“Neither a state agency nor a political subdivision may prohibit or restrict a person in accepting digital assets as a method of payment for legal goods and services or in taking custody of digital assets using a self-hosted wallet or hardware wallet,” an excerpt from the bill states.

It also protects the right of people in Wisconsin to “operate” blockchain nodes, “develop software on a blockchain protocol,” transfer cryptocurrencies to another person, and “participate in staking on a blockchain protocol.”

For the bill to pass, it must first move through the Committee on Financial Institutions, where lawmakers will review, debate, and potentially amend it before it can be taken up for a vote in the full Assembly. If it clears that stage, the bill would then head to the state Senate, where it faces a similar committee process and chamber vote before reaching the governor’s desk for final approval.

According to the Legislative Reference Bureau’s filing, the bill has backing from nine Republican sponsors against a single Democrat, giving it the profile of a moderately partisan push. While that support may be enough to advance it through Republican-controlled channels, it will likely need broader bipartisan traction in both chambers to become law.

Wisconsin’s pro-crypto attitude

Wisconsin regulators have long been viewed as relatively open to digital asset innovation compared to other U.S. states. The state made headlines last year when it became the first U.S. state government to gain Bitcoin exposure via an investment in BlackRock’s iShares Bitcoin Trust.

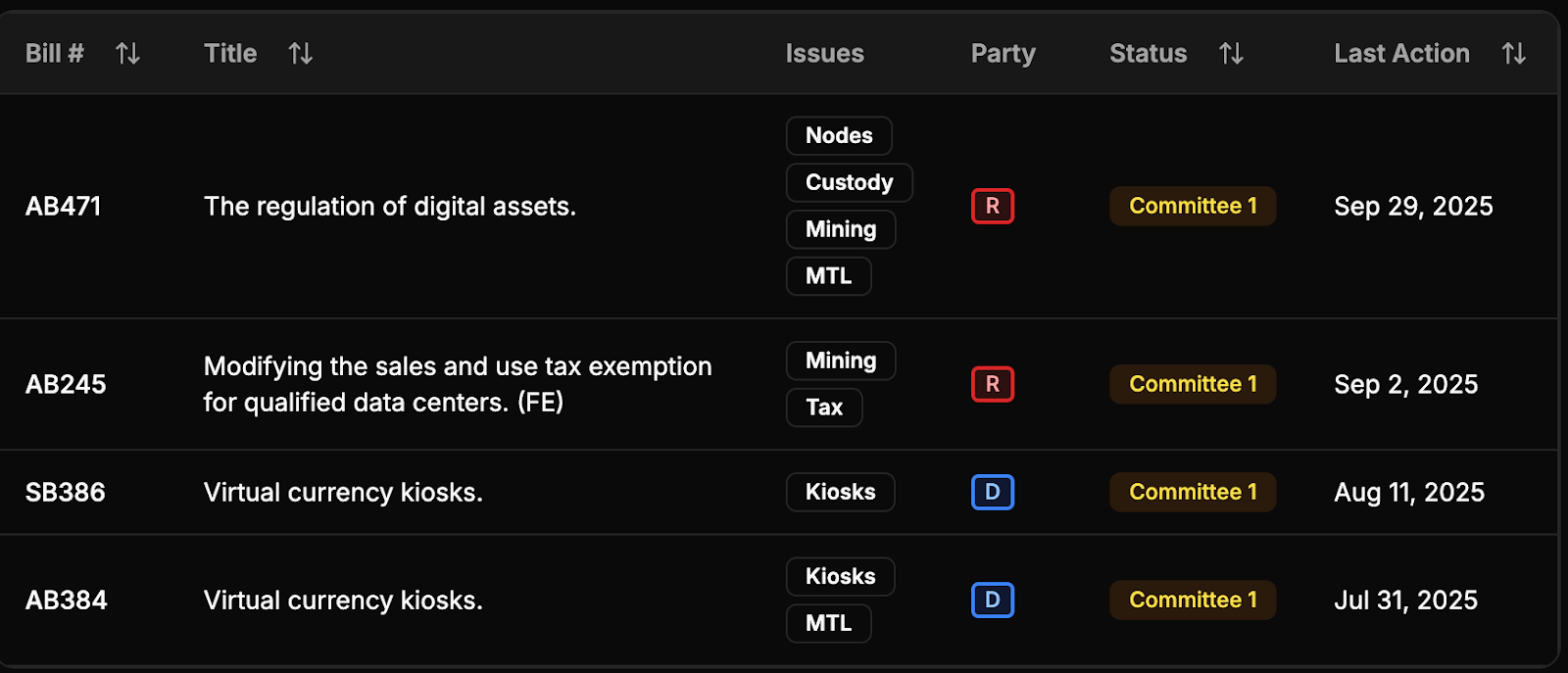

As of Sep. 30, data from crypto legislation tracker Bitcoin Laws shows that regulators are reviewing three other crypto-related bills, including two covering regulations involving crypto ATMs, and one involving tax exemptions for certain qualified data centers.

Proposed crypto legislations | Source: Bitcoin Laws

Proposed crypto legislations | Source: Bitcoin Laws

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.

PFDEX Makes a Grand Debut at the PopChain Global Ecosystem Conference in Hong Kong

Cathie Wood Revises Bitcoin’s 2030 Forecast: Will Stablecoins Take Over?

In Brief Cathie Wood revises Bitcoin's 2030 target due to rapid stablecoin adoption. Stablecoins serve as digital dollars, impacting Bitcoin's expected role. Trump's crypto-friendly policies encourage Bitcoin's market prominence.