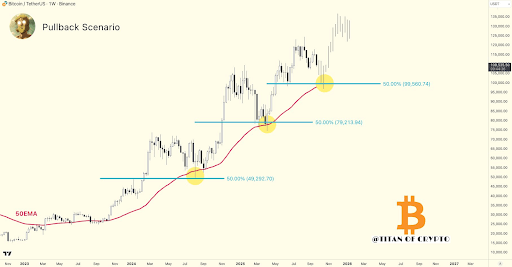

Bitcoin consolidation near $109K is supported by the rising 50 EMA and overlapping Fibonacci retracement levels, creating a support confluence that suggests continued bullish momentum. Key pullback areas to monitor are ~99K, ~79K and ~49K, with the 50 EMA as the primary trend guard for bulls.

-

50 EMA aligns with Fibonacci levels as primary support near $99K–$109K.

-

Short-term consolidation above $109K signals indecision; volume confirms participation but not breakout conviction.

-

Key pullback zones: $99,560 (near-term), $79,214 (mid-range), $49,292 (long-term).

Bitcoin consolidation: 50 EMA and Fibonacci retracement support near $109K; track $99K, $79K and $49K for pullbacks — COINOTAG analysis.

Published: 2025-09-29

Updated: 2025-09-29

What is driving Bitcoin consolidation above $109K?

Bitcoin consolidation above $109K is driven by a confluence of technical supports: a rising 50-period exponential moving average (50 EMA) and multiple Fibonacci retracement levels that overlap near critical price zones. This alignment creates a structural support band that helps sustain bullish momentum while traders digest recent parabolic gains.

How does the 50 EMA act as support for Bitcoin?

The 50 EMA is a commonly watched intermediate-term trend indicator that currently slopes upward, indicating an ongoing uptrend. When price trades above the 50 EMA, it acts as dynamic support; traders historically use pullbacks to this EMA to add long positions. In the current setup, the 50 EMA roughly overlaps with the 50% Fibonacci level, strengthening the support signal.

Why do Fibonacci retracement zones matter for pullback targets?

Fibonacci retracement zones matter because they represent mathematically derived levels where prior swings often produce support or resistance. In this case, the identified levels at $99,560, $79,214 and $49,292 mark probable return points for buyers during a corrective move. Historical price action has shown reaction at these bands.

Critical Fibonacci Zones

The chart highlights three Fibonacci retracement levels that could guide pullbacks. The nearest level sits at $99,560, overlapping with the 50 EMA and current consolidation. The mid-range level is around $79,214, and long-term structural support appears near $49,292. These zones act as technical checkpoints if momentum weakens.

Source: Titan of Crypto

How has recent price action shaped consolidation after parabolic gains?

After a sharp rally in late 2024, Bitcoin climbed rapidly from $60,000 to above $100,000 in a short span. The market then entered a consolidation phase above $109,000 as traders reassessed positions. Volume indicates active participation, but current candlestick patterns show indecision around resistance, making the 50 EMA the technical pivot for the next directional move.

What should traders watch this week?

Traders should watch three things: 1) price interaction with the 50 EMA, 2) volume spikes at $99K–$109K, and 3) candlestick rejection or acceptance at the Fibonacci zones. A clean hold above the 50 EMA supports the bullish case; a decisive break below $99K would increase odds of a deeper retracement toward $79K.

Frequently Asked Questions

What is the nearest strong support level for Bitcoin?

The nearest strong support is the 50 EMA overlapping with the 50% Fibonacci retracement near $99,560, which should act as the first defense for bulls during pullbacks.

How deep could a corrective pullback go?

In a deeper correction, Bitcoin could test the mid-range Fibonacci zone near $79,214. Only if market structure breaks materially would the long-term support near $49,292 be reached.

Key Takeaways

- Support confluence: 50 EMA + Fibonacci retracements near $99K–$109K strengthen bullish support.

- Pullback zones: Primary levels to monitor are $99,560, $79,214 and $49,292.

- Trading signal: Hold above the 50 EMA to validate continued uptrend; volume and price reaction at fib zones will guide entries.

Conclusion

Bitcoin consolidation above $109K reflects a healthy pause underpinned by the rising 50 EMA and overlapping Fibonacci retracement levels. Traders should monitor $99K, $79K and $49K as key pullback targets while using the 50 EMA as a trend filter. COINOTAG will track developments and update this analysis as new data emerges.