Tokenized Gold Market Nears $3B as Bullion Blasts to Fresh Record Highs

Gold’s historic rally accelerated on Monday, with spot prices punching through $3,800 per ounce to set fresh all-time record, extending a torrid year in which bullion is up roughly almost 47% year-to-date.

That surge is echoing on across crypto rails, with gold-backed tokens climbing to an all-time high market capitalization of $2.88 billion, CoinGecko data shows. Tokenized versions of the metal are backed by physical reserves but settle on blockchain rails, offering round-the-clock trading and near-instant transfers.

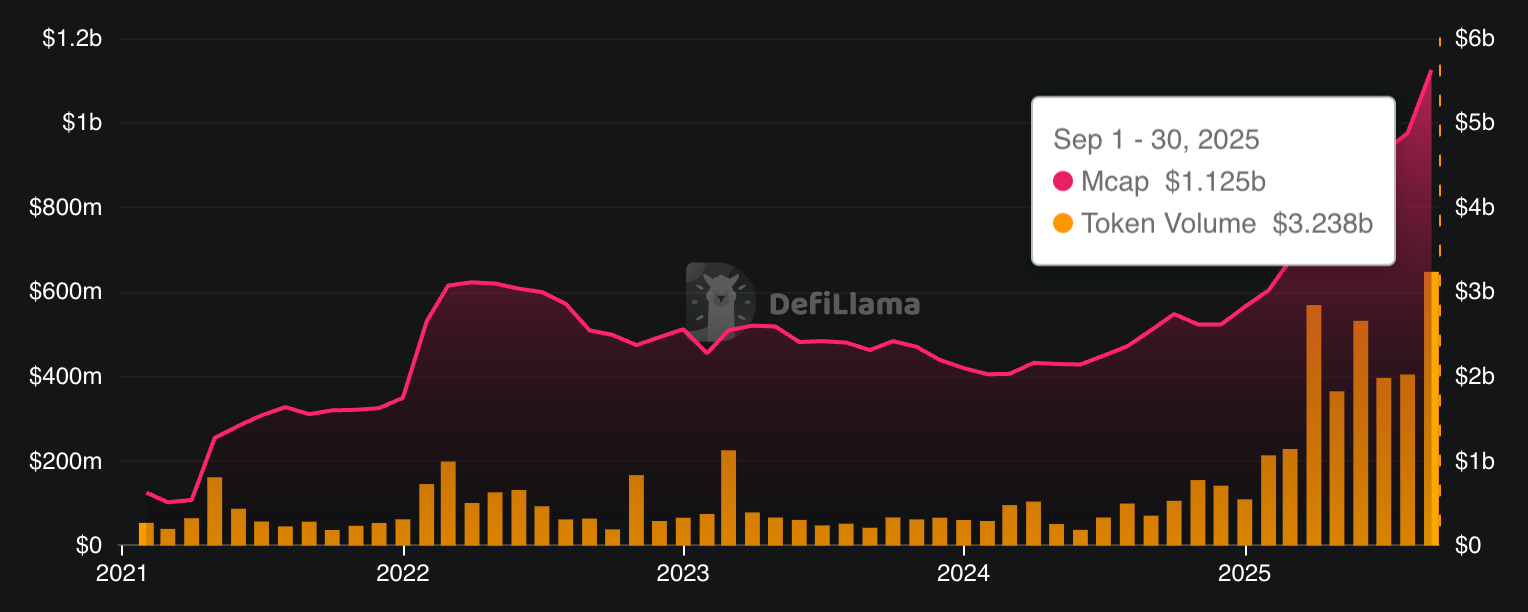

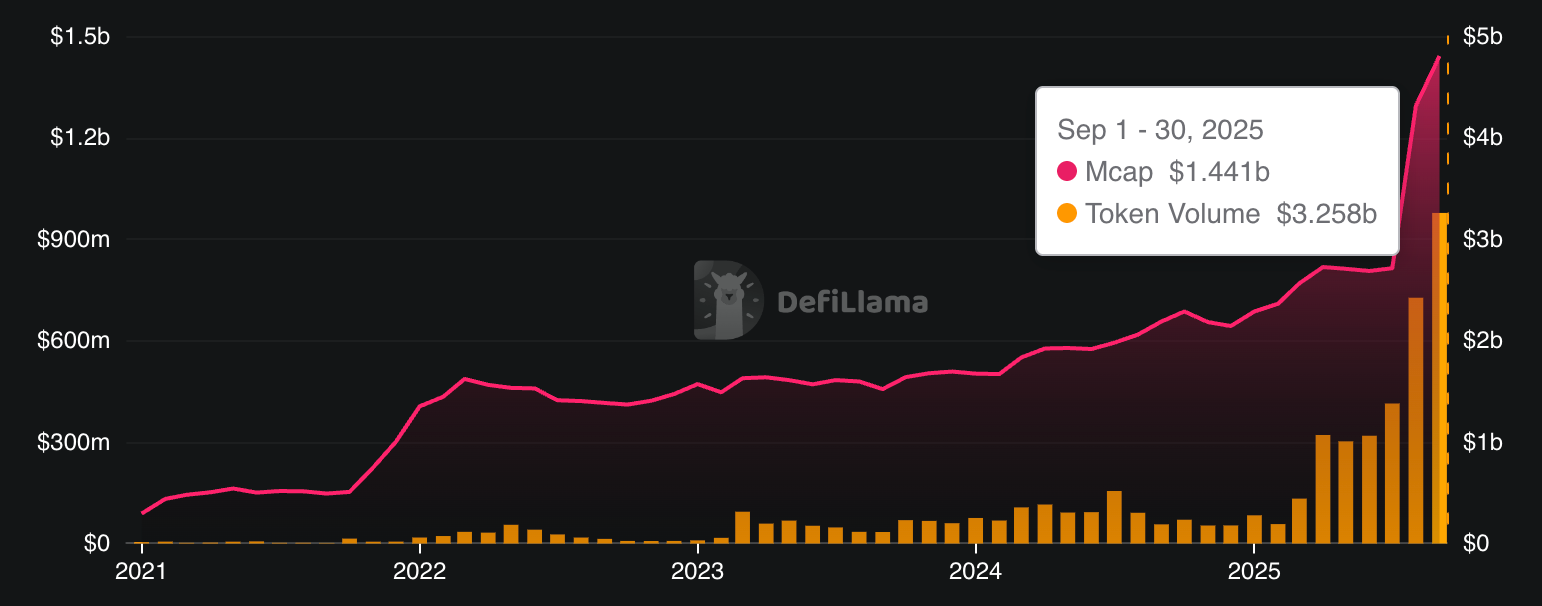

XAUT$3,832.05 and Paxos' PAXG$3,843.58, both tokens issued by firms predominantly known for their stablecoins, are dominating the category. XAUT’s capitalization stood near $1.43 billion and PAXG’s at roughly $1.12 billion, both at their respective all-time highs.

Liquidity has swelled alongside the rally, too. PAXG attracted more than $40 million in net inflows during September and set a fresh trading volume record surpassing $3.2 billion in monthly turnover.

XAUT also posted a record $3.25 billion in monthly volume, per DeFiLlama. Meanwhile, the token's market cap growth came solely from the underlying metal's appreciation, as no new token minting happened this month after August's $437 million jump.

The tokenized gold market could continue gaining as macro conditions remain supportive for the yellow metal. Investors expectations mount for more Federal Reserve rate cuts and a softer U.S. dollar, while anxiety builds over a possible government shutdown in the U.S. Meanwhile, BTC$114,362.81, often dubbed as "digital gold," is lagging behind gold with a 22% year-to-date return.

Read more: Bitcoin to Join Gold on Central Bank Reserve Balance Sheets by 2030: Deutsche Bank

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Abu Dhabi Invests $518 Million in Bitcoin Despite Bearish Death Cross Warnings

- Bitcoin's 2025 "death cross" signals bearish concerns as price nears $90,000, contrasting Abu Dhabi's $518M IBIT investment boost. - Historical death cross patterns show mixed outcomes, with 2022's 64% drop contrasting recent local bottom recoveries amid rising selling pressure. - Institutional confidence grows (Harvard, KindlyMD) despite $3.1B ETF outflows, as technical indicators suggest short-term bounce but $100,000 resistance remains key.

Solana News Today: The Future of Crypto—Global Platforms, Immediate Connectivity, and Widespread Confidence

- Solana introduces Sunrise, a tool streamlining token imports via Orb and Jupiter integrations, tested by MON token migration from Monad. - CryptoAppsy, a no-registration crypto app, offers real-time insights and multilingual support to democratize 24/7 trading access. - Curaçao-licensed CryptoGames expands altcoin support to 50+ coins, showcasing blockchain's role in reshaping traditional industries like gaming. - These innovations, including Solana's infrastructure upgrades, aim to reduce barriers and p

Bitcoin News Update: Satoshi’s $41 Billion Decline Ignites Discussion: Ought Anonymous Crypto Wealth Be Included in Worldwide Rankings?

- Satoshi Nakamoto's Bitcoin holdings lost $41B in late 2025, dropping his estimated net worth to $95.8B and global ranking from 11th to 20th. - The 30% BTC price crash stemmed from institutional exits, liquidity strains, and macroeconomic pressures, tracked via the "Patoshi Pattern" mining signature. - Quantum computing risks and market instability reignite debates over whether pseudonymous crypto fortunes should be included in traditional wealth rankings. - Analysts warn Nakamoto's 1.1M BTC stash could d

Bitcoin News Update: Decentralization Scores Big with $265K Solo Miner Victory

- A solo Bitcoin miner earned $265,000 by solving block 924,569 using a 1.2 TH/s Bitaxe Gamma rig, defying 1-in-100,000 odds. - 2025 saw 13 solo-mined blocks, including a 6 TH/s win with 1-in-180 million daily odds, highlighting growing but risky accessibility. - Experts warn solo mining remains niche as Bitcoin's 855.7 EH/s network hash rate makes individual success statistically negligible. - The win underscores Bitcoin's decentralized appeal, though industrial dominance and halving events will likely sh