MicroStrategy Expands Bitcoin Holdings With $22M Purchase Despite Price Dip

Contents

Toggle- Quick breakdown

- MicroStrategy buys the dip amid market weakness

- Total holdings now exceed 640,000 BTC

- Saylor remains confident in year-end rally

Quick breakdown

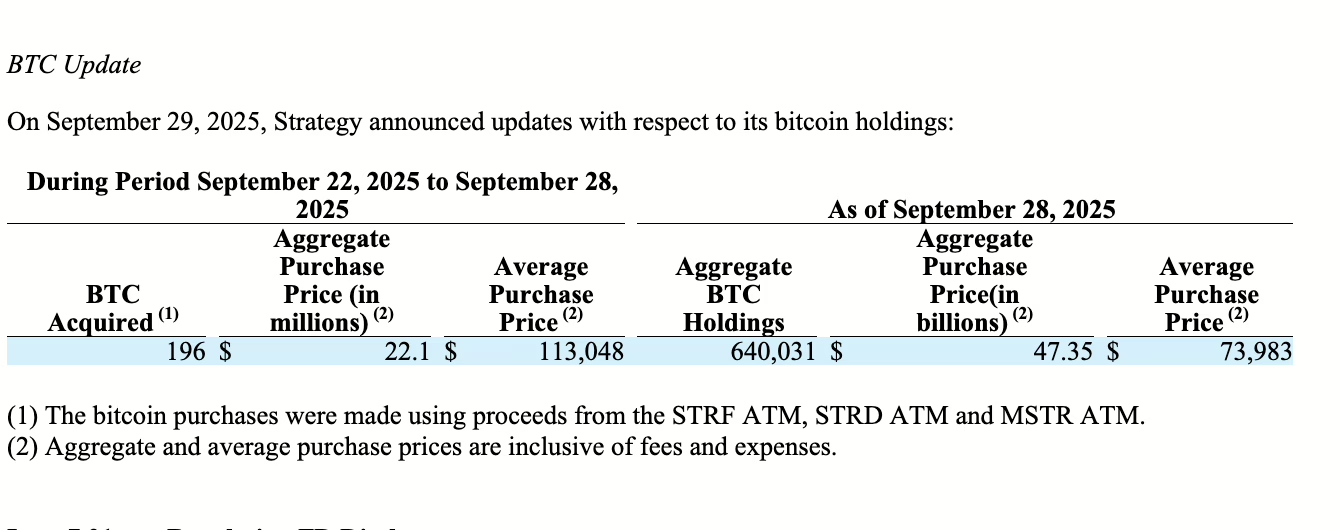

- MicroStrategy bought 196 BTC for $22.1M as Bitcoin fell below $110,000.

- The company now holds 640,031 BTC, purchased for $47.35B in total.

- Michael Saylor expects Bitcoin to rally toward year-end despite headwinds.

MicroStrategy buys the dip amid market weakness

MicroStrategy, the world’s largest corporate holder of Bitcoin, has strengthened its position by acquiring an additional 196 BTC last week. The $22.1 million purchase came as Bitcoin briefly slipped below the $110,000 mark, according to a U.S. Securities and Exchange Commission (SEC) filing on Monday.

Source:

SEC

Source:

SEC

The latest acquisition was made at an average price of $113,048 per Bitcoin, with the cryptocurrency beginning the week near $112,000 before tumbling on Thursday, data from CoinGecko shows.

Total holdings now exceed 640,000 BTC

Following the purchase, MicroStrategy now controls 640,031 BTC valued at roughly $47.35 billion, bought at an average price of $73,983 per coin. While this latest buy underscores the company’s continued accumulation strategy, it represents one of its smallest weekly Bitcoin acquisitions in recent months, reflecting a gradual slowdown in purchase volumes.

Saylor remains confident in year-end rally

Despite reduced buying, co-founder Michael Saylor maintains a bullish outlook. Speaking last week, he predicted Bitcoin could rebound strongly toward the end of the year as institutional adoption grows and macroeconomic pressures ease.

“I think that as we work through the resistance of late and some macro headwinds, we’ll actually see Bitcoin start to move up smartly again toward the end of the year,”

Saylor said. Saylor added that

“companies that are capitalizing on Bitcoin are buying even more than the natural supply being created by the miners,”

which is “putting upward pressure on the price.”

Meanwhile, Saylor urged U.S. regulators in August to establish a formal taxonomy for digital assets , warning that ongoing regulatory ambiguity threatens to stall innovation and hinder the nation’s competitiveness in the global crypto market.

Speaking during Strategy’s second-quarter earnings call on Thursday, Saylor emphasized the urgent need to define key terms such as “digital security,” “digital commodity,” and “tokenized asset.”

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Falls by 2.16% as Traders Adjust Short Positions During Market Fluctuations

- ZEC fell 2.16% to $352.42 on Dec 6, 2025, despite a 526.09% annual gain, highlighting its extreme volatility. - Hyperliquid's $14.1M ZEC short position, averaging $412 entry, shows shrinking profits as prices rise toward breakeven. - Broader bearish activity includes ETH and MON shorts with $6.22M and $2.26M unrealized gains, reflecting active market positioning. - Traders adjust exposure amid ZEC's 17.68% monthly drop and 2.43% weekly rise, signaling cautious strategy shifts in volatile crypto markets.

The Growing Popularity of Momentum ETFs Amid Market Volatility: Tactical Portfolio Allocation and Optimizing Risk-Adjusted Performance in 2025

- Momentum ETFs surged 74.8% in 2023 and 72.7% in 2024 but faced a 4.3% average loss in 2025 amid volatility and macroeconomic uncertainty. - Quality/value ETFs like QUAL and AVUV showed greater resilience during downturns, contrasting momentum strategies' lack of defensive characteristics. - 2025 market shifts highlighted risks of overvaluation in momentum sectors, with tech indices diverging from economic fundamentals. - Strategic diversification through hedging (VIXY/UVXY), alternative assets (VTIP), an

The Unexpected Rise of the MMT Token: Reflecting Speculative Trends in an Evolving Cryptocurrency Market

- MMT token's 1,330% surge post-Binance listing and 77.82% correction highlight speculative volatility in a maturing crypto market driven by institutional adoption and macroeconomic factors. - Institutional participation and regulatory clarity, like ETF approvals, have shifted market dynamics, balancing speculative fervor with macroeconomic caution. - MMT's governance incentives and liquidity mechanisms contrast with Solana and Avalanche's ecosystem-driven growth, exposing risks of speculative altcoin stra

The Emergence of MMT Token TGE: Ushering in a New Era for Digital Finance?

- Momentum Token's TGE (MMT) surged 800% post-launch, reaching $5.18B market cap on Sui blockchain with ve(3,3) governance. - Volatile price swings (47% drop to $2.54) highlight risks, but buybacks and CLMM DEX innovations show technical resilience. - Sui's low-cost DeFi ecosystem (25B TVL) and MiCAR/GENIUS regulatory alignment position MMT as a bridge for institutional adoption. - Cross-border regulatory divergence between U.S. and EU frameworks complicates global scaling despite 47% institutional interes