The U.S. Securities and Exchange Commission (SEC) recently made a significant move by withdrawing delay notifications for ETF applications involving several altcoins, including Solana $207 , XRP, Hedera, Litecoin, and Cardano $0.795732 . This action by the regulatory body came just before the new general cryptocurrency ETF listing standards, accepted earlier this month, come into effect. Following the decision, notable price movements were observed across the cryptocurrency market .

Withdrawal of Delay Notifications for Altcoin ETFs

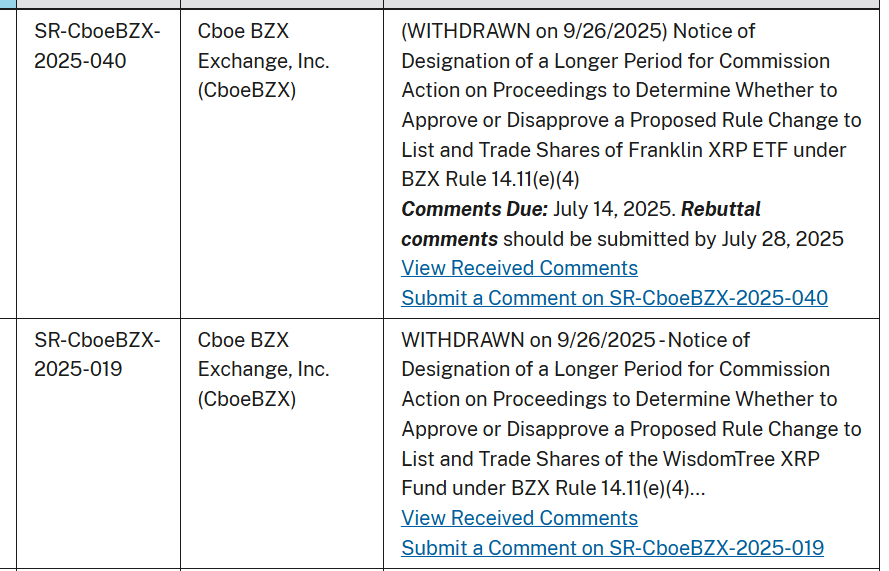

The SEC hastened the process by retracting formal notices that extended additional review periods, ahead of final approval dates for various altcoin ETFs set to expire in October. Delay notices for Solana ETF applications by Bitwise, VanEck, Fidelity, Canary, 21Shares, and Invesco Galaxy, as well as XRP ETF applications by Bitwise, Franklin, WisdomTree, Canary, CoinShares, and 21Shares, were canceled. Additionally, delay notifications were retracted for Canary’s Hedera ETF, CoinShares and Canary’s Litecoin ETFs, and 21Shares’ Polkadot ETF.

SEC decision to withdraw delay notifications for Altcoin ETFs

SEC decision to withdraw delay notifications for Altcoin ETFs

This regulatory development occurred just before the introduction of the new General Listing Standards for cryptocurrency ETFs, which will come into force on October 1st. Major exchanges like Nasdaq, CBOE BZX Exchange, and NYSE Arca updated their applications related to Bitcoin $112,205 and Ethereum $4,124 ETFs to comply with the new standards.

The SEC’s actions suggest that the market is much closer to receiving the long-awaited cryptocurrency ETF approvals.

SEC Steps Back on Ethereum ETFs

Furthermore, the SEC also withdrew delay notifications in the approval process of spot Ethereum ETFs with staking features. Progress was made in the applications of major institutions such as BlackRock’s iShares ETF, Fidelity, Franklin, VanEck, 21Shares, Bitwise, and Invesco Galaxy.

Following the news, markets exhibited swift reactions. The price of XRP rose by 4% to $2.90 within 24 hours. Solana saw an increase of over 3%, reaching $210 with a 46% rise in trading volume. Hedera also climbed over 2%, reaching $0.2152.