From zero to 40,000 dollars, will the Hypurr NFT become the community mascot?

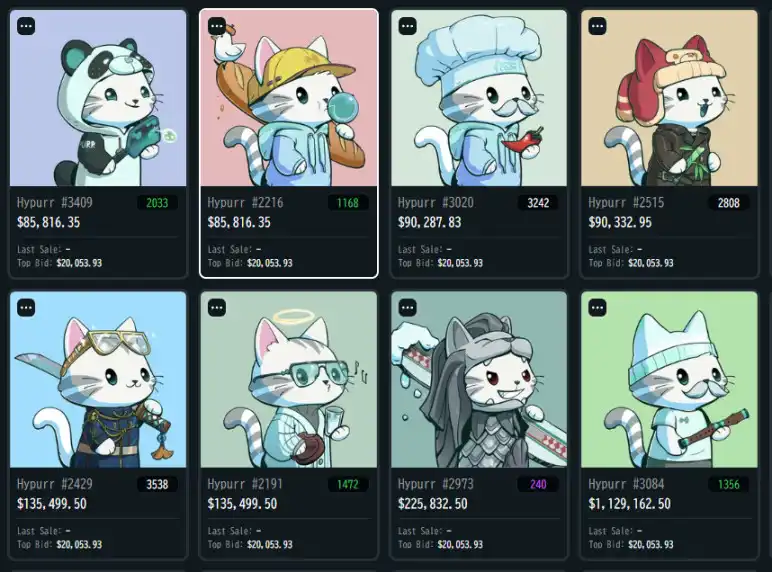

Each NFT's id seems to correspond to its ranking on the Hyperliquid Points Leaderboard, with lower id numbers indicating more rare features.

Original Article Title: "Quick Look at Hypurr: $400,000 Worth NFT Airdropped with a Click?"

Original Article Author: Alex Liu, Foresight News

The Hyper Foundation (Hyperliquid Foundation) announced in the early hours of September 29th that the deployment distribution of the Hypurr NFT has been completed. The floor price of this NFT on Opensea once surged to $80,000 and is currently above 1,400 HYPE, valued at over $60,000, or 400,000 RMB.

Where does this NFT come from, and why does it hold value? Is it true that it was given away with a "click" during the airdrop?

Hypurr NFT: Hyperliquid's "Community Commemoration"

In the Web3 world, many projects connect with their early community and foster a sense of belonging through NFTs, airdrops, and other means. The Hypurr NFT is a community commemorative NFT launched by Hyperliquid. It is not merely a utility NFT or a financial product promising returns but more of a symbol, identity, and cultural artifact.

Background and Initial Distribution: Who Could Get the Hypurr NFT

Hyperliquid and HyperEVM

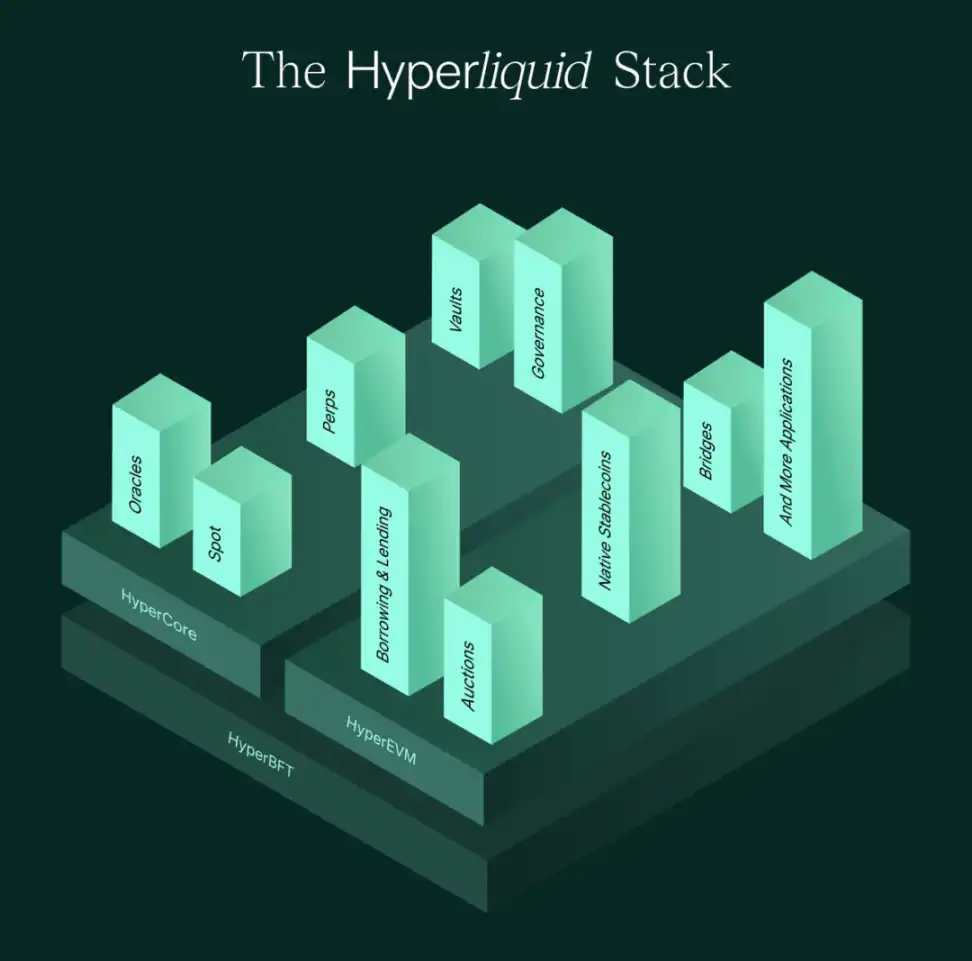

To understand the Hypurr NFT, one must first grasp the network architecture behind it. Hyperliquid is an L1 network with decentralized trading at its core, aiming to enable on-chain efficient trading, margin settlements, and order matching. Its consensus mechanism is HyperBFT, a fundamental design that equips Hyperliquid with competitiveness in high-frequency trading and low-latency scenarios.

HyperEVM is part of the Hyperliquid architecture. It is not a standalone EVM chain but rather a channel mechanism that allows developers to "trustlessly read the L1 state and interact with the core modules" on-chain. In other words, HyperEVM has bidirectional interaction capabilities with HyperCore (the foundational state layer of Hyperliquid).

Smart contracts on HyperEVM can read the L1 state (via read precompiles) and can interact with HyperCore through CoreWriter, establishing a link between the two layers. This design enables DeFi applications developed on the EVM layer to seamlessly connect to Hyperliquid's liquidity infrastructure.

The design of the Hypurr NFT was born on top of this infrastructure and is not a standalone project, but a community commemorative program within the Hyperliquid architecture.

Acquisition Method: Genesis Event and Accredited Distribution

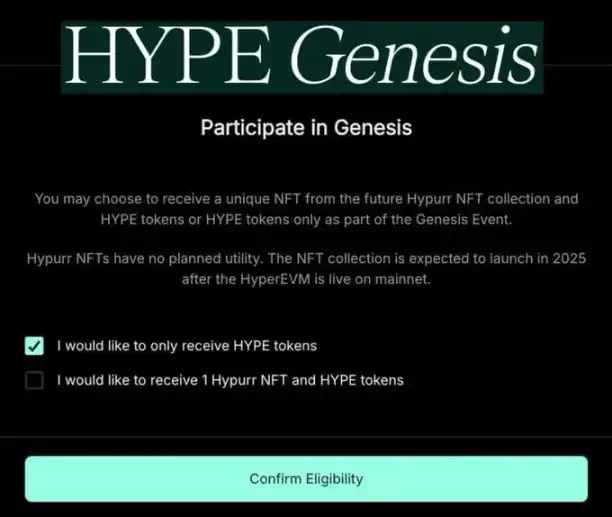

The distribution of the Hypurr NFT took place alongside Hyperliquid's Genesis Event in November 2024. According to the official statement from the Hyper Foundation: "Participants can choose whether to receive a Hypurr NFT as a commemoration after the launch of HyperEVM."

In fact, only in Hyperliquid's S1 season, the top 5000 in the Platinum tier could see this option. The choice between "token only" and "token and NFT" has indeed confused overly suspicious participants. The NFT worth 400,000 USD is not a "click to claim" but a "miss it, miss out."

Additionally, the Hyper Foundation conducted a risk assessment of participants and limited the acquisition of too many NFTs by a single address or user through cluster analysis to prevent sybil attacks.

Page Note: The Hypurr NFT does not have any planned empowerment

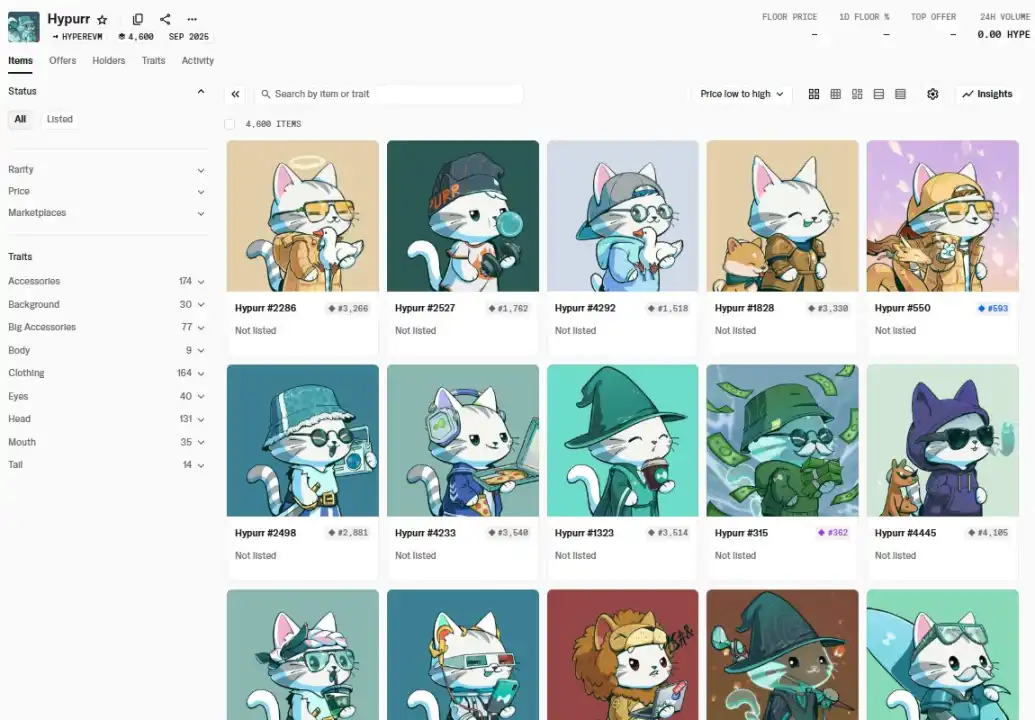

In terms of total supply, the Hypurr NFT collection has a total of 4,600 pieces, including:

· 4,313 pieces allocated to eligible participants of the Genesis Event

· 144 pieces reserved for the Hyper Foundation itself

· 143 pieces distributed to core contributors (including Hyperliquid Labs, NFT artists, and other early contributors)

After the distribution is complete, the Hypurr NFT enters a circulation state. The Hyper Foundation also emphasized in an official statement: "No additional action is required from users, as the NFTs have already been distributed."

Holder Distribution and Circulation

Currently, the number of Hypurr NFT holders is 4,031, with a dispersal rate of approximately 87.6%. In other words, the majority of the NFTs are spread across multiple addresses rather than highly concentrated.

This distribution is beneficial to avoid extreme centralization and increase community involvement. However, it may also lead to liquidity dispersion: if some holders lock their tokens for the long term or remain inactive, the active supply may be insufficient.

Original Intent and Potential Empowerment: Commemoration, Culture, and Future

Commemoration and Community Belonging

The primary goal of the Hypurr NFT is to serve as a commemorative item, used for giving back, motivating, and symbolizing acknowledgment to early supporters of the project. In official terms, "to share a memento with those who early on believed in and contributed to the growth of Hyperliquid." According to community observations, each NFT's ID seems to correspond to its ranking on the Hyperliquid leaderboard, with NFTs having lower IDs possessing more rare features.

Each Hypurr NFT is artistically designed to reflect the diversity and individuality of the community: different emotions, hobbies, tastes, and "eccentricities" are depicted in visual art, becoming part of the community's identity.

In this sense, holding a Hypurr NFT may have symbolic identity value in a community context—a kind of badge that says, "I am an early witness."

Potential Future Empowerment: No Commitment

Although the protocol explicitly does not commit to empowerment (Utility), it does not rule out the possibility of adding certain additional benefits to the Hypurr NFT through third parties or on the ecosystem level in the future. The protocol states, "Hypurr NFTs may be associated with certain benefits, features, or capabilities, but these are not protocol guarantees."

This opens up space for future planning by the community or ecosystem: for example, future events, airdrops, community governance, interactive permissions, etc., may be prioritized based on holding a Hypurr NFT. However, all of this is subject to future developments. Currently, there are no confirmed additional benefits.

Currently, the price of this NFT is high, and the market sentiment is enthusiastic, with many people buying in with the expectation of receiving benefits such as "the next season airdrop from Hyperliquid." It is important to note that the official stance does not promise "airdrops" or other benefits, intending for this NFT to be solely a symbol of "identity."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spot gold just broke through the $3,820.00/ounce mark

Waller: Stablecoins should be included in regulatory protections to increase payment options

U.S. gold reserves value exceeds $1 trillion