Will Bitcoin drop to $95,000 or surge toward $140,000? Cycle signals reveal the real direction

Recently, Crypto Twitter (CT) has been hotly debating the future trend of Bitcoin: is it about to drop to $95,000, or is it heading toward a new high of $140,000? After 18 hours of chart, on-chain, and macro data analysis, a clear conclusion can be drawn:

The current decline is not a sign of a long-term top, but rather the last deep correction of the cycle, preparing for the next wave of frenzy.

1. Lessons from Historical Cycles

Looking back at past cycles, Bitcoin has always experienced a sharp correction of more than 50% after reaching an all-time high (ATH), with the market mistakenly believing the bull run is over in the midst of panic. But each time, the result is the same: after the panic, a new high is reached.

2. The Nature of the Current Decline

Bitcoin is currently in a "cooling off after overheating" phase, which is not a bad thing, but rather an inevitable result of market psychology:

The market uses the decline to wash out impatient investors;

The media amplifies fear, intensifying short-term pessimism;

Whales accumulate at low points, continuing to dominate liquidity.

3. On-chain and Macro Data Validation

ETF inflows: still rising, indicating institutional interest remains strong;

M2 liquidity index: continues to expand, suggesting new capital is entering the market;

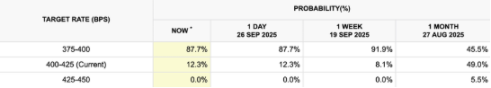

Interest rates: rate cuts have already occurred, and expectations for the next cut will bring more liquidity;

MVRV Z-Score: currently only at 2 (historical tops usually appear at 3–4);

Puell Multiple: miner profitability index is around 1, far below historical top levels (>4).

All these indicators show that the market has not yet entered a true bubble peak.

4. Bear Trap, Not a Real Crash

The current situation is more like a Bear Trap:

Retail investors are scared away by the short-term decline;

Funds have not left the market, but are instead accumulating at low levels;

The real risk is not now, but will come when the market is unanimously bullish.

5. Investor Coping Strategies

Stay calm and patient, and do not be manipulated by media sentiment;

Develop a clear exit plan, and plan your selling pace in advance for when BTC approaches $140,000;

Closely monitor signs of capital rotation into Altcoins, as the next wave of capital flows may be brewing.

Conclusion

The current decline in Bitcoin is a cyclical correction, not a signal of a market top. On-chain and macro indicators show that market liquidity is accumulating strength, with ETF and institutional funds still flowing in.

The real risk is not in the current adjustment, but at the future frenzy peak. For investors, now is a key stage to accumulate patience and develop an exit plan.

$95,000 may be the short-term bottom, but $140,000 will be the ultimate target of the cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[English Long Read] Restaking Track Review: Truths, Misconceptions, and the Unfinished Journey

2026: The Year of Federal Reserve Regime Change

The Federal Reserve will shift away from the technocratic caution of the Powell era, moving toward a new mission that clearly prioritizes lowering borrowing costs to advance the president’s economic agenda.

Over $756M In 11 days : XRP ETF Break Records