Stablecoins Connect Financial Sectors as Total Supply Exceeds $300 Billion

- Stablecoin supply surpassed $300B in 2025, with USDT (58%), USDC ($74B), and USDe ($14B) leading the market. - Regulatory clarity via the U.S. GENIUS Act reduced uncertainty, while yield-bearing stablecoins (7.39%-8.98% APY) drove adoption. - Market growth accelerated 63% YoY, fueled by $4.1T monthly transactions and 30M active wallets in DeFi and cross-border payments. - Projections suggest $2T potential as stablecoins bridge traditional finance and crypto, though CBDCs and regulatory fragmentation pose

The stablecoin market has reached an unprecedented total supply of $300 billion, representing a significant achievement for the crypto industry. As of September 2025, CoinMarketCap reports the market at $307 billion, while CoinGecko and DeFiLlama list slightly lower numbers at $299 billion and $295.5 billion. This rapid expansion highlights the increasing role of stablecoins as a link between conventional finance and decentralized platforms. Tether’s

The increasing use of stablecoins demonstrates their expanding importance in international payments, DeFi, and institutional transactions.

Yield-generating stablecoins, often called “Stablecoin 2.0,” are transforming the market. Projects like Ethena’s USDe, Falcon Finance’s USDf, and Aave’s GHO offer annual yields between 7.39% and 8.98%, drawing interest from both individual and institutional investors. DWF Ventures, a Web3 investment firm, observed that these yield-bearing stablecoins have captured a notable share of the market, with USDe alone reaching $13.7 billion in supply. These coins generate returns from various sources, such as real-world assets (RWAs), staking, and DeFi arbitrage, while staying pegged to the U.S. dollar. Falcon Finance’s USDf, for example, has expanded to $1.8 billion in supply, supported by its governance structure and compatibility with multiple blockchains DWF Ventures Analyzes Stablecoin Growth As Market Cap Nears … [ 3 ].

Regulation continues to play a vital role. The GENIUS Act has established a regulatory framework for stablecoins, fostering innovation while managing risks. Nonetheless, obstacles remain, such as scrutiny from the European Central Bank and ongoing transparency issues. For instance, Tether’s reserves consist of 79.7% U.S. Treasury securities and 4.4% in

Looking forward, projections indicate further growth. U.S. Treasury Secretary Scott Bessent anticipates stablecoins could reach a $2 trillion market cap in the next few years, driven by their ability to provide efficient, programmable money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

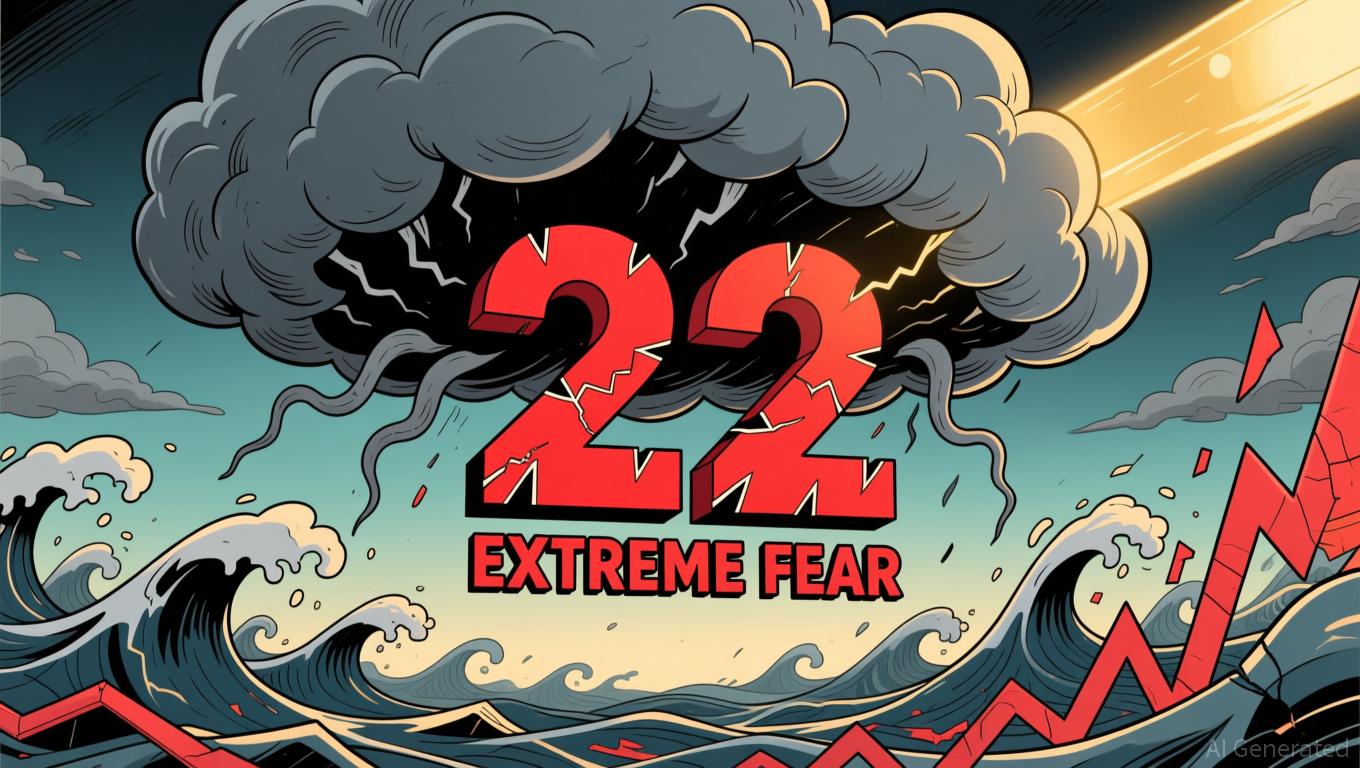

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou