Bitcoin News: Will BTC Price Crash to $81,000?

Bitcoin price is holding just above 109,000, but pressure is mounting. With inflation climbing again on the back of Trump’s renewed tariffs, and the Fed stuck between rate cuts and sticky prices, investors are asking: could Bitcoin price slide all the way down to 81,000? Let’s break it down.

Bitcoin News: Inflation, Tariffs, and Market Psychology

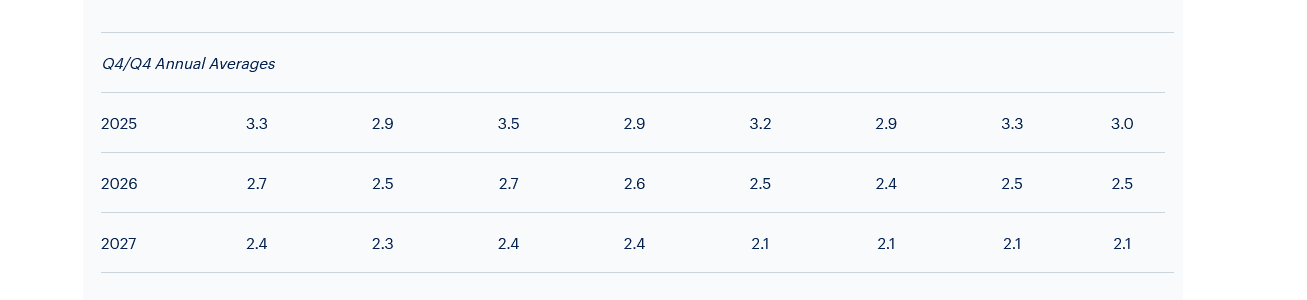

The survey from the Federal Reserve Bank of Philadelphia points to inflation rising to 3% by year-end, a notch higher than the current 2.9%. Core PCE remains stubborn at 2.9%, and Goldman sees it climbing to 3.2% by December. That’s not runaway inflation, but it’s high enough to keep the Fed cautious.

Here’s the thing: markets were betting on faster and deeper rate cuts after the Fed’s first cut in 2025. Inflation re-accelerating flips that script. If the Fed slows down, risk assets like BTC price could suffer. Traders tend to rotate out of crypto when rates remain restrictive, since the opportunity cost of holding a non-yielding asset rises.

Tariff Inflation: A Temporary but Sticky Threat

Tariffs are acting as an artificial inflation driver . Surveys suggest companies have passed through about 70% of costs so far, but more pass-through is expected in Q4. That means inflation may look hotter into year-end, even if underlying demand is soft.

For Bitcoin news , tariff-driven inflation cuts two ways. On one hand, persistent inflation keeps real yields high, which hurts crypto. On the other, prolonged tariff pressure weakens consumer confidence and stirs demand for hedge assets. Historically, Bitcoin price thrives when investors see fiat policy as compromised. Right now, however, traders are more worried about Fed delays in easing than about long-term hedge arguments.

Bitcoin Price Prediction: BTC Daily Chart

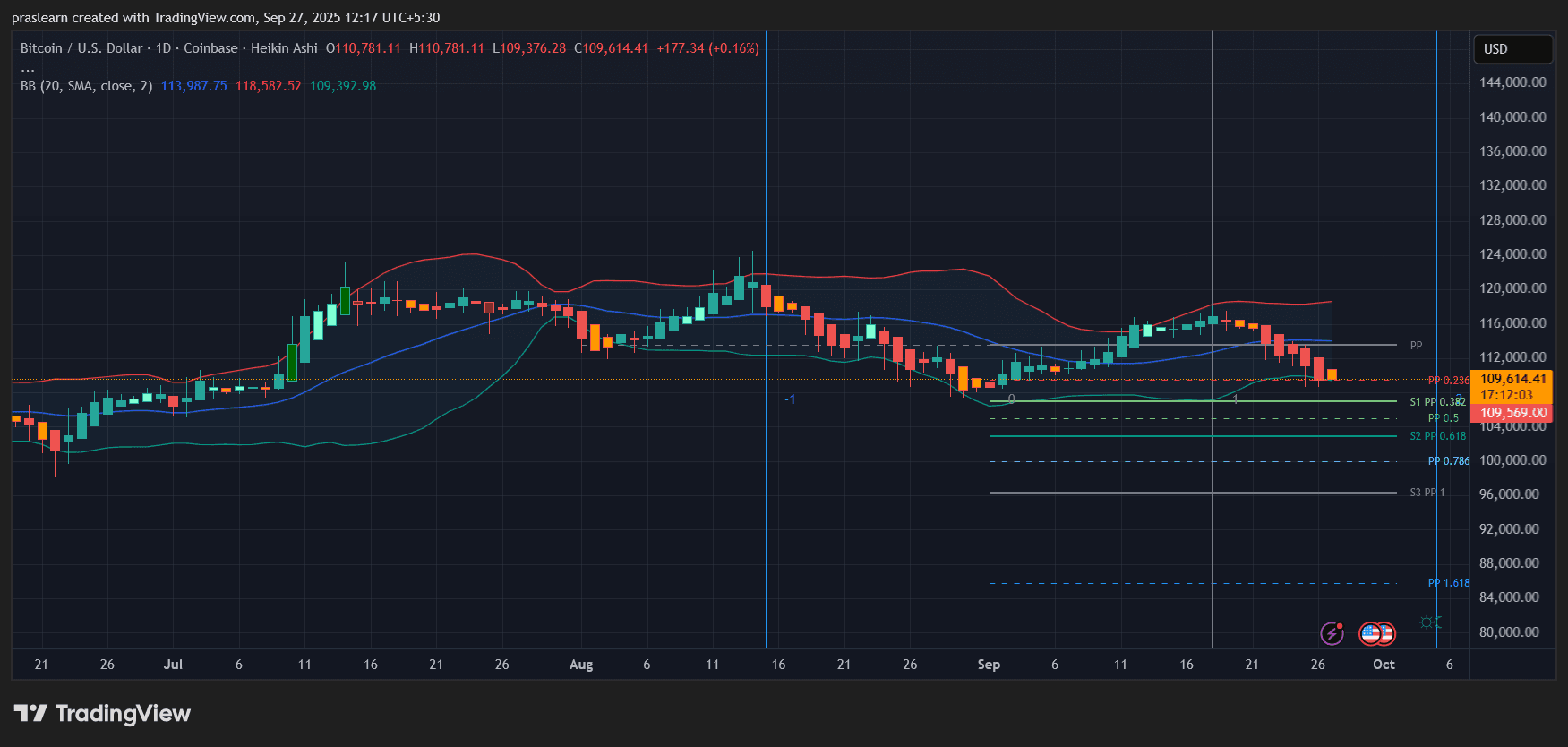

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

The BTC price daily chart shows price consolidating near 109,600 after a sharp drop from 116,000. Bollinger Bands are widening, and candles are hugging the lower band, which signals strong downside momentum. The pivot levels tell the real story:

- Immediate support lies around 109,500, right where BTC price is testing now.

- Next key Fibonacci levels line up at 104,000 (0.618) and 100,000 (0.786).

- Below that, the S3 support aligns with 96,000, and the extended pivot projection points to 81,000.

If $BTC loses the 104,000–100,000 zone, technicals open the door to a deeper flush. The 81,000 mark isn’t a forecast—it’s the tail risk if panic selling aligns with worsening macro sentiment.

Macro Meets Bitcoin News: The Risk of 81,000

The chart setup plus inflation outlook means the market is cornered between two forces.

- If the Fed ignores rising inflation and continues easing, BTC may find support and rebound off the 100,000 level.

- If inflation keeps the Fed sidelined, BTC could see another leg lower, with 96,000 as the next logical stop.

For Bitcoin price to truly test 81,000, you’d need a combination of stubborn inflation, delayed Fed easing, and perhaps a liquidity shock in equities. Without that trifecta, the odds favor a bounce before such extremes.

Bitcoin Price Prediction: Crash or Correction?

So, will BTC price crash to 81,000? The probability exists but is not the base case. The technical roadmap suggests 104,000 and 100,000 are critical battlegrounds. If those give way under heavy selling and macro headwinds stay negative, then 81,000 becomes a possible target. But if inflation cools in early 2026 as expected, and the Fed resumes cutting, Bitcoin price could re-establish the 115,000–120,000 range instead.

For now, traders should treat 81,000 as the extreme downside scenario, not the central forecast. The real fight is whether $BTC price can defend 100,000 in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Bollinger Bands repeat ‘parabolic’ bull signal from late 2023

Bitcoin adds $732B in new capital this cycle as market structure transforms

[English Long Read] Restaking Track Review: Truths, Misconceptions, and the Unfinished Journey