BlockDAG's $1 Bet: Will Its Infrastructure Surpass XRP's Challenges and SHIB's Waning Momentum?

- XRP gains institutional traction post-SEC resolution, targeting $3.70–$3.75 if it breaks $3.20 resistance. - Shiba Inu (SHIB) struggles with weak on-chain metrics despite community buzz, facing $0.000013 consolidation. - BlockDAG raises $410M in presale, aiming $1 price with 300+ apps and 19,000 miners, outpacing XRP/SHIB's speculative dynamics. - Q4 crypto focus shifts to infrastructure-driven projects like BlockDAG amid XRP's regulatory clarity and SHIB's fading utility.

[1] Q4 Objectives:

[2] Fastest Expanding Crypto 2025: BlockDAG’s $1 Forecast Surpasses XRP Whale Activity and Shiba Inu’s Progress

[3] Leading Cryptocurrencies for 2025: BlockDAG,

[4] Premier Crypto Projects for 2025: BlockDAG, XRP, ETH

As the last quarter of 2025 gets underway, the crypto sector is bracing for a crucial period marked by consolidation and the potential for significant breakouts. XRP, Shiba Inu (SHIB), and BlockDAG are among the most closely monitored assets, each following unique paths influenced by technical trends, regulatory developments, and ecosystem factors.

Ripple’s XRP has attracted fresh institutional attention after resolving its prolonged SEC dispute, eliminating regulatory ambiguity and sparking a 4% surge to $3.26 at the end of September. Experts point to a pivotal technical juncture: XRP is challenging resistance at $3.20–$3.21, and a confirmed breakout could propel it toward $3.70–$3.75. On-chain analytics reveal steady transaction volumes but a slowdown in new address creation, suggesting a cautiously optimistic outlook. Nonetheless, if momentum fades, a pullback to $2.70 remains a risk, highlighting the importance of strong trading volume to support a bullish scenario.

Although it remains a topic in community trading circles,

BlockDAG stands out为a leading emerging project, having drawn the attention of developers and the community through its hybrid Proof-of-Work/DAG consensus and EVM compatibility, driving forward decentralized application development. Partnerships with Seattle sports teams and innovative gamified features have further enhanced community involvement. Analysts predict that as adoption continues, BlockDAG could see significant price appreciation. The upcoming infrastructure launch event in October is expected to demonstrate ongoing progress and could trigger a surge in interest.

The wider market, which saw $1.1 billion in leveraged liquidations in late September, underscores the vulnerability of overextended positions. While XRP and SHIB contend with technical and on-chain hurdles, BlockDAG’s robust infrastructure and real-world collaborations offer a counterweight to meme-driven hype. Institutional ETF investments and Ethereum’s approach to $5,000 highlight broader market drivers, but BlockDAG’s development momentum and deployment schedule make it a standout contender for Q4 expansion.

For those navigating the unpredictable terrain of Q4 2025, XRP’s regulatory resolution and technical setup, SHIB’s community-driven resilience, and BlockDAG’s infrastructure-based growth each present unique prospects. XRP’s path to $3.70 depends on a confirmed breakout, SHIB’s future relies on revived on-chain activity, and BlockDAG’s growth is tied to the successful execution of its rollout plan. As the market faces economic headwinds and regulatory changes, these projects illustrate the dynamic interplay of technical, institutional, and speculative forces shaping the next phase of crypto evolution.

---

: Q4 Objectives: XRP Price Outlook & Shiba Inu Volatility Compared to BlockDAG’s Market Performance

: Fastest Expanding Crypto 2025: BlockDAG’s $1 Forecast Surpasses XRP Whale Activity and Shiba Inu’s Progress

: Leading Cryptocurrencies for 2025: BlockDAG, Solana, XRP & Others Poised for Major Moves This October

: Premier Crypto Projects for 2025: BlockDAG, XRP, ETH

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

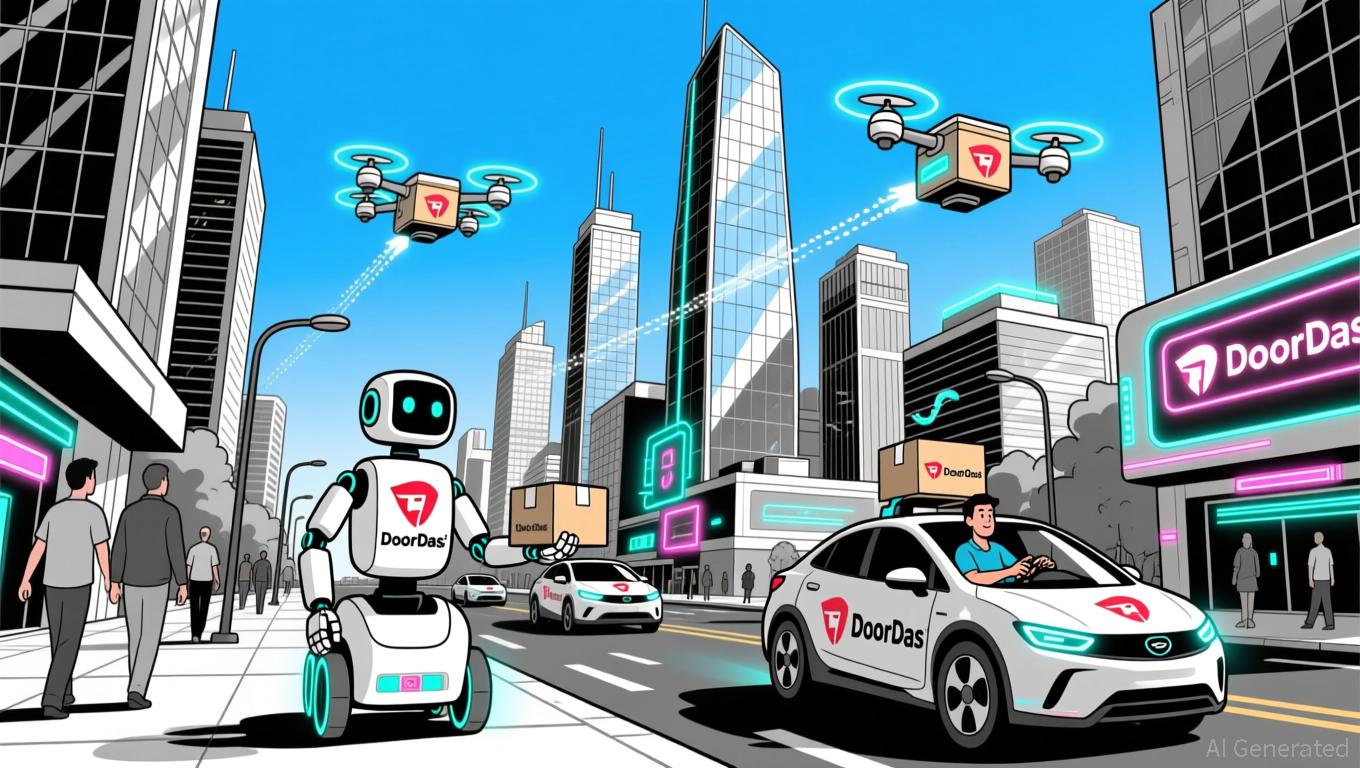

DASH Gains 5.78% Following DoorDash’s Expansion of Delivery Network and New Partnerships

- DoorDash's DASH stock surged 5.78% in 24 hours amid Q3 2025 results showing $3.4B revenue and $244M profit, driven by 27% YoY growth. - Strategic expansions include grocery delivery partnerships with Kroger/Family Dollar and robot delivery via Serve Robotics , enhancing its 68% U.S. food delivery market share. - Long-term investments in automation (Waymo, Dot robot) and $1.2B SevenRooms acquisition aim to boost efficiency but caused a 20% post-earnings stock pullback. - Favorable regulatory shifts (Prop

BCH sees a 32.36% increase over the past year as the network undergoes upgrades and mining adjustments

- Bitcoin Cash (BCH) surged 32.36% in a year due to network upgrades, mining shifts, and positive market sentiment. - Price hit $574.7 on Dec 5, 2025, with 6.34% 30-day and 0.03% 24-hour gains. - 2024 protocol upgrade boosted transaction throughput, fees, and real-world payment adoption. - Mining pools shifted hashrate to BCH, enhancing security and decentralization. - Institutional support and fixed supply model drive BCH’s appeal as a scalable payment alternative.

ZEC Rises 11.19% in the Past 24 Hours Amid Increasing Average Short Positions

- Zcash (ZEC) rose 11.19% in 24 hours to $395.27 but fell 4.99% weekly/monthly amid mixed performance. - "Calm Long King" trader increased ZEC short positions to $2.51M, raising average entry price to $360 with 20% unrealized gains. - ZEC shorting reflects cautious optimism as traders adjust exposure amid volatility, with BTC/SOL shorts showing $160k combined losses. - The trader's recent 15-trade winning streak contrasts November setbacks, highlighting shifting market dynamics in altcoin trading.

ZEC Value Rises 5.73% as Short Sellers Adjust Positions During Market Fluctuations

- ZEC surged 5.73% in 24 hours to $385.59, defying 9.19% weekly/monthly declines but rising 590.63% annually amid market turbulence. - "Calm Long King" trader increased ZEC short positions to $2.51M (10x leverage) with a $20K unrealized gain, contrasting losses in BTC and SOL shorts. - The trader's $17.29M ZEC short exposure reflects volatile market dynamics, with leveraged positions showing mixed gains/losses as crypto prices swing sharply. - ZEC's 24-hour rebound highlights risks for short sellers in a m