Has this bull market already peaked?

Source: The DeFi Report

Original Title: Is the Top In?

Compiled and organized by: BitpushNews

A small-scale altcoin season has just ended. It began when ETH drew liquidity from BTC, as the market hyped up ahead of the launch of DATs (Digital Asset Treasuries).

Next, we saw altcoins drawing liquidity from ETH. Assets such as ENA, WLD, HYPE, PUMP, SOL, BNB, and AVAX all performed exceptionally well.

Now, we are seeing liquidity rotate back to BTC.

But how likely is it that the top is in? This is the question on everyone’s mind.

We will attempt to answer this question in today’s report.

Bitcoin

As mentioned in the introduction, a mini “altcoin season” unfolded over the summer months.

During this period, BTC Dominance fell from 65% to 57%.

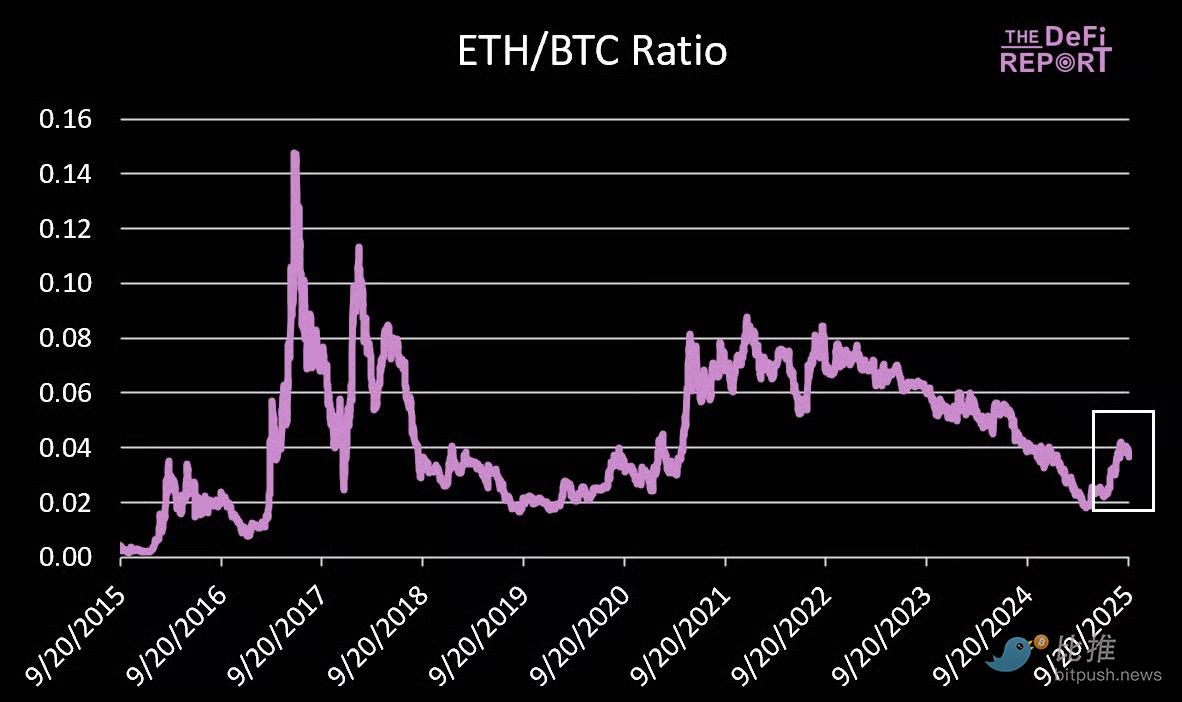

ETH was the first to rally, with the ETH/BTC ratio rising from a low of 0.018 in April to 0.042 as liquidity shifted from BTC.

Now, the ETH/BTC ratio is pulling back, and the BTC Dominance chart appears ready to consolidate in the 57% range (we still believe it will eventually move lower).

Onchain Data

Long-Term Holders

After taking profits in July and August, the supply held by long-term holders has started to stabilize—a positive signal.

ETF Flows

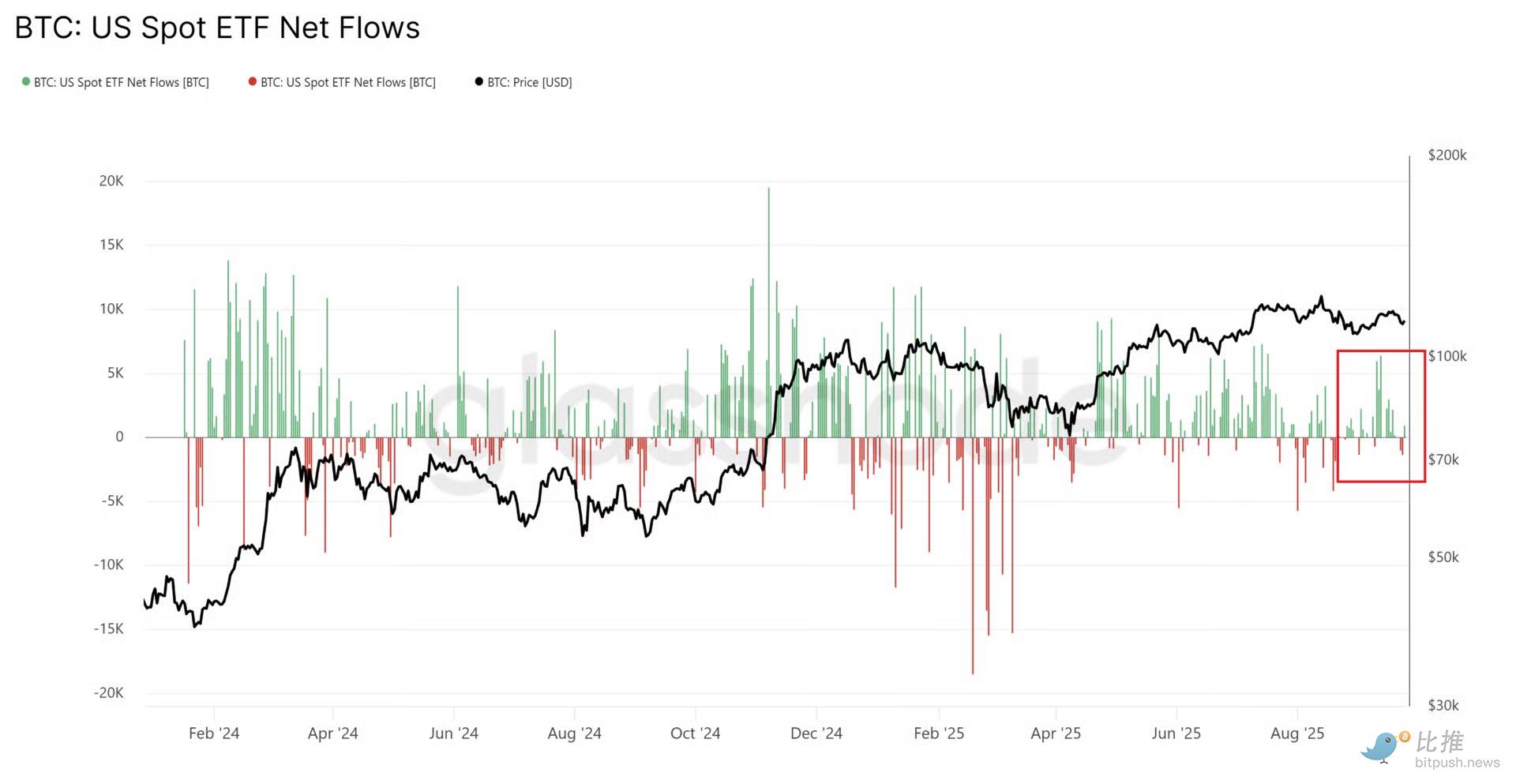

Meanwhile, inflows into ETFs have weakened.

On the bright side, outflows from ETFs have also decreased.

Spot Volumes

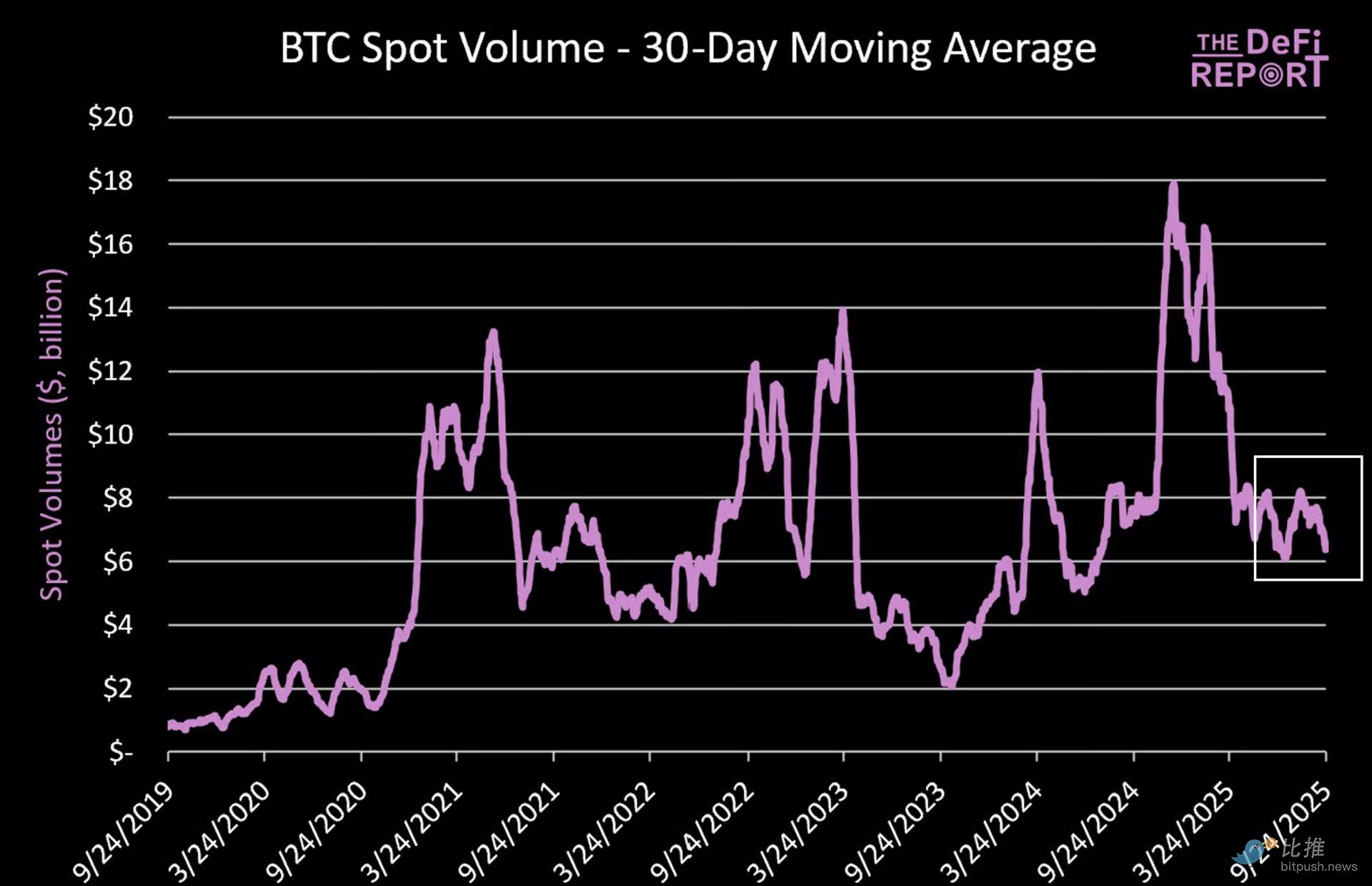

Trading volumes remain sluggish after peaking earlier this year—indicating a lack of significant “new money” entering the market over the past six months.

What’s Next for BTC?

At the time of writing, BTC is currently trading at $109,000, below its 50-day moving average ($114.3k) and 100-day moving average ($113.8k). It is still above its 200-day simple moving average ($103.8k).

We have undoubtedly lost momentum.

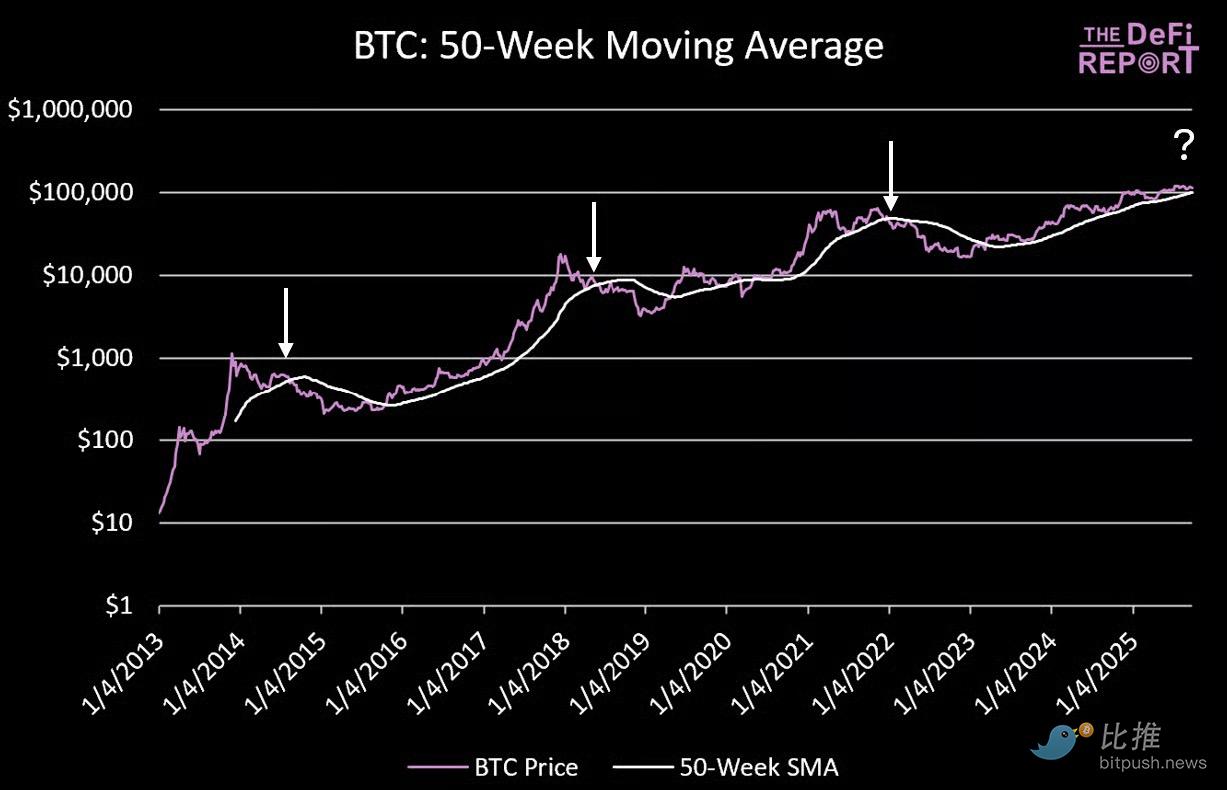

However, when looking for topping signals, we prefer to focus on the longer-term 50-week moving average.

Why the 50-week?

In the past three cycles, when BTC had a weekly close below the 50-week simple moving average (SMA) in the fourth year of the cycle, it marked the start of a bear market.

Bitcoin’s 50-week moving average is currently $99,000.

Altcoins

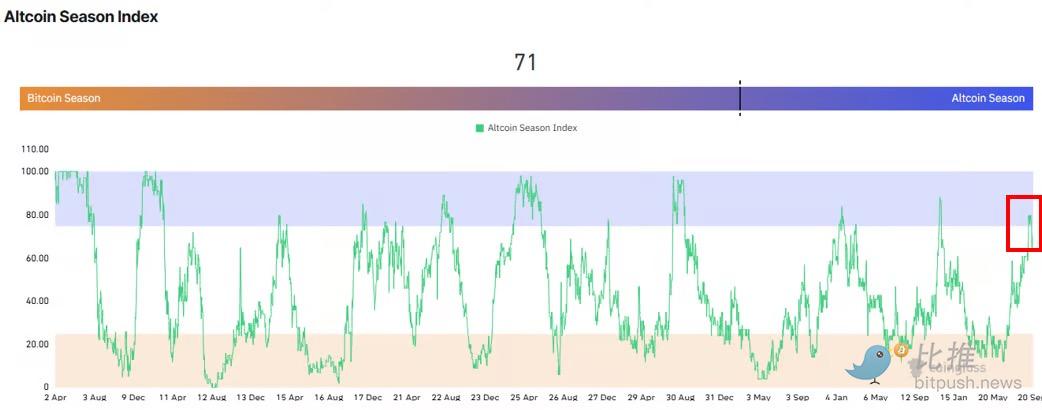

Altseason Index

We can visually see the “summer altcoin season” from the chart.

If you were expecting a 2021-style “rising tide lifts all boats” scenario where all coins rally, you might not consider this an “altcoin season.”

This will not happen in this cycle. The key now is to select the right assets and find the best entry points.

What are the “right” assets? Those with strong fundamentals, tokenomics, and mindshare/narrative (Treasury companies).

We were fortunate that some altcoins in our portfolio yielded substantial profits before the correction.

Ethereum

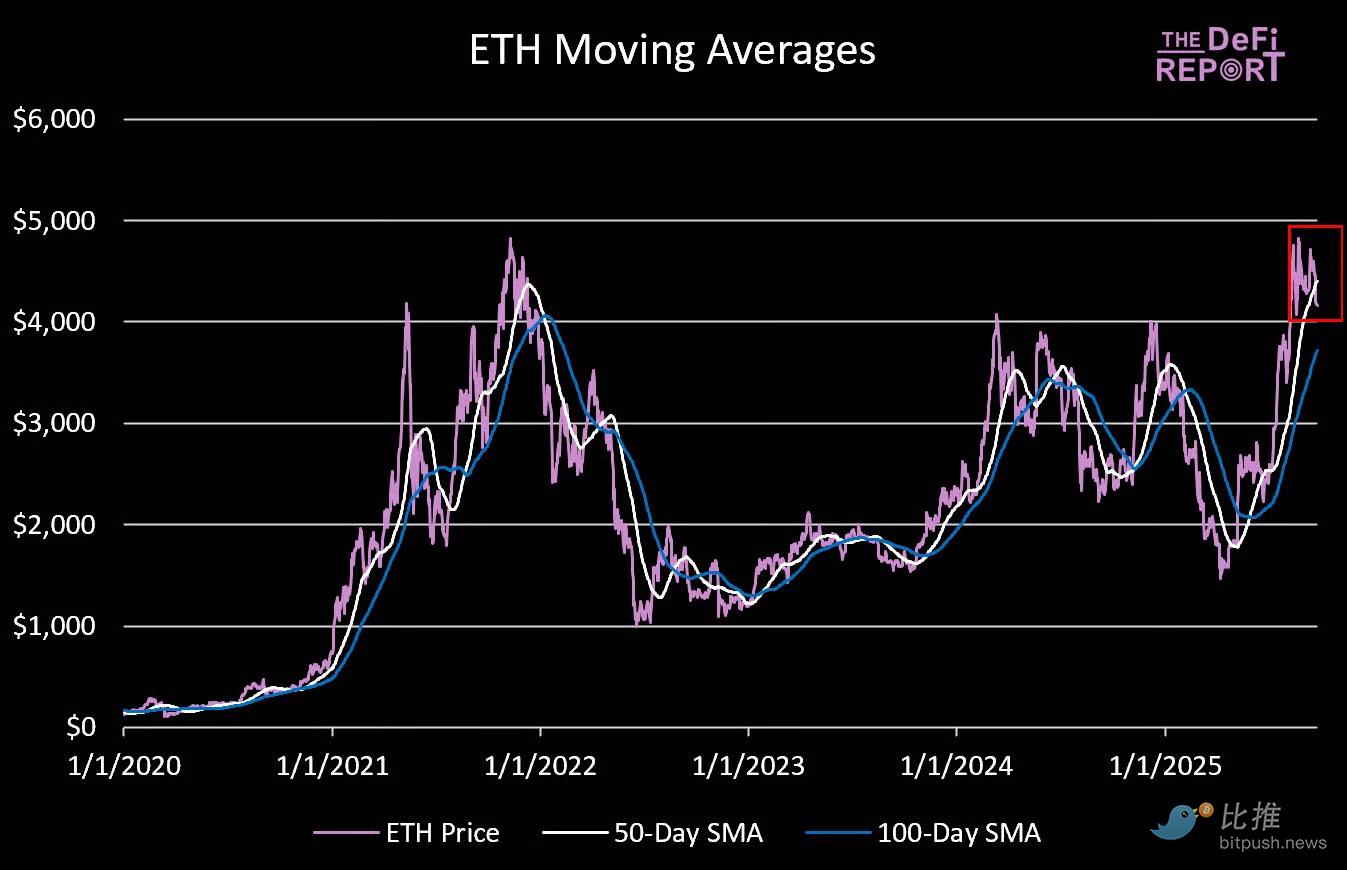

ETH has fallen below its 50-day moving average and is now trading below the critical $4,000 level.

Further downside could take it to the 100-day moving average at $3,700. Ultimately, for ETH to sustainably break new all-time highs, it needs BTC to hold key support levels.

"Blue-Chip" Memes

As liquidity is withdrawn from the long end of the risk curve, meme coins are currently taking the hardest hit.

If we assume the cycle still has room to run (see below), some of these tokens may present attractive entry points.

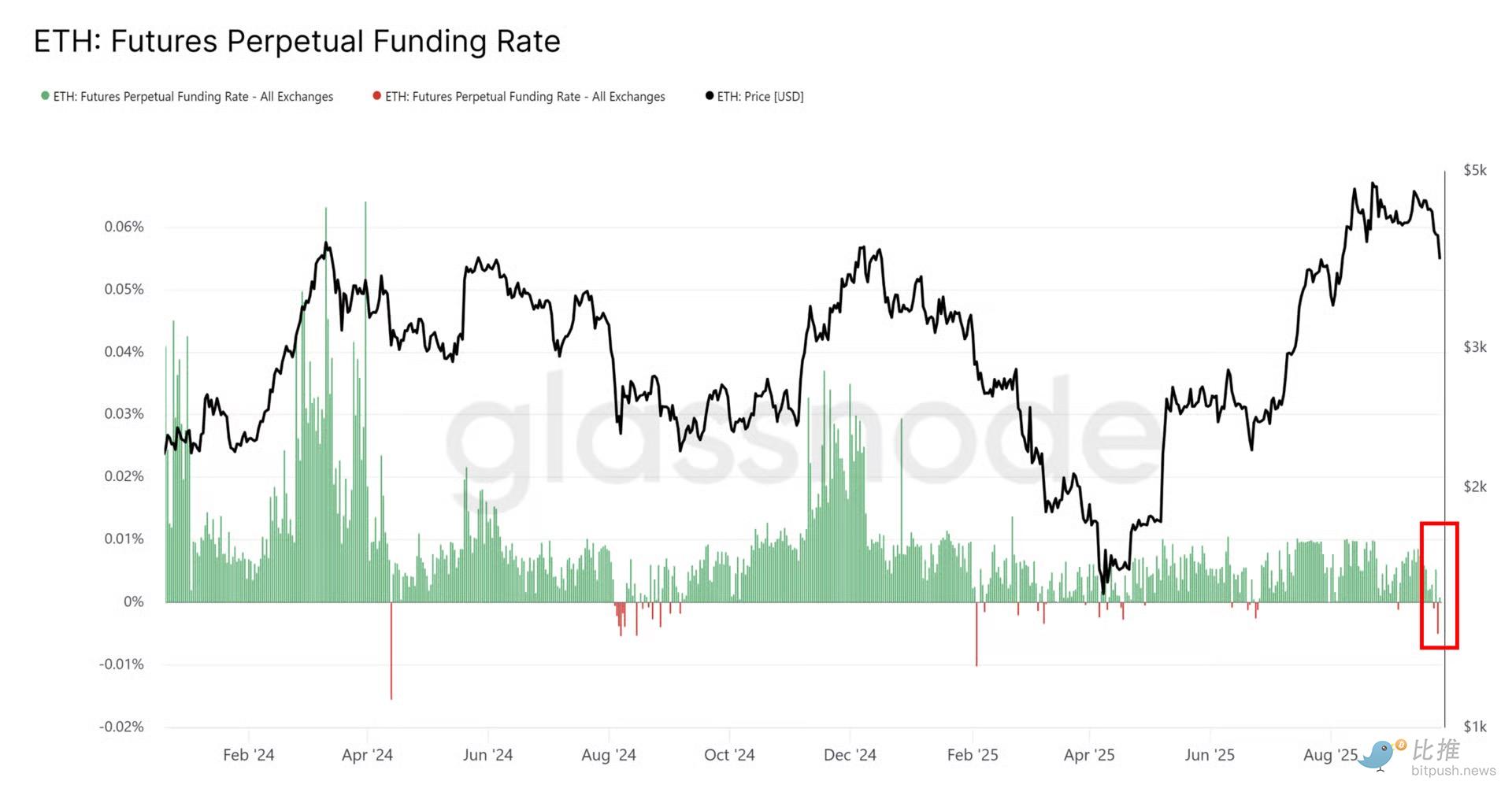

Funding Rates

As momentum fades, ETH funding rates in the futures market have turned negative.

For an ideal setup, we need to see further bearish positioning among traders, followed by a shift in sentiment and short covering to reignite the bull market.

Summary Thoughts

Is the probability of a top high?

It’s certainly possible, but we do not believe this is the top. In our view, the recent sell-off is a healthy correction/flush, and the bull market structure remains intact.

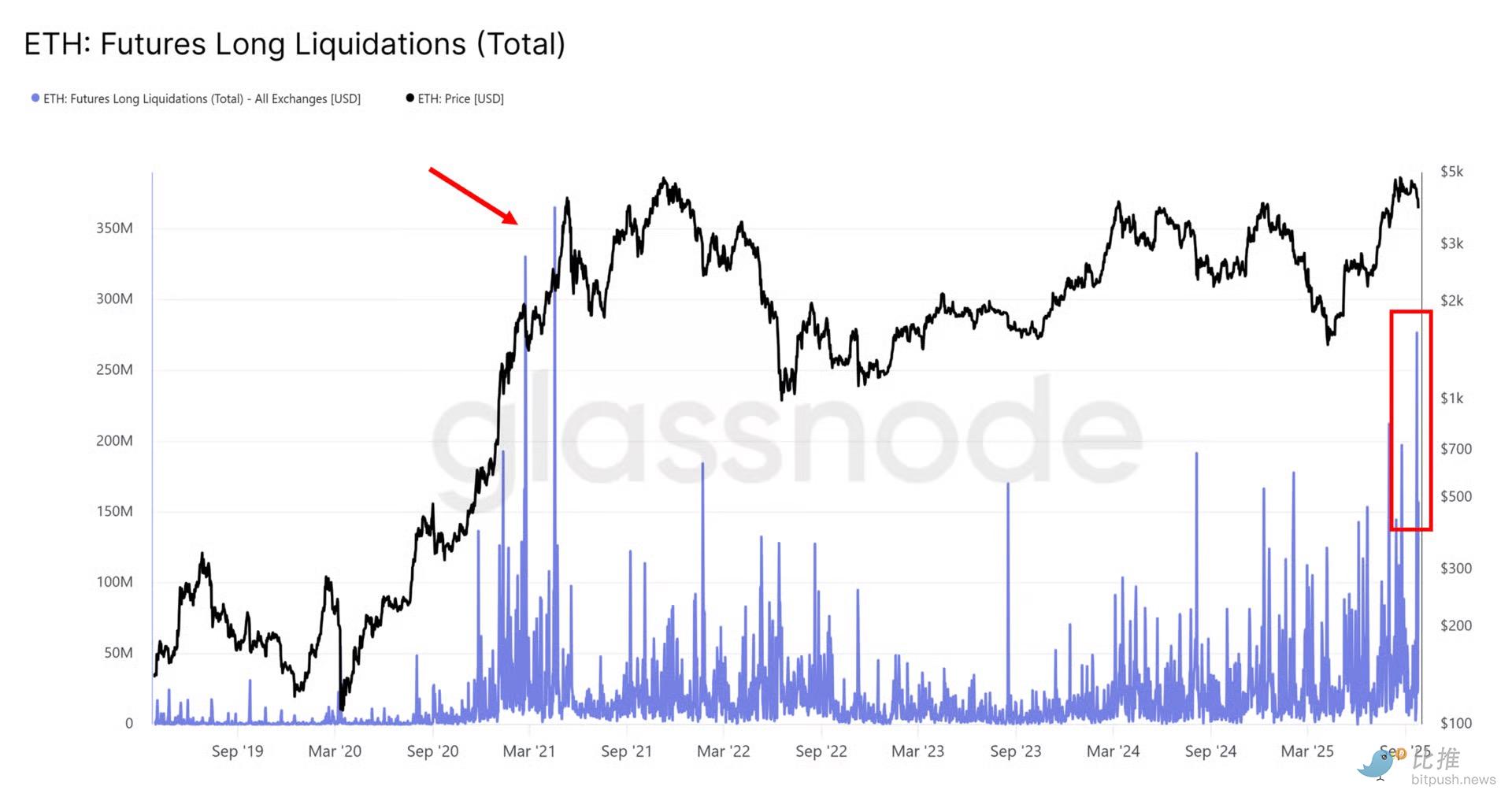

We believe that excessive leverage and complacency in the perpetuals market (especially for altcoins) are the main culprits. In the past few days, ETH experienced $480 million in futures long liquidations on centralized exchanges—the most since April 2021. Billions more were lost on Hyperliquid and other decentralized perpetuals exchanges.

When this happened in 2021, it turned out to be just a minor setback on the road to new all-time highs.

In many ways, we see similarities to last year—when the market briefly rallied after the Federal Reserve’s September rate cut, then corrected, followed by a larger rally in October and November.

From a macroeconomic and business cycle perspective, we believe the setup is positive:

-

Profits are rising

-

Banks are lending

-

The Federal Reserve is cutting rates

-

Capital is still moving out on the risk curve (small caps are now outperforming)

-

Long-term yields are rising moderately (which is appropriate given strong growth)

-

Yesterday’s initial jobless claims data shows unemployment remains very low

-

ISM appears ready to enter expansion territory

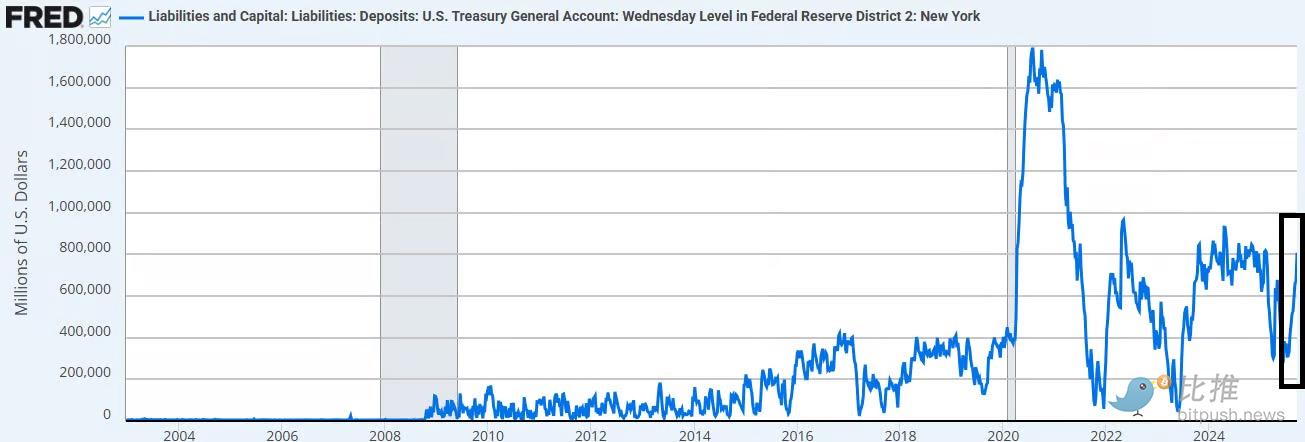

That said, we do see some liquidity being withdrawn from the market as the US Treasury replenishes its “checking account.” In the past few weeks, about $500 billions have been added back to the TGA (US Treasury General Account).

We believe this is one of the reasons for the crypto sell-off (along with excessive leverage).

The good news?

This is now behind us, as the TGA has returned to its target level.

Looking Ahead

To confirm the continuation of the bull market, we are watching the following:

-

BTC holds the previous high range of $105,000-$107,000. If this area is breached, the ultimate level to hold is the 50-week moving average (currently $99,000). If this level is lost, the probability of a bear market outweighs that of a bull market.

-

ETH rebounds and reclaims the $4,000 level. If it breaks down, we expect a bounce near the 100-day SMA ($3,700).

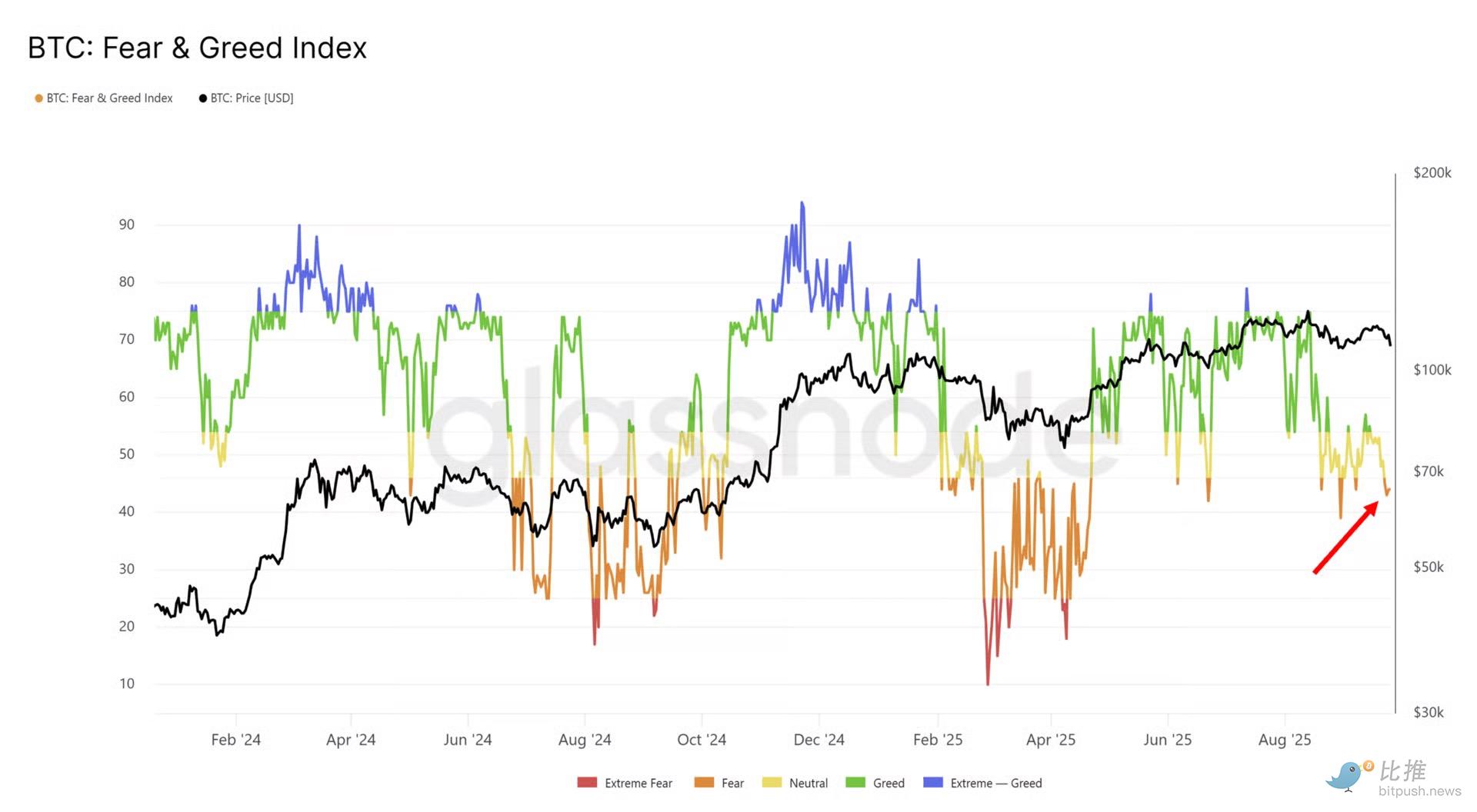

Generally speaking, at the end of the 2021 cycle, the market caught many investors off guard. In our view, this “trauma” is very evident in current market sentiment.

The market is not only at panic levels right now, but we are also seeing a lot of “the top is in” sentiment on social media.

The reality is, when the real top arrives, few will be shouting about it.

This is how market psychology works.

Stay curious.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Stable (STABL)

The IMF warns about the global impact of dollar stablecoins

Ether Outperforms Bitcoin In ETF And Technicals

Stunning SpaceX Bitcoin Transfer: $99.8M Move Signals Major Institutional Crypto Strategy