Financial sector earthquake! Even SWIFT can't hold on anymore!

According to an exclusive report by foreign media outlet The Big Whale, international financial communications giant SWIFT is collaborating with several major global banks (including BNP Paribas and BNY Mellon) and has selected the Ethereum Layer2 network Linea as its blockchain testing platform, aiming to migrate its traditional cross-border payment messaging system “on-chain.”

The project, reportedly driven by Ethereum core developer Consensys, has attracted participation from more than ten global financial institutions and will enter the actual deployment phase in the coming months. An insider from one of the participating banks stated: “This collaboration is expected to bring about a major technological transformation for the global interbank payment system.”

If this collaboration is officially announced in the future, it will not only be a technical milestone but could also mark a historic turning point:The widespread adoption of blockchain and stablecoins is shaking the technological foundations of legacy financial infrastructures like SWIFT, forcing them to take the first step toward transformation.

Who is SWIFT? How important is its status?

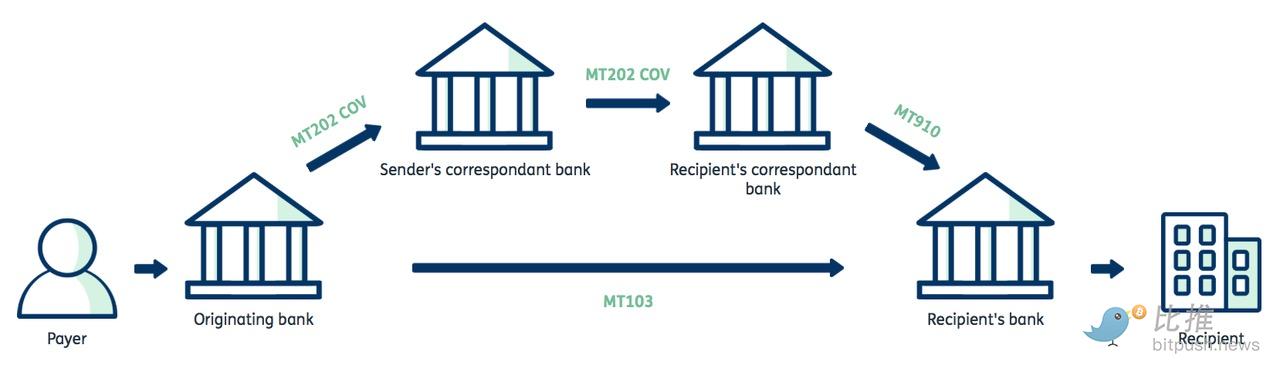

SWIFT (Society for Worldwide Interbank Financial Telecommunication), founded in 1973 and headquartered in Belgium, is the “super hub” used by banks worldwide to transmit financial messages (such as payment instructions, clearing confirmations, fund settlements, etc.).

Simply put, SWIFT is like a “super WeChat group” for banks around the world. It does not handle specific businesses like deposits or remittances, but is responsible for securely transmitting instructions such as “A should transfer X amount to B” between banks.

Currently, SWIFT connects more than 11,000 financial institutions worldwide, covering over 200 countries and regions, and processes more than 42 million financial messages daily. It plays a “central nervous system” role in global trade, cross-border remittances, securities trading, and clearing.

However, this highly centralized network system also faces numerous pain points:

-

Low efficiency: Cross-border payment cycles can take 1–3 business days, depending on the number of intermediary banks and national regulations;

-

High costs: Each transaction involves intermediary bank fees;

-

Poor transparency: Payment paths and statuses are unclear and difficult to track;

-

Geopolitical risks: In recent years, SWIFT has been used multiple times as a tool for financial sanctions (e.g., Russia being removed from SWIFT), exposing its highly centralized strategic sensitivity.

Against this backdrop, the inherent decentralization, transparency, and high efficiency of blockchain technology are seen as potential solutions to SWIFT’s “outdated structure.”

Why Linea?

Linea is an Ethereum Layer2 network developed by Consensys, utilizing ZK-Rollup (zero-knowledge rollup) technology, and has several notable advantages:

-

Privacy protection: ZK technology allows verification of transaction authenticity without exposing the underlying data, meeting banks’ dual requirements for compliance and confidentiality;

-

High performance, low cost: Compared to the Ethereum mainnet, Layer2 can handle larger transaction volumes at lower fees;

-

Compatibility with Ethereum mainnet: Seamless integration with existing stablecoins, RWA, and DeFi components;

-

Enterprise-level support: Backed by Consensys, with the capability and reputation to serve large institutions.

Compared to other chains, Linea provides a “regulator-friendly, high-performance on-chain environment,” making it an ideal choice for SWIFT under current compliance pressures.

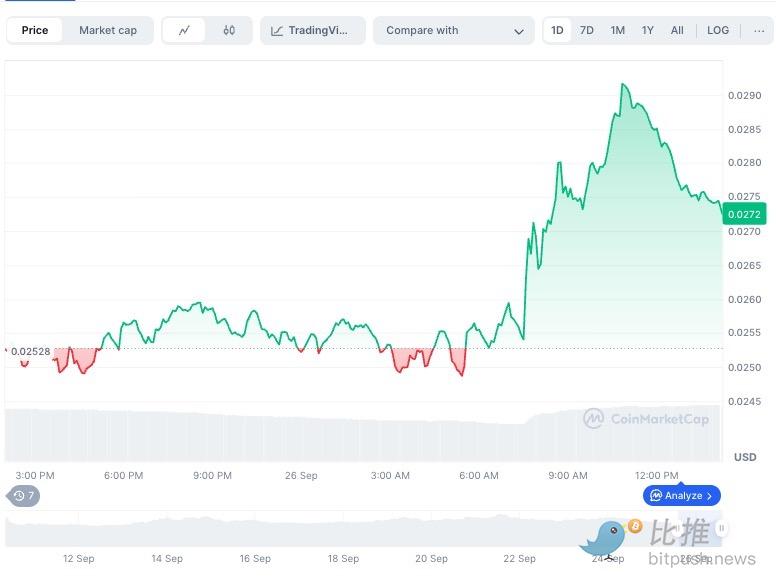

Market data shows that after this news broke, the price of the Linea token surged by more than 14% at its peak that day and remains at the upper end of the upward range, significantly outperforming the broader market.

What does an on-chain SWIFT mean?

If SWIFT migrates part or all of its messaging transmission system to blockchain, it will have the following impacts:

1. Lower cross-border payment costs and time

On-chain systems running on ZK-Rollup and other L2 architectures can achieve second-level transaction confirmations, greatly reducing intermediary steps and corresponding fees. For the current SWIFT payment system, which can take up to three days to settle, this is a qualitative leap.

2. Improved financial transparency and traceability

On-chain records can be queried and audited by authorized parties, greatly enhancing anti-money laundering and compliance capabilities. At the same time, real-time visibility of transaction status also increases the transparency and trustworthiness of financial transactions.

3. More flexible asset settlement

In the future, SWIFT may not only transmit “payment instructions” but also “the assets themselves.” On-chain, assets such as stablecoins, government bonds, and bills can be implemented via smart contracts, enabling settlement finality.

4. Building a unified global payment standard

Blockchain is inherently global, unlike the fragmented standards of traditional finance. If SWIFT builds a unified standard based on this, it could lead the next generation of global payment infrastructure.

Who benefits first? Who might be left out?

Potential winners:

-

Ethereum ecosystem: Linea’s integration with SWIFT will bring massive capital flows and application scenarios to the Ethereum mainnet;

-

Stablecoin issuers (such as USDC, DAI): Will play a key role in on-chain settlement;

-

On-chain compliance service providers (such as Chainalysis, Fireblocks): Will benefit from the demand for regulatory-friendly infrastructure;

-

Modular DeFi component developers: Providing underlying functions such as account systems, AML tools, and payment interfaces.

Potentially pressured parties:

-

Correspondent Banks: In the SWIFT system, they profit from “transfer channels.” If these paths are replaced by on-chain smart contracts, their business model will be challenged;

-

Legacy clearinghouses and payment networks: If they cannot quickly adapt to on-chain operations, they may be marginalized;

-

National payment systems with outdated technology: Will gradually lose competitiveness in the face of global on-chain payment systems.

Summary

This is not SWIFT’s first attempt to embrace blockchain. Previously, it has explored cross-chain communication with Chainlink and piloted digital bond clearing with Euroclear. However, this time, choosing to migrate its core messaging system to the public chain environment represented by Linea is its most “decentralized” attempt ever.

Whether SWIFT will truly “go on-chain” in the future still awaits official confirmation. But even at the testing stage, it sends a strong signal: The “old order” of the global cross-border payment system is undergoing a revolution driven by technology.

Author: Bootly

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.