mUSD’s “Home Court Advantage”: Can MetaMask Make Waves with Stablecoins in Its Own Pond?

Source: Token Dispatch

Author: Prathik Desai

Compiled and organized by: BitpushNews

Recently, every week feels like déjà vu—yet another stablecoin launch, yet another attempt to reshape the flow of value.

First, there was the bidding war for the USDH issuance rights by Hyperliquid, followed by discussions about the broader trend of vertical integration to capture US Treasury yields.

Now, it’s MetaMask’s turn with its native stablecoin, mUSD. What do all these strategies have in common? Distribution.

In the crypto space, and in every sector, distribution has become the “success story” for building thriving business models.

If you have a community of millions, why not airdrop tokens directly to them to leverage this advantage? Well, because it doesn’t always work.

Telegram tried to do this with TON. Despite having 500 million messaging users, those users never migrated on-chain.

Facebook tried to do this with Libra, convinced that its billions of social media accounts could form the foundation of a new currency. In theory, both seemed destined for success, but in practice, they fell apart.

This may be why MetaMask’s mUSD, with its fox ears and the “$” symbol on top, caught my attention. At first glance, it looks like any other stablecoin—backed by short-term US Treasuries held at regulated custodians, and issued using the framework developed by the M0 protocol via Bridge.xyz.

But in a $300 billion stablecoin market dominated by two giants, what will make MetaMask’s mUSD stand out?

Distribution: MetaMask’s Secret Weapon

MetaMask may be entering a fiercely competitive field, but it has a unique selling point that competitors can’t match: distribution.

MetaMask boasts 100 million annual users worldwide, a user base few can rival.

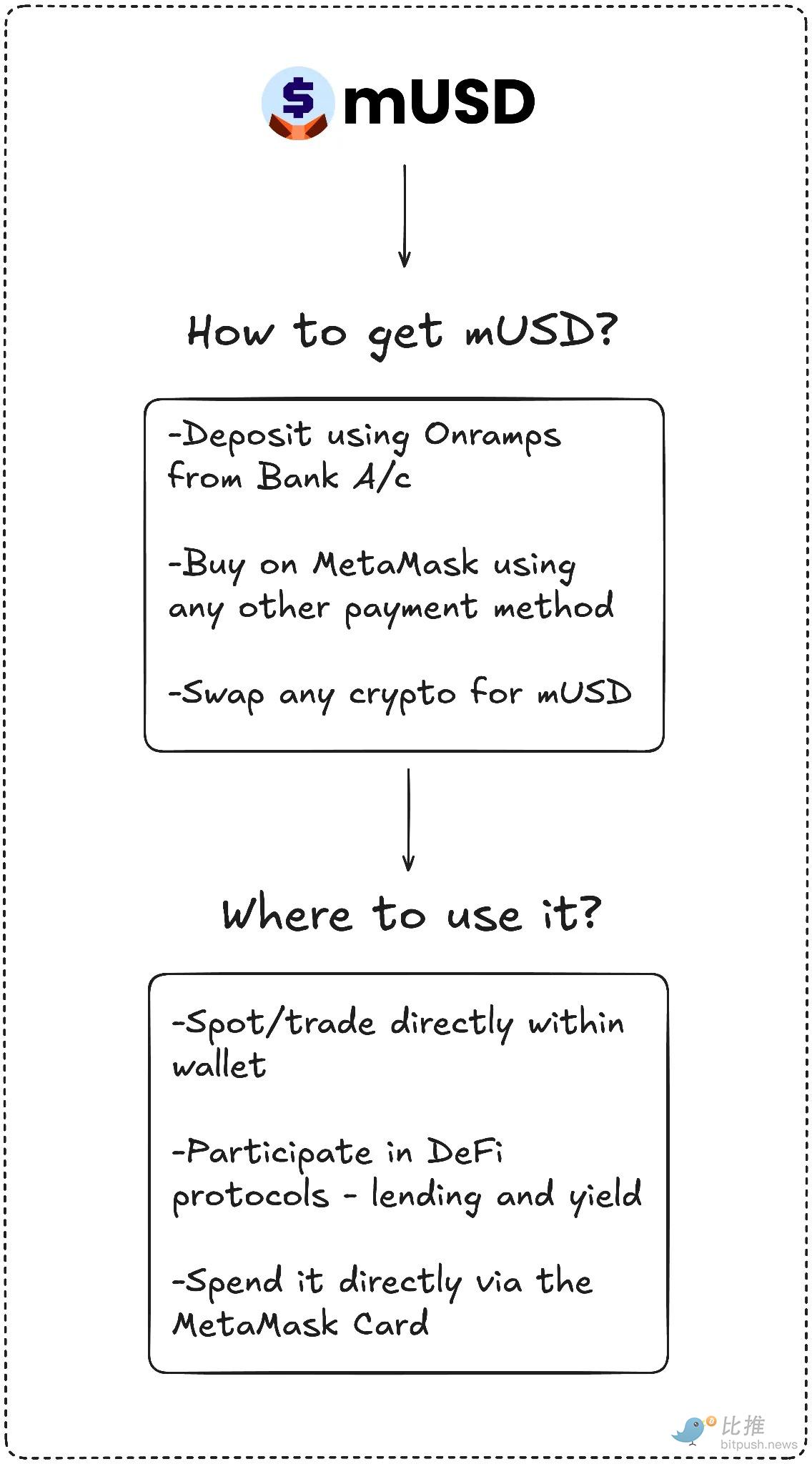

mUSD will also be the first stablecoin ever natively launched within a self-custody wallet, supporting fiat on-ramps, swaps, and even in-store spending via the MetaMask Card. Users no longer need to search across exchanges, bridge between different chains, or deal with the hassle of adding custom tokens.

Telegram didn’t have this alignment between product and user behavior. But MetaMask does.

Telegram’s goal was to move its messaging users onto the blockchain for decentralized finance applications. MetaMask, on the other hand, enhances user experience by integrating a native stablecoin directly into the app.

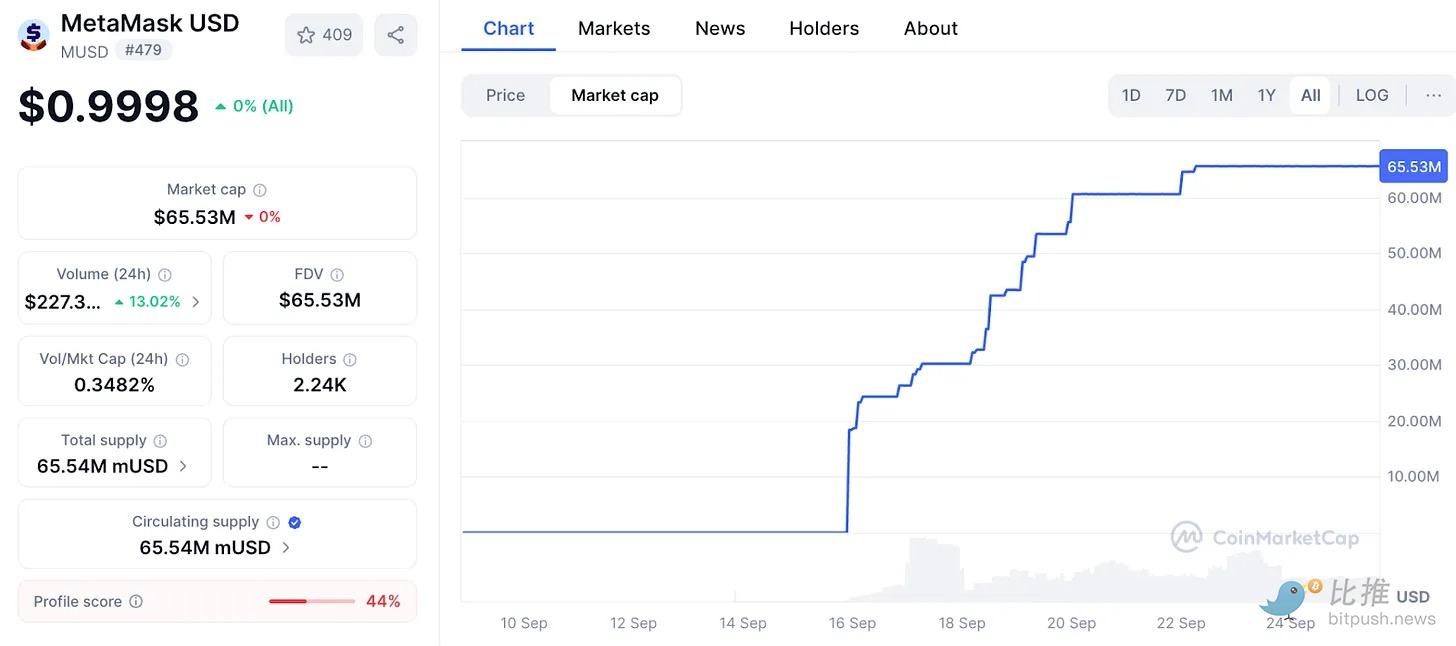

Data shows its adoption rate is very fast.

MetaMask’s mUSD market cap grew from $25 million to $65 million in just one week. Nearly 90% of this is on ConsenSys’s internal Layer 2 network, Linea, indicating that MetaMask’s interface can effectively direct liquidity.

This influence is similar to what exchanges have used in the past: when Binance automatically converted deposits to BUSD in 2022, its circulation soared overnight. Whoever controls the screen, controls the token. MetaMask, with over 30 million monthly active users, has more screens than any other entity in Web3.

It’s this distribution advantage that will set MetaMask apart from early players who tried to build sustainable stablecoins but ultimately failed.

Telegram’s grand plan partly collapsed due to regulatory issues. MetaMask, however, shields itself by partnering with Bridge, a Stripe subsidiary, and backing each token with short-term US Treasuries. This meets regulatory requirements, and the US GENIUS Act has provided a legal framework from day one.

Liquidity will also be key. MetaMask is seeding Linea’s DeFi ecosystem with mUSD trading pairs, hoping its internal network will anchor adoption.

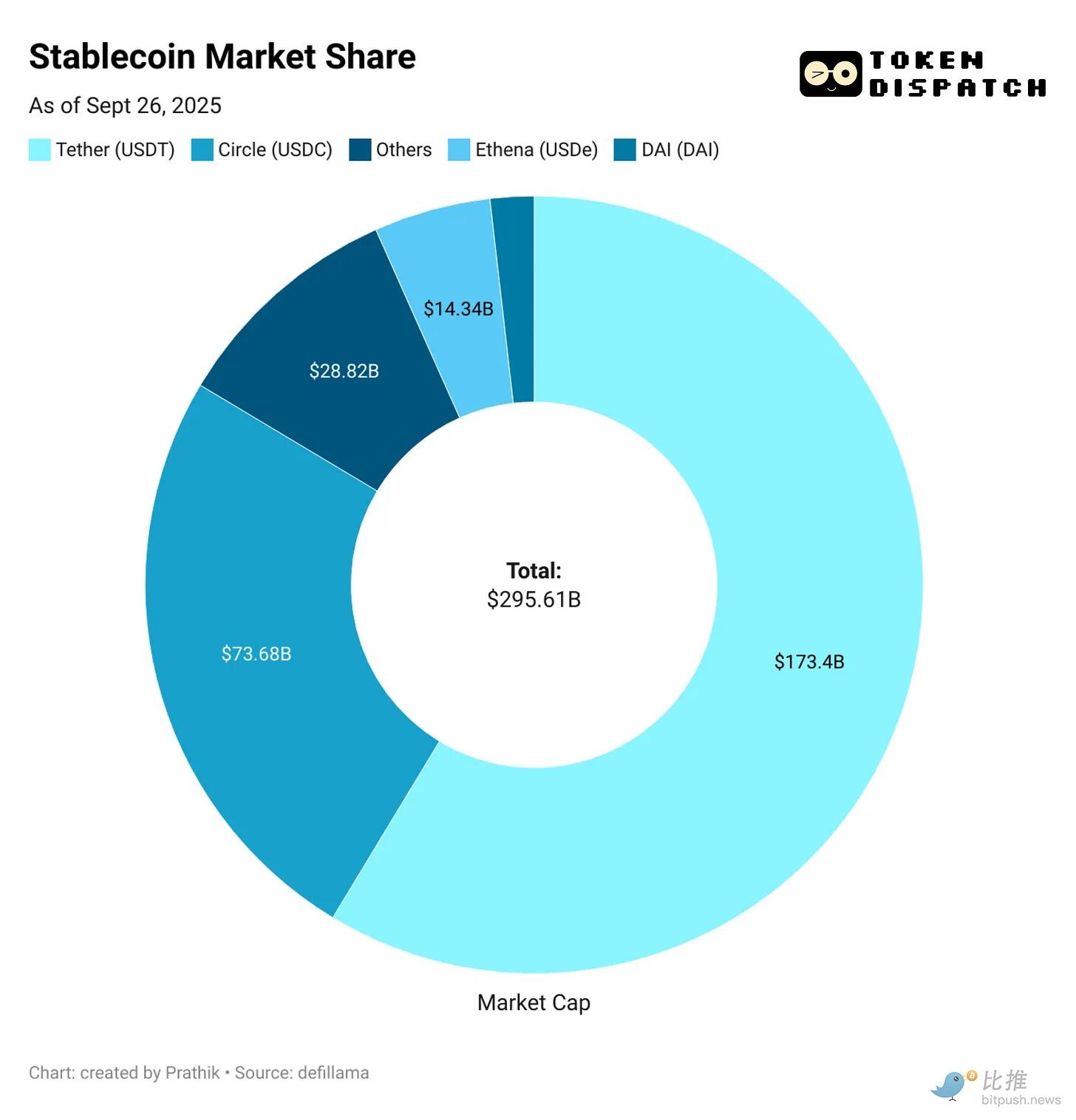

However, distribution does not guarantee success. MetaMask’s biggest challenge will come from existing giants, especially in a market already dominated by a handful of major players.

Tether’s USDT and Circle’s USDC account for almost 85% of all stablecoins. Ethena’s USDe, which uses yield as a lure, is a distant third with a supply of $14 billion. Hyperliquid’s USDH has just arrived, aiming to recycle its trading deposits back into its own ecosystem.

This brings me back to the original question: What exactly does MetaMask want mUSD to become?

Challenges and Value Capture: mUSD’s Positioning

Directly challenging USDT and USDC seems unlikely. Liquidity, exchange listings, and user habits all favor the existing giants. Perhaps mUSD doesn’t need to compete head-on. Just as I expect Hyperliquid’s USDH to benefit its ecosystem by channeling more value to its community, mUSD may also be a move to capture more value from its existing user base.

Whenever a new user onboards via Transak, whenever someone swaps ETH for the new stablecoin inside MetaMask, and whenever they swipe their MetaMask Card in stores, mUSD will be the first choice. This makes the stablecoin the default option integrated within the network.

This reminds me of the times I had to bridge USDC to Ethereum, Solana, Arbitrum, and Polygon, depending on what I needed to do with stablecoins.

mUSD puts an end to all those tedious bridging and swapping processes.

Another important takeaway: yield

With mUSD, MetaMask will capture the yield from the US Treasuries backing the token. For every $1 billion in circulation, tens of millions of dollars in annual interest will flow back to ConsenSys. This transforms the wallet from a cost center into a profit engine.

If only $1 billion of mUSD is backed by an equivalent amount of US Treasuries, it can earn $40 million in annual interest income from the yield. For comparison, MetaMask earned $67 million in revenue from its fees last year.

This could unlock another passive and considerable revenue stream for MetaMask.

However, there’s something about this that makes me uneasy.

For years, I’ve considered wallets to be neutral “sign and send” tools. mUSD blurs this line, turning a tool I once trusted as neutral infrastructure into a revenue-generating business unit profiting from my deposits.

Thus, distribution is both an advantage and a risk. It can make mUSD sticky through default settings, but it may also raise questions about bias and lock-in. If MetaMask tweaks the swap process to make its own token path cheaper or more prominent, it could make the world of open finance less open.

There’s also the issue of fragmentation.

If every decentralized wallet starts issuing its own dollar token, it could create multiple “walled garden” currencies, rather than the interchangeable USDT/USDC duopoly we have now.

I don’t know where this will lead. MetaMask has integrated its card feature, nicely closing the financial loop of buying, investing, and spending mUSD. The first week’s growth suggests it can overcome the initial hurdles. However, the dominance of existing giants shows how challenging it is to go from millions to billions.

The fate of MetaMask’s mUSD may lie somewhere between these realities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Stable (STABL)

The IMF warns about the global impact of dollar stablecoins

Ether Outperforms Bitcoin In ETF And Technicals

Stunning SpaceX Bitcoin Transfer: $99.8M Move Signals Major Institutional Crypto Strategy