Payments Platform Bolt Announces New ‘SuperApp’ Combining Traditional Finances With Crypto

A leading payments platform is launching a new smartphone application promising to effortlessly combine crypto with traditional financing.

On Tuesday, Bolt launched its new SuperApp, a platform that combines payments, banking, crypto trading, rewards and shopping into one application.

The app, previously available in beta, is now live on the Apple App Store and Google Play Store.

The company said the product is designed to replace the need for multiple financial apps by offering services such as peer-to-peer transfers, direct deposit, ATM access, and debit card issuance. Users can also trade more than 40 cryptocurrencies, including Bitcoin, Ethereum, Polygon, Solana and USDC, with low transaction fees.

Bolt’s SuperApp integrates rewards and commerce features as well. Customers earn automatic base rewards on categories like streaming and gaming, with additional boosts available for dining, travel and groceries. AI tools power personalized shopping flows, product comparisons and real-time order tracking.

Says Ryan Breslow, Founder and CEO of Bolt, of the new SuperApp,

“The future of money and commerce isn’t siloed—it’s seamless. Today’s consumer shouldn’t have to juggle multiple apps for fiat, crypto, rewards, or shopping. Our SuperApp brings it all together in one secure, intuitive platform.

By building rewards, banking and commerce directly into a single app, we’re creating not just another wallet, but a financial operating system for the modern consumer. Bolt is delivering the infrastructure to make this future real, scalable, and accessible to everyone.”

Banking services for the app are provided by Midland States Bank.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

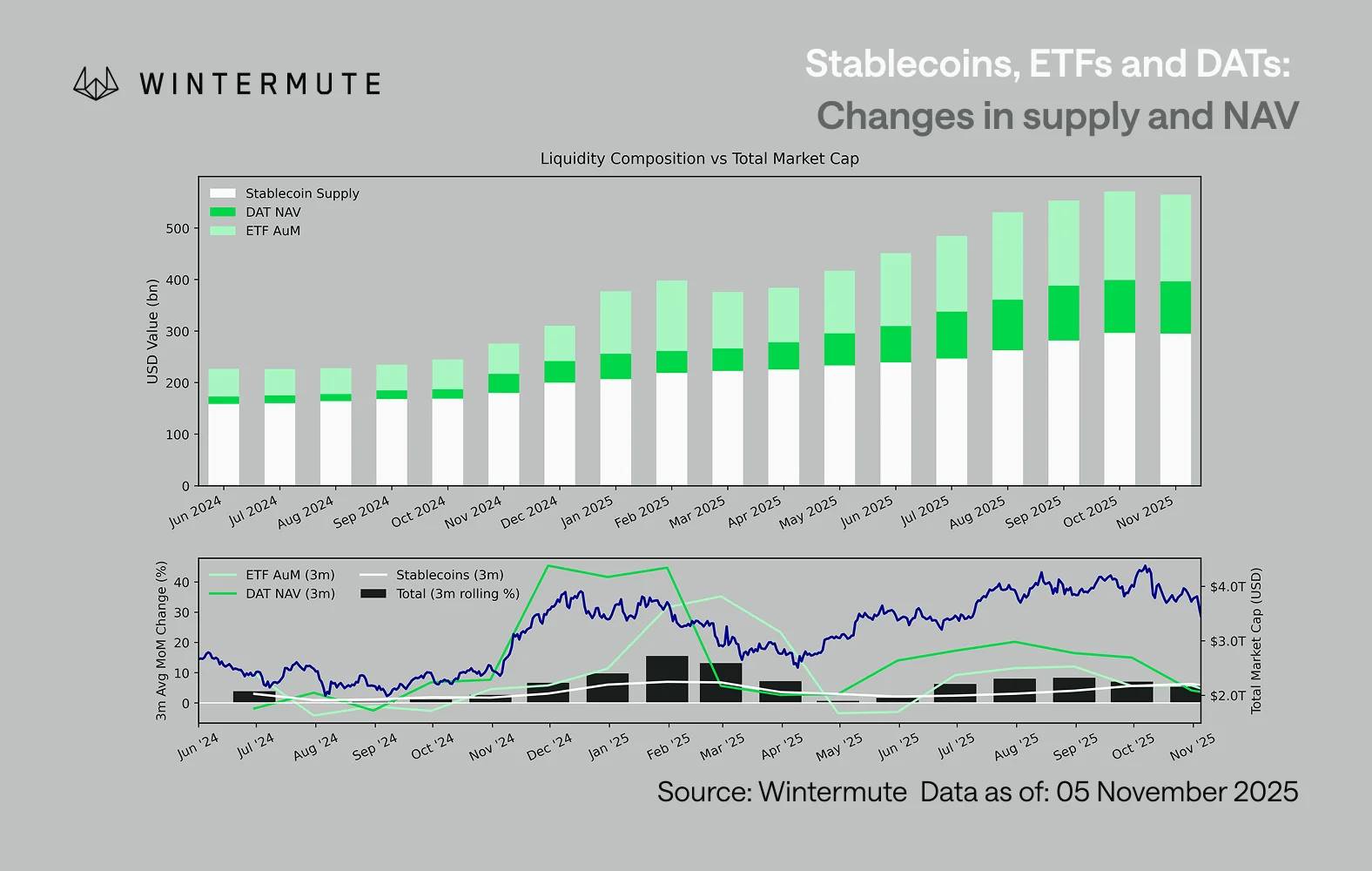

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.