Ethereum (ETH) Price Prediction for September 26

The market is totally red at the end of the week, according to CoinStats.

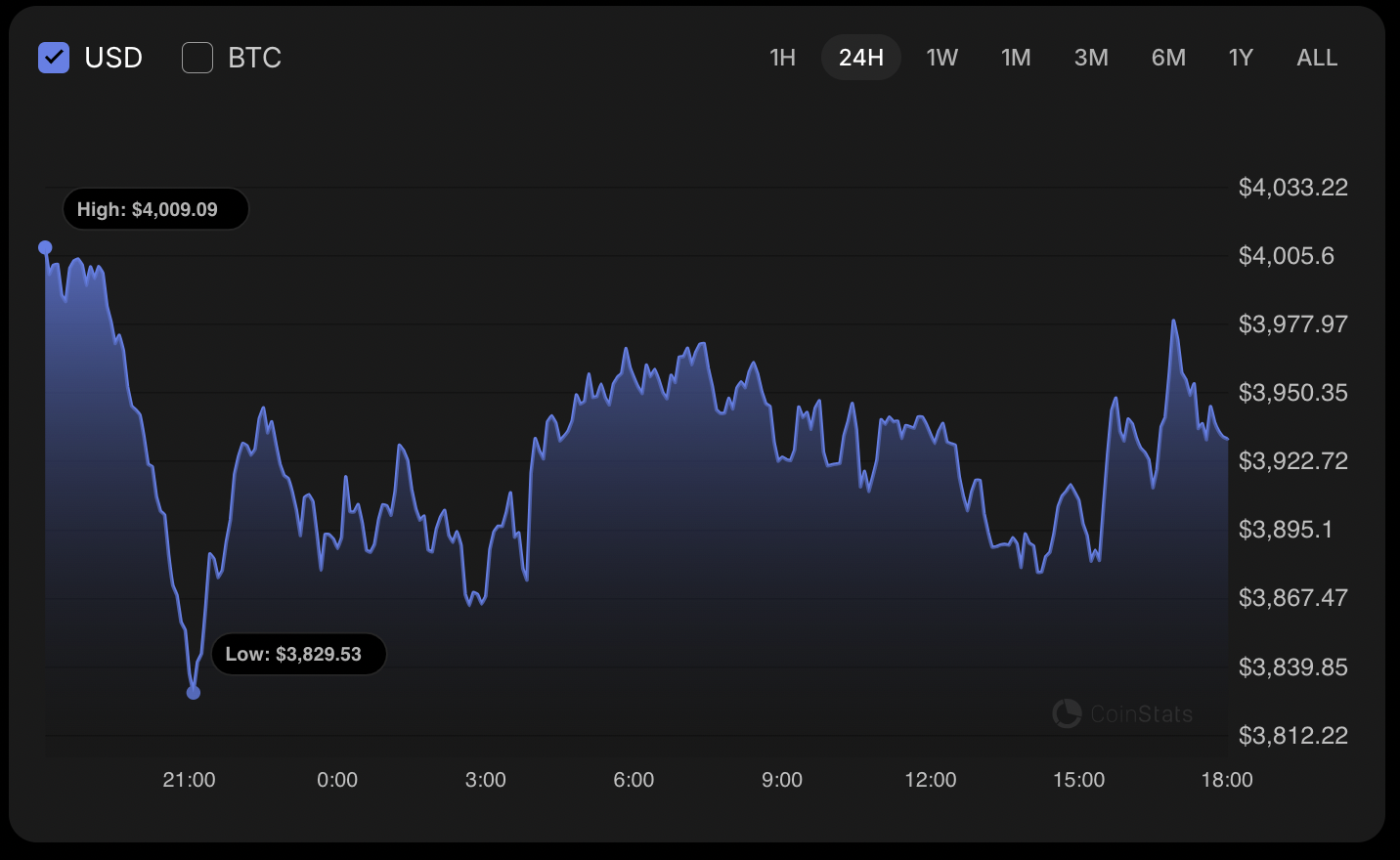

ETH/USD

The rate of Ethereum (ETH) has declined by almost 2% over the last 24 hours.

On the hourly chart, the price of ETH has made a false breakout of the local resistance of $3,976. However, if the daily bar closes around that mark, traders may expect a test of the $4,000 zone by tomorrow.

On the longer time frame, the rate of the main altcoin has entered a bearish area after breaking the $4,107 level.

Until the price is below that mark, sellers keep controlling the situation on the market. In this case, one can expect a further decline to the $3,700-$3,800 range.

From the midterm point of view, one should focus on the weekly candle's closure in terms of the $4,107 level. If it happens below it, the correction is likely to continue to the $3,600 mark.

Ethereum is trading at $3,937 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Surges Back to $90K—Is This a New Beginning or Just a Pause in the Bear Market?

- Bitcoin rebounded from $79,500 to $88,000 amid mid-sized wallet accumulation and ETF inflows, signaling potential market stabilization. - BlackRock ETF holders regained $3.2B profits as price reclaimed $90K, shifting institutional sentiment despite whale selling. - On-chain data shows mid-sized wallets (10–1,000 BTC) stabilizing prices, contrasting with whale outflows and leveraged futures liquidations. - Technical indicators cap Bitcoin below $105K EMAs, with $97K–$98K liquidity pocket as next critical

Visa’s Embrace of Blockchain Technology Updates the Worldwide Payment System

- Visa partners with Aquanow to expand stablecoin settlements in CEMEA, enabling faster cross-border payments via USDC and reducing operational costs. - The initiative scales to $2.5B monthly volume after a 2023 pilot, modernizing payment infrastructure by eliminating intermediaries and weekend delays. - Aquanow's institutional-grade crypto expertise supports Visa's digital asset ambitions, aligning with broader industry trends toward blockchain adoption. - While competitors like Mastercard advance stablec

Uzbekistan’s 2026 Stablecoin Initiative Seeks Expansion While Enforcing Rigorous Regulation

- Uzbekistan will legalize stablecoin payments and tokenized securities under strict 2026 regulations, marking a shift from prior crypto restrictions. - A regulatory sandbox will test stablecoin systems and develop tokenized markets, aligning with its Digital Uzbekistan 2030 innovation strategy. - The central bank will oversee risks, requiring all crypto transactions to flow through licensed providers with mandatory customer identification since 2023. - This controlled approach aims to attract foreign inve

Bitcoin News Update: S&P 500 Maintains Its Criteria, Leaves Out Bitcoin-Focused MSTR

- S&P 500 excludes MSTR for third time, citing reliance on Bitcoin assets over operational revenue. - MSCI reviews crypto-heavy firms, proposing 50% asset threshold for benchmark removal to maintain sector balance. - Saylor defends MSTR's corporate identity but acknowledges financials resemble investment vehicles with minimal software revenue. - Index providers prioritize operational stability and profitability, contrasting MSTR's volatile Bitcoin-linked earnings and losses. - Market context shows S&P 500