JPMorgan Cautions About Jobless Recovery Fueled by AI While Optimists Challenge the Prediction

- JPMorgan warns AI could trigger a "jobless recovery," displacing 45% of U.S. white-collar roles in finance, law, and tech. - Non-routine cognitive workers now dominate unemployment, signaling rising structural risks as AI automates expertise-driven tasks. - Optimists like David Sacks argue AI enhances productivity, not replaces jobs, with historical tech shifts creating net employment gains. - Goldman Sachs estimates 6-7% job displacement from AI, but notes temporary effects as new roles emerge in evolvi

JPMorgan’s team of economists has voiced concerns that artificial intelligence could lead to a “jobless recovery” in the U.S. workforce, especially impacting white-collar professionals. In a recent report, senior U.S. economist Murat Tasci pointed out that the rapid integration of AI technologies may replace jobs involving complex cognitive tasks—such as those in finance, law, engineering, and business management. These professions, which made up 45% of U.S. jobs in 2025, have typically weathered economic downturns well, but now face greater threats as AI begins to automate work that once required specialized human skills title1 [ 1 ]. Tasci observed that workers in non-routine cognitive roles now represent a higher portion of the unemployed compared to those in non-routine manual jobs, calling this trend “ominous” and a sign of increasing structural unemployment title2 [ 2 ].

This warning is based on shifting labor market trends. Over the last forty years, jobs involving repetitive tasks—both mental (like sales and clerical work) and physical (such as construction and manufacturing)—have struggled to recover after recessions, with employment in these areas still lagging behind pre-2008 numbers. Now, AI’s capacity to handle cognitive work threatens to bring similar challenges to highly skilled positions. For example, generative AI is already reducing the need for entry-level staff in finance, legal, and tech sectors, as tasks like reviewing contracts, analyzing data, and producing content are increasingly automated title3 [ 3 ].

The economic fallout from this shift could be significant. A jobless recovery—where economic output and company earnings rebound but hiring remains weak—could mean prolonged joblessness for white-collar workers and reduced consumer spending. Tasci cautioned that the slow job growth for non-routine cognitive roles could resemble the sluggish recoveries seen in routine jobs, potentially worsening wage gaps and regional inequalities as cities with many knowledge workers experience sharper employment declines title5 [ 5 ]. At the same time, Goldman Sachs Research predicts that AI could eliminate 6–7% of U.S. jobs, though it believes these disruptions will be temporary as new types of employment emerge.

Initial findings indicate that AI’s effects are already being felt. Data from the Bureau of Labor Statistics and JPMorgan reveal that non-routine cognitive workers now make up a greater share of the unemployed than those in routine jobs, reversing previous patterns title6 [ 6 ]. Industries like cloud computing, internet search, and IT systems design have seen job growth stall since 2022, coinciding with the rise of advanced language models title4 [ 4 ]. Furthermore, research from the Federal Reserve Bank of St. Louis identified a 0.47 correlation between AI exposure and increased unemployment in fields like computer science and mathematics, adding to concerns about job displacement title9 [ 8 ].

However, not everyone agrees with JPMorgan’s bleak outlook. Technology investor David Sacks, who also serves as the White House’s advisor on AI and crypto, contends that AI will enhance worker productivity rather than replace jobs, giving an advantage to those who adapt to the technology. He stressed that human involvement is still essential for providing context, guidance, and verification, and that fears of massive job losses are exaggerated title1 [ 1 ]. Likewise, Goldman Sachs points out that past technological revolutions have resulted in a net increase in jobs, with 60% of today’s roles not existing in 1940.

As AI adoption speeds up, both policymakers and businesses are under increasing pressure to respond to possible disruptions. JPMorgan recommends taking proactive steps, such as investing in workforce retraining, redesigning career paths, and strengthening social safety nets, to reduce the risk of long-term unemployment. Meanwhile, recent data from the Federal Reserve highlights the need for careful monitoring: even though the overall jobless rate remains near historic lows at 4.2%, trends within specific sectors point to a more complex transition in the labor market title9 [ 8 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

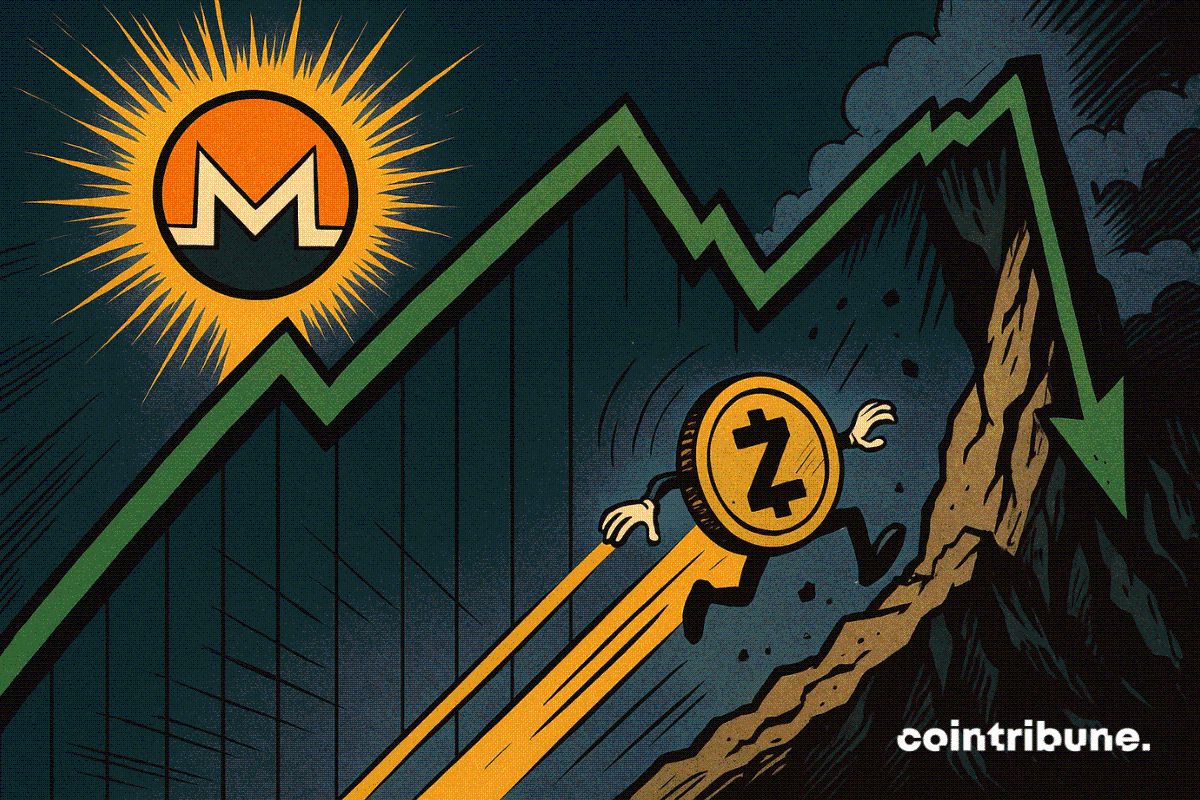

Monero Gains, Zcash Struggles In Privacy Coin Shake-up

Is Pump.fun (PUMP) Poised for a Bullish Move? This Fractal Setup Suggest So!

Bitcoin (BTC) Bounces Off Key Support — Can This Bullish Pattern Trigger an Upside Breakout?

Altcoins To Rally Higher? Analyst Highlights Key Fractal Hinting at Potential Upside