Just now, Bitcoin crashed again! $1.1 billion in liquidations!

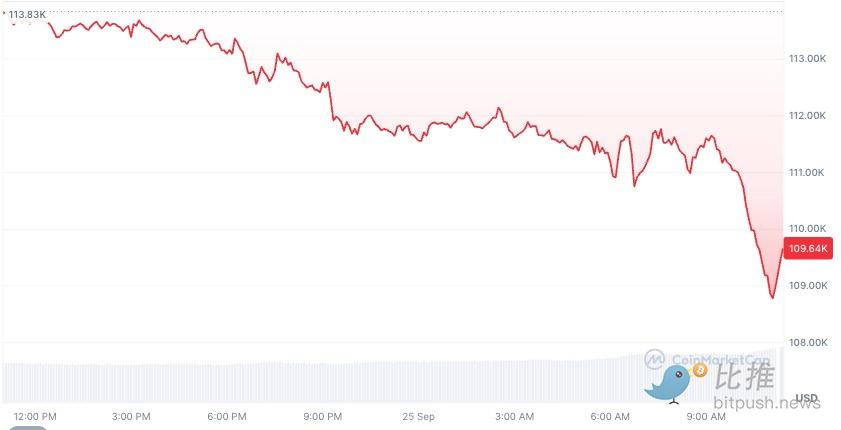

In the early hours of September 26, East 8th District time, the crypto market experienced a sudden drop. After hovering around $113,000 for several days, bitcoin suddenly fell below the key psychological threshold of $110,000, reaching a low of $108,909, with an intraday decline of 3.3%.

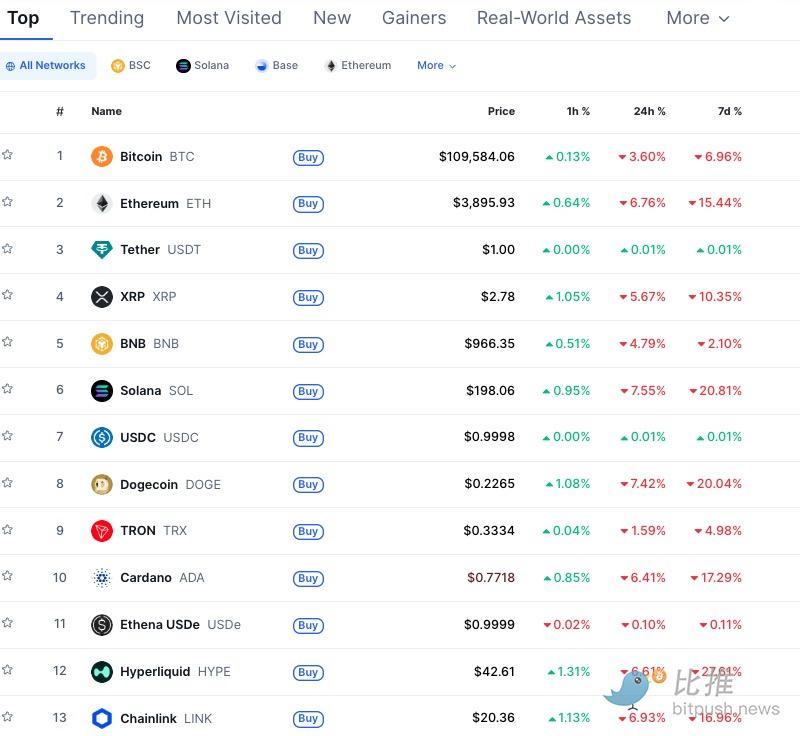

Ethereum fell further, with a drop of 7.5%, reaching as low as $38,279. Other major coins also suffered heavy losses, with Dogecoin down nearly 9%. Solana dropped nearly 9% as well.

Risk Appetite Reversal: Subtle Changes in the Macro Environment

The most notable feature of this decline is that it occurred in a relatively calm market environment. Unlike the flash crash in August triggered by whale sell-offs, this drop did not see any abnormal transactions exceeding 10,000 bitcoins in a single trade. Instead, the market showed a "boiling frog" style gradual downward trend.

The primary reason is the shift in market risk appetite. Although the Federal Reserve cut interest rates as expected at its September meeting, there was disagreement in the market about the future policy path. Some analysts pointed out that rate cut expectations have been excessively priced in, while the U.S. government's fiscal situation is worrying. If Congress fails to pass a funding bill by October 1, the U.S. government faces the risk of a shutdown, and this uncertainty is prompting investors to turn conservative.

It is worth noting that traditional financial markets have already sent early signals. The S&P 500 Index, Nasdaq Index, and Dow Jones Industrial Average have all declined. This synchronized drop in risk assets reflects that global capital is reassessing asset allocation strategies.

Samer Hasn, Senior Market Analyst at asset brokerage platform XS.com, said: "The continued downward pressure stems from a lack of sufficient buying power to defend prices after Monday's wave of large-scale liquidations. Another round of long liquidations today further weakened market sentiment, while the overall adjustment in the stock market amplified the cautious tone."

"Self-Fulfilling" Decline in the Leverage Market

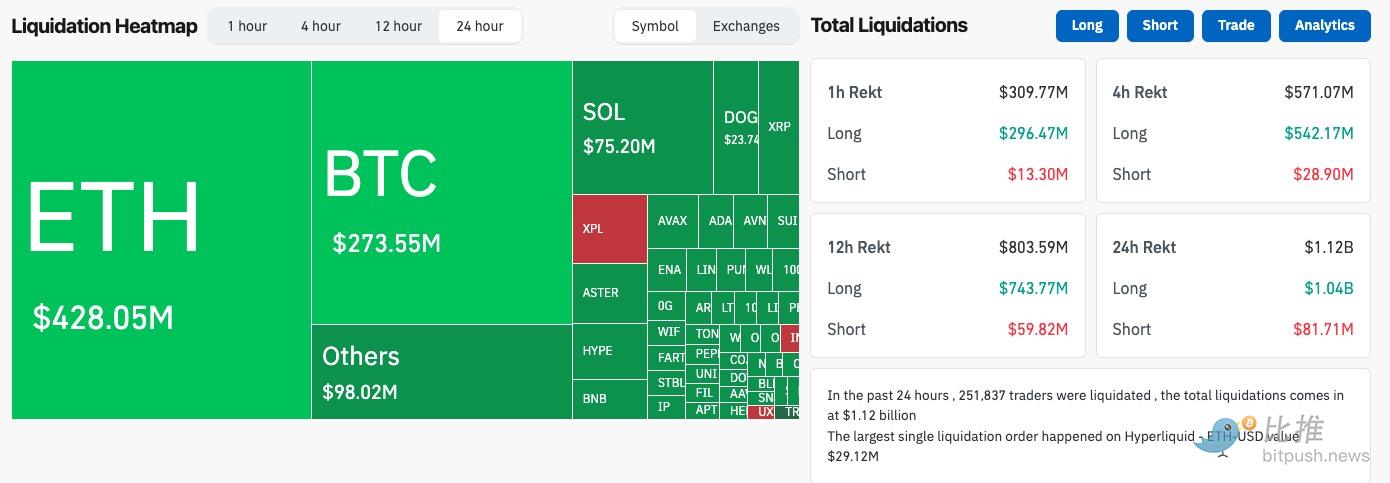

From a technical perspective, this drop has typical characteristics of a leveraged market. When bitcoin prices fell below the key support range of $110,000-$111,000, it triggered a large number of stop-loss liquidations in leveraged trades. According to Coinglass data, the total amount of liquidations across the network in the past 24 hours reached $1.1 billions, with long liquidations accounting for more than 80%.

This "leverage washout" phenomenon is not uncommon in the crypto market. During the relatively illiquid Asian early trading session, even small selling pressure can trigger disproportionate price fluctuations. When prices fall below key technical levels, programmatic trading stop-loss orders are triggered en masse, resulting in so-called "waterfall declines."

Subtle Changes in Institutional Fund Flows

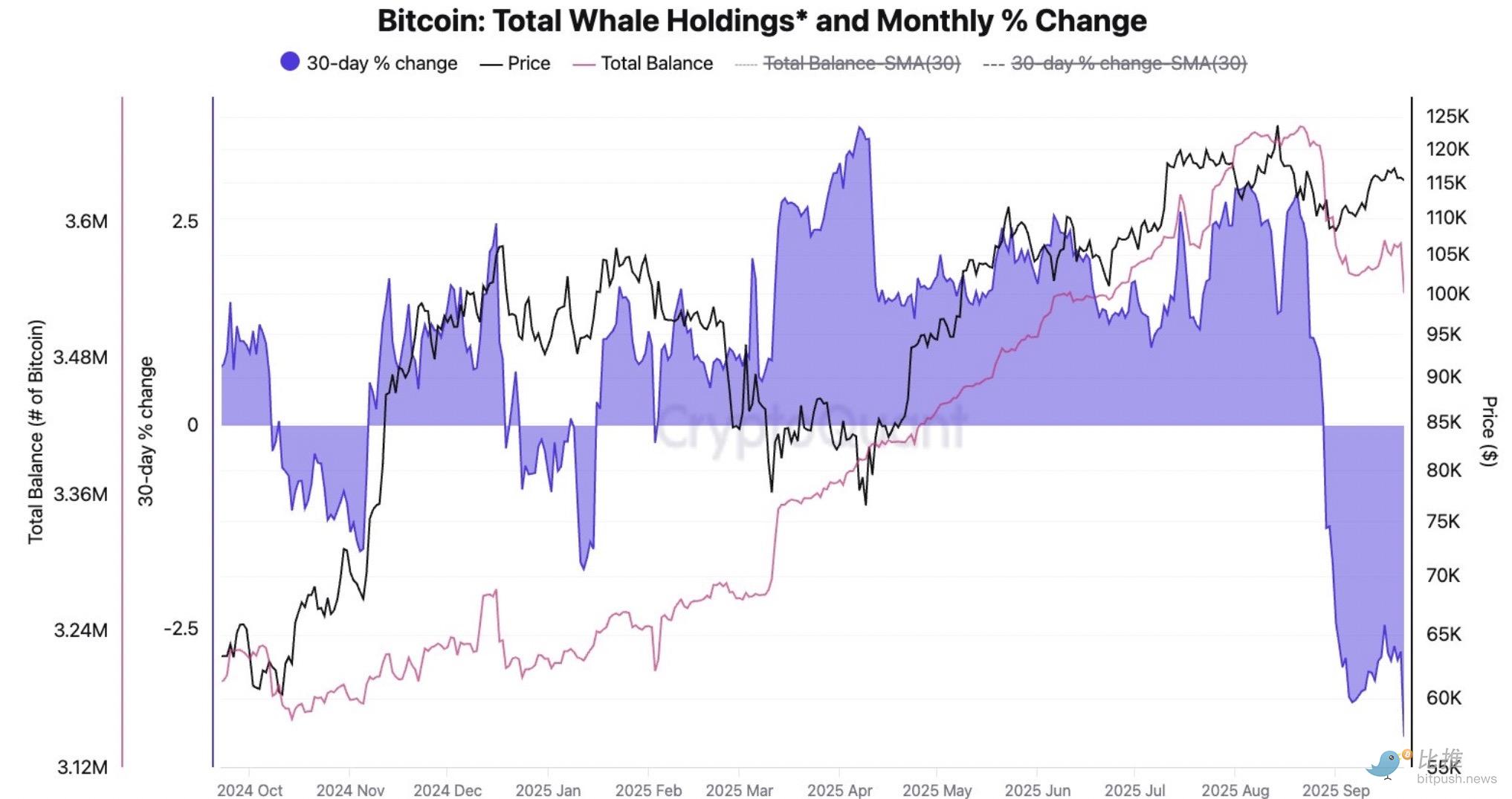

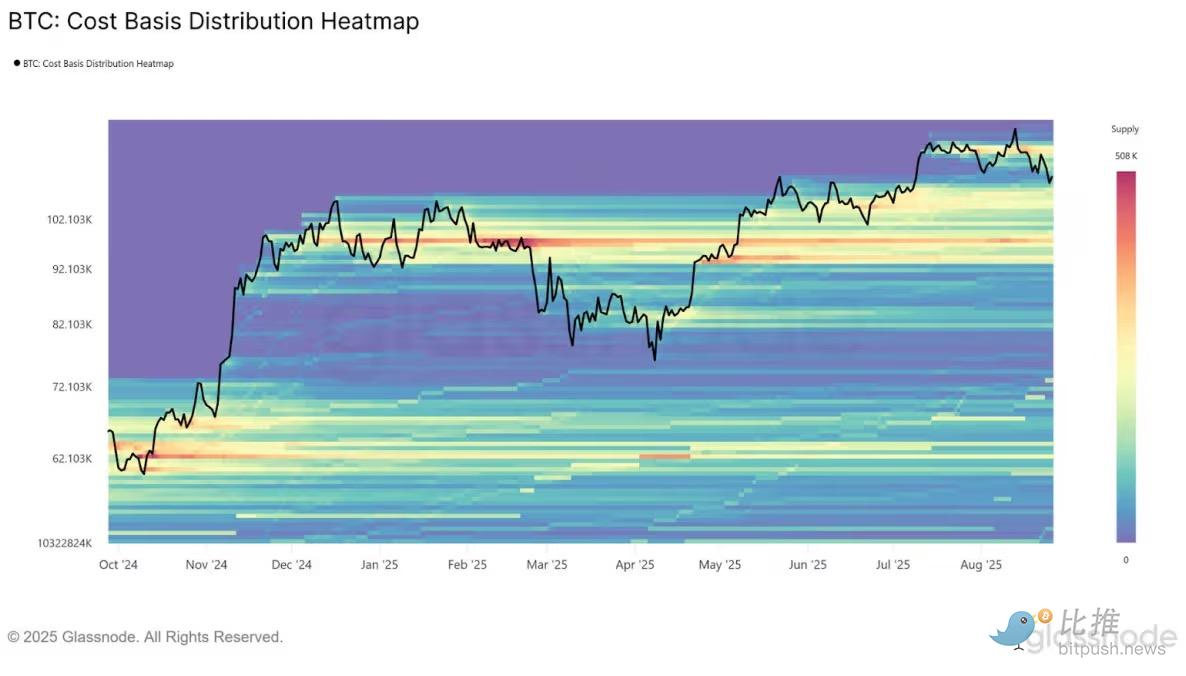

Although there was no whale sell-off on the scale seen in August, on-chain data still shows some noteworthy signs. According to CryptoQuant data, in the past month, addresses holding more than 1,000 bitcoins have reduced their holdings by about 147,000 bitcoins in total. This ongoing reduction in holdings may be related to institutional investors taking profits.

Spot bitcoin ETF fund flows have also shown a divergent trend. While ETFs from large institutions such as BlackRock and Fidelity continue to see net inflows, the overall inflow rate has slowed significantly. Some analysts believe this indicates that institutional investors are becoming more cautious about bitcoin’s short-term outlook.

This decline also reflects deeper structural changes in the crypto market. Compared to the 2021 cycle, institutional participation in the current market has increased significantly, making price movements more correlated with traditional financial markets. When U.S. stocks adjust, it is difficult for the crypto market to remain unaffected.

Key Level Analysis

From a technical analysis perspective, $108,000 is an important support level. If bitcoin can find support at this level, it may subsequently retest the $111,000-$113,000 range. Multiple technical indicators show that bitcoin is currently in a short-term oversold state, with a need for a technical rebound.

However, if the $108,000 support is broken, the next important support will be in the $105,000-$106,000 range. This range is not only the upper edge of the previous consolidation platform but also an area where multiple moving averages converge, and is expected to provide strong support.

Fundamental factors also need attention. The U.S. government funding deadline on October 1 is an important time point. If a government shutdown occurs, it may further intensify market risk aversion. In addition, the third-quarter earnings season for listed companies is about to begin, and corporate earnings performance may affect the overall performance of risk assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SharpLink Announces $104M Profit on the Back of Its Ethereum Strategy

Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

Digital Asset ETPs See $2 Billion Outflows Amid Policy Uncertainty