The four-year cycle has ended, and a new crypto order has arrived.

Author: Ignas | DeFi Research

Compiled by: TechFlow

Original Title: Farewell to Wild Growth: Will the Four-Year Cycle Repeat? The New Order of Cryptocurrency Has Arrived

I am a big fan of Ray Dalio’s Changing World Order model because it allows us to examine issues from a macro perspective and see the bigger picture.

Rather than getting caught up in the daily “drama” of the crypto space, it’s better to focus on the industry’s long-term trends. This is also how we should view cryptocurrency.

This is not just a rapid shift in narrative, but a fundamental change in the entire industry order.

The crypto market is no longer what it was in 2017 or 2021.

Here are several aspects where I believe the industry order has changed.

The Great Rotation: Asset Rotation in the Crypto Industry

The launch of bitcoin and ethereum ETFs marks a major shift.

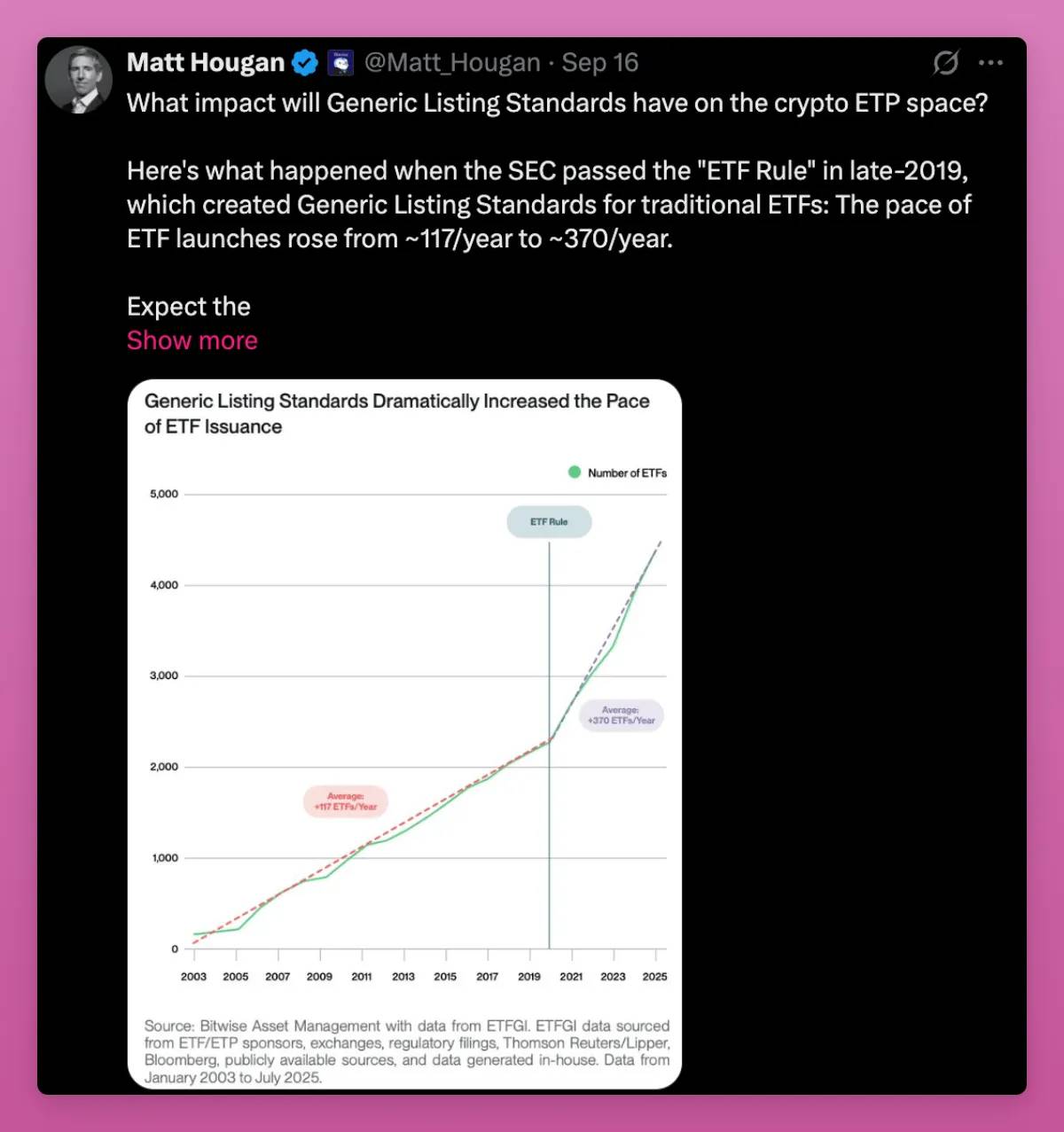

Just this month, the SEC approved listing standards for generic commodity exchange-traded products (ETPs). This means the approval process is speeding up, and more assets will enter the market. Grayscale has already filed an application based on this change.

The bitcoin ETF set the record for the most successful launch in history. The ethereum ETF started off slower, but even in a weak market, it now holds billions of dollars in assets.

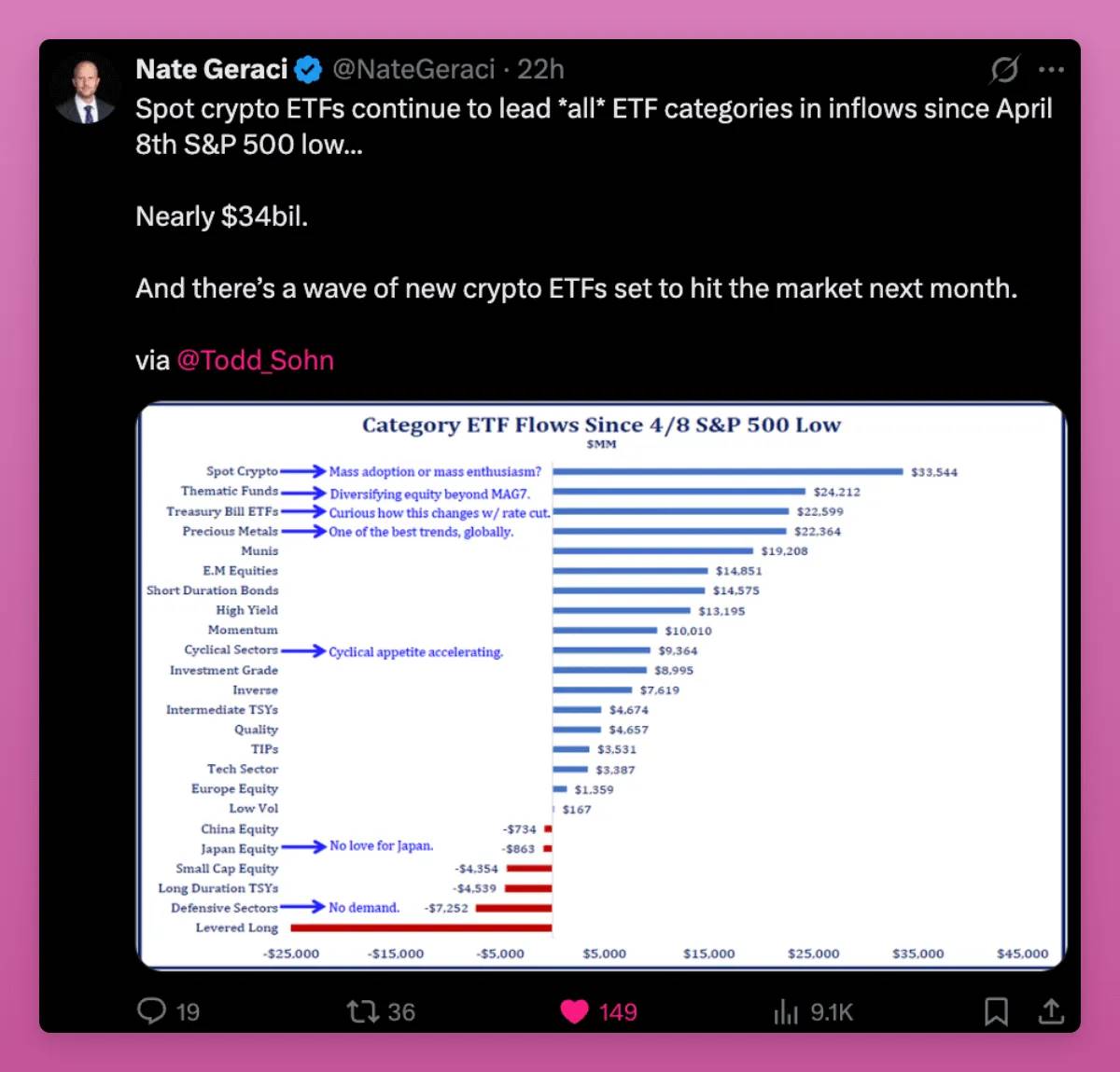

Since April 8, spot crypto ETFs have led all ETF categories in capital inflows, reaching $34 billion, surpassing thematic ETFs, treasuries, and precious metals.

Buyers include pension funds, advisors, and banks. Crypto is now part of portfolios just like gold or the Nasdaq.

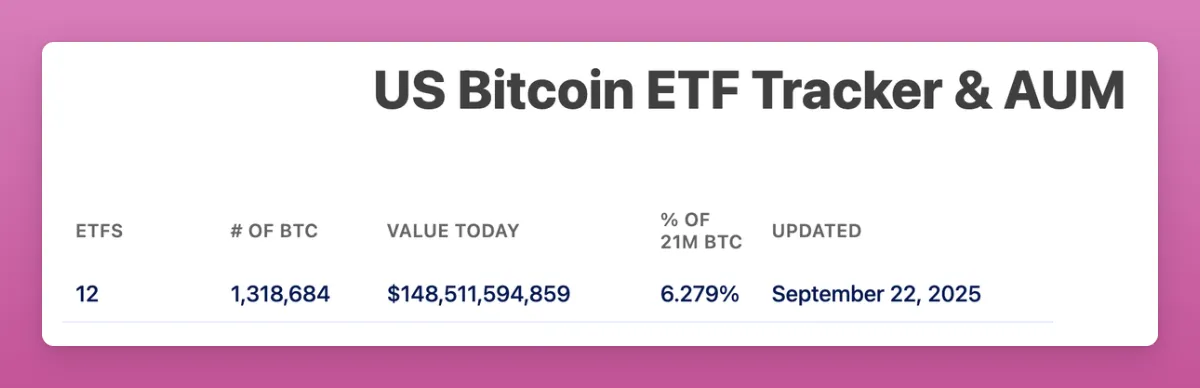

Bitcoin ETFs hold $150 billion in assets under management, accounting for over 6% of total supply.

Ethereum ETFs account for 5.59% of total supply.

All of this has happened in just a little over a year.

ETFs are now the main buyers of bitcoin and ethereum, shifting the ownership base from retail to institutions. As seen in my post, whales are buying while retail is selling.

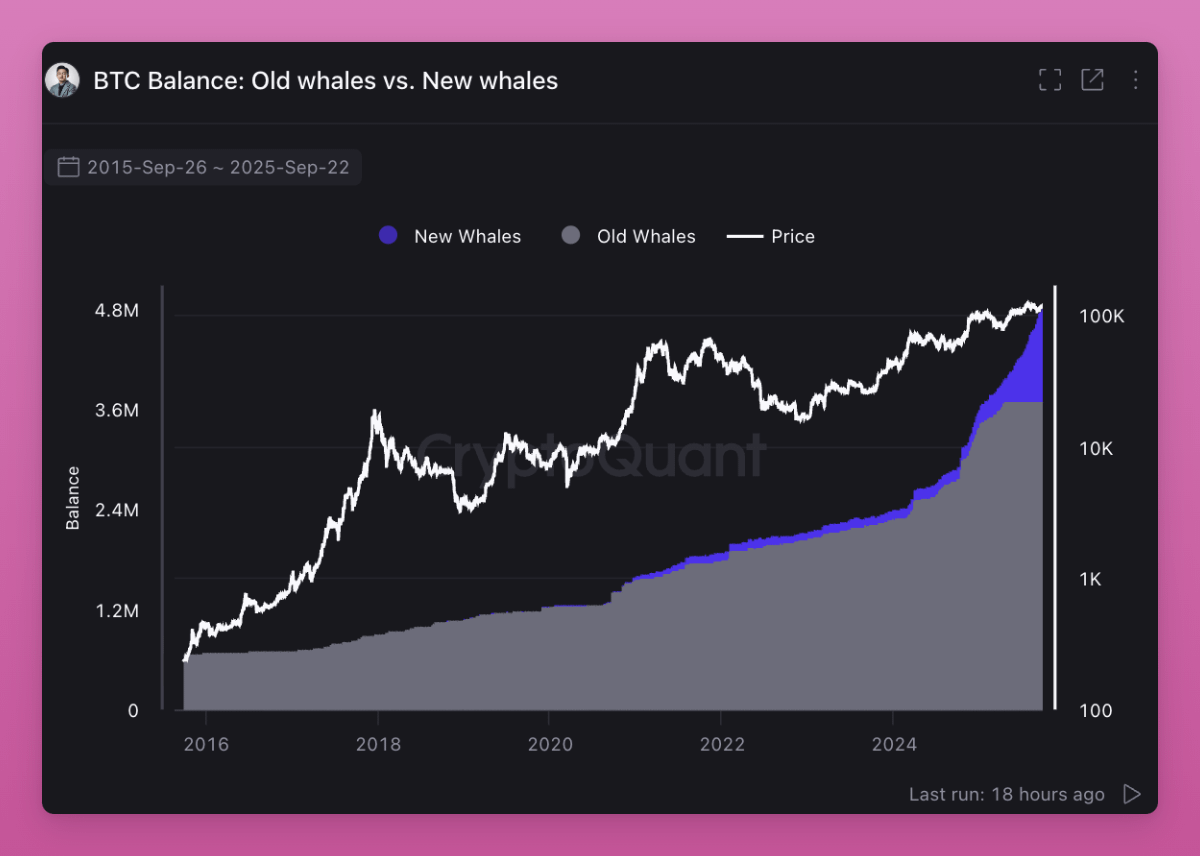

More importantly, “old whales” are selling assets to “new whales.”

Ownership is rotating. Investors who believe in the four-year cycle are selling, expecting the old script to repeat. However, something different is happening.

Retail who bought at low prices are selling assets to ETFs and institutions. This transfer raises the cost basis and lifts the floor for future cycles, as new holders are less likely to sell for small profits.

This is the great rotation of the crypto industry. Crypto assets are moving from speculative retail hands to long-term allocators.

The generic listing standards have kicked off the next stage of this rotation.

In 2019, similar rules in the stock market tripled the number of ETF issuances. Expect a similar situation in crypto. Many new ETFs are about to launch, such as SOL, HYPE, XRP, DOGE, etc., providing exit liquidity for retail.

The key question remains: can institutional buying power balance retail selling pressure?

If the macro environment remains stable, I believe those selling now, expecting the four-year cycle, will buy back at higher prices.

The End of Broad Market Surges

In the past, the crypto market usually moved as a whole. Bitcoin moved first, then ethereum, followed by other assets. Small-cap tokens surged as liquidity moved down the risk curve.

This time is different—not all tokens are rising together.

There are now millions of tokens on the market. New coins launch daily on pump.fun, with “creators” shifting attention from old tokens to their own Memecoins. Supply is surging, while retail attention remains unchanged.

Liquidity is scattered across too many assets because issuing new tokens is almost costless.

Previously, low-float, high FDV tokens were hot and suitable for airdrops. But now retail has learned. They prefer tokens that offer value return or at least have strong cultural appeal (for example, $UNI, despite strong trading volume, failed to rise).

Ansem’s view is correct—we’ve reached the peak of pure speculation. The new trend is revenue, because it’s sustainable. Applications with product-market fit and fees will rise, while others will not.

There are two notable points: users pay high fees for speculation, and the efficiency comparison between blockchains and traditional financial systems. The former has peaked, while the latter still has room to grow.

Murad raised another good point that I think Ansem overlooked. Tokens that can still rise are often new, weird, easily misunderstood, but have strong, conviction-driven communities. I’m also one of those who like novel things (like my iPhone Air).

Cultural significance determines the gap between survival and failure. A clear mission, even if it seems crazy at first, can keep a community going until the adoption snowball effect appears. I would put Pudgy Penguins, Punk NFT, and Memecoin in this category.

However, not all shiny new things succeed. Runes, ERC404, etc., have shown me how novelty can fade quickly. Narratives may disappear before reaching critical mass.

I think these views together explain the new order. Revenue filters out weak projects, while culture supports misunderstood ones.

Both are important, but in different ways. The biggest winners will be the few tokens that can combine both.

The Stablecoin Order Grants Credibility to Crypto

Initially, traders held USDT or USDC to buy BTC and other cryptocurrencies. New inflows were bullish because they converted into spot buys. At that time, 80% to 100% of stablecoin inflows ultimately went to crypto purchases.

Now things have changed.

Stablecoin funds flow into lending, payments, yield, treasury management, and airdrop farming. Some of these funds never touch BTC or ETH spot buys but still enhance the whole system. More L1 and L2 transactions. More DEX liquidity. More lending market revenue, such as Fluid and Aave. The monetary markets of the entire ecosystem are deeper.

A new trend is payment-first L1s.

Stripe and Paradigm’s Tempo is designed for high-throughput stablecoin payments, equipped with EVM tools and a native stablecoin AMM.

Plasma is an L1 supported by Tether, designed for USDT, with banking apps and payment cards for emerging markets.

These blockchains are pushing stablecoins into the real economy, not just trading. We’re back to the topic of “blockchains for payments.”

What could this mean (to be honest, I’m still not sure)?

-

Tempo: Stripe’s distribution power is huge. This helps crypto adoption but may bypass spot demand for BTC or ETH. Tempo may ultimately be like PayPal: huge traffic, but little value accrual for ethereum or other blockchains. What’s unclear is whether Tempo will issue a token (I think it will), and how much fee revenue will flow back into crypto.

-

Plasma: Tether already dominates USDT issuance. By connecting blockchain + issuer + apps, Plasma may concentrate a large portion of emerging market payments in a closed ecosystem. It’s like a battle between Apple’s closed ecosystem and the open internet advocated by ethereum and solana. It triggers a fight for USDT’s default chain status among solana, tron, and EVM Layer2s. I think tron loses the most here, while ethereum was never a payment chain anyway. However, Aave and others launching on Plasma is a huge risk for ETH…

-

Base: The savior of ETH L2. As Coinbase and Base push payments through Base apps and earn USDC yield, they will continue to drive up fees for ethereum and DeFi protocols. The ecosystem remains fragmented but highly competitive, further expanding liquidity.

Regulation is aligning with this shift. The GENIUS Act is pushing other countries to catch up with stablecoins globally.

Additionally, the US Commodity Futures Trading Commission (CFTC) has just allowed stablecoins to be used as tokenized collateral in derivatives. This adds payment demand to capital markets’ non-spot needs.

Overall, stablecoins and new stable L1s grant credibility to the crypto industry.

What was once just a gambling venue now has geopolitical significance. Speculation is still the number one use, but stablecoins are clearly the second largest application in crypto.

The winners are the blockchains and applications that can capture stablecoin flows and convert them into sticky users and cash flow. The biggest unknown is whether new L1s like Tempo and Plasma can become leaders in locking value within their ecosystems, or if ethereum, solana, L2s, and tron can fight back.

The next big deal will take place on Plasma mainnet on September 25.

DAT: New Leverage and IPO Model for Non-ETF Tokens

Digital Asset Treasuries (DATs) worry me.

In every bull cycle, we find new ways to leverage tokens. This drives prices up far beyond spot buying capacity, but when the market reverses, deleveraging is always brutal. When FTX collapsed, forced selling from CeFi leverage crushed the market.

This cycle’s leverage risk may come from DATs. If they issue shares at a premium, raise debt, and invest funds into tokens, they amplify the upside. But when market sentiment turns, these structures could exacerbate the downside.

Forced redemptions or exhausted buyback funds could trigger heavy selling pressure. So, while DATs expand market access and bring in institutional capital, they also add a new layer of systemic risk.

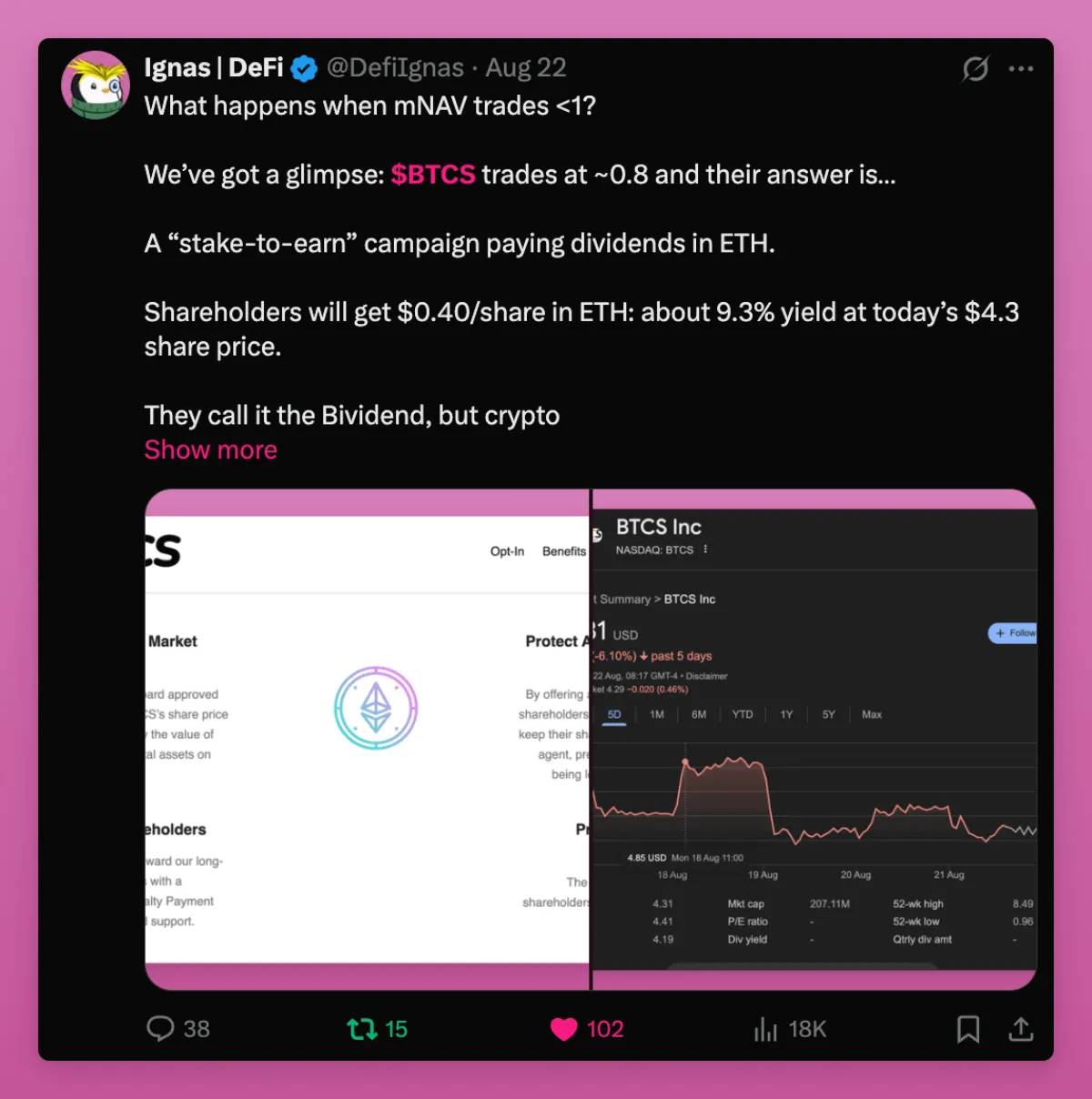

We gave an example of what happens when mNAV > 1. In short, they distribute ETH to shareholders, who are likely to sell. However, despite the “airdrop,” BTCS still trades at 0.74 mNAV. That’s bad.

On the other hand, DATs are a new bridge connecting token economies and the stock market.

As the founder of Ethena wrote:

“What worries me is that we may have exhausted crypto-native capital to push altcoins above the previous cycle’s peaks. If we look at the total nominal market cap peak for altcoins in Q4 2021 and Q4 2024, both are stuck at about $1.2 trillion. Adjusted for inflation, the numbers are almost identical. Maybe this is the limit of what global retail capital can bid for 99% of ‘air coins’?”

This is why DATs matter.

Retail capital may have peaked, but tokens with real business, real revenue, and real users can access the much larger stock market. Compared to the global stock market, the entire altcoin market is just a trivial number. DATs open the door for new capital inflows.

Moreover, since few altcoins have the expertise to launch DATs, those that can will draw attention from millions of tokens back to a few “Schelling Point” assets.

He also mentioned that NAV premium arbitrage doesn’t matter, which is itself a positive.

Most DATs can’t use leverage through capital structure like Saylor to maintain a NAV premium. The real value of DATs isn’t in the premium game, but in access to capital. Even a stable 1:1 NAV plus ongoing inflows is better than no access to capital at all.

ENA and even SOL’s DATs have been criticized as “tools” for cashing out tokens held by venture capital funds.

ENA in particular is vulnerable because VCs hold a large number of tokens. But precisely because of capital allocation issues, private VC funds far exceed the liquidity of the secondary market, so exiting via DAT is positive, as VCs can reallocate capital to other crypto assets.

This is important because VCs have been hit hard this cycle by being unable to exit investments. If they can sell and get new liquidity, they can fund new innovations in crypto, driving the industry forward.

Overall, DATs are bullish for crypto, especially for tokens that can’t get ETF support. They allow projects with real users and revenue, like Aave, Fluid, Hype, etc., to shift investment into the stock market.

Of course, many DATs will fail and have spillover effects on the market. But they also bring IPO opportunities to ICO projects.

RWA Revolution: The Possibility of On-Chain Financial Life

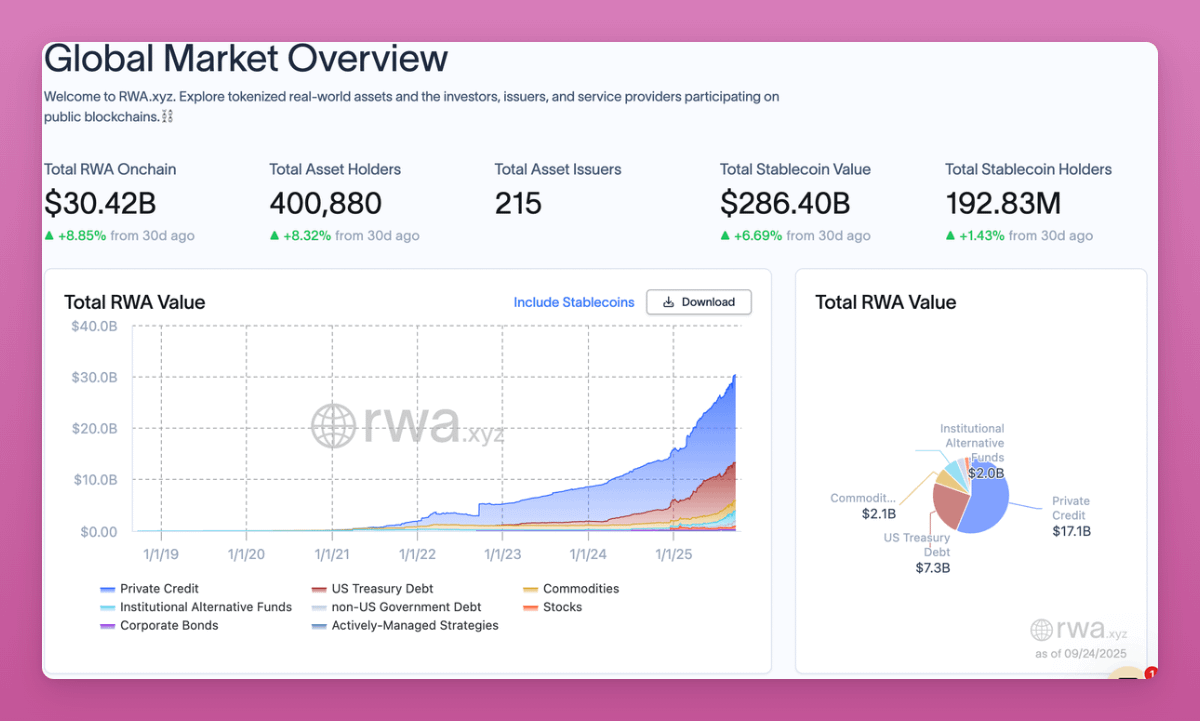

The total on-chain RWA market has just surpassed $30 billion, growing nearly 9% in just one month. The trend chart continues upward.

Treasuries, credit, commodities, and private equity are now all tokenized. The pace of change is accelerating rapidly.

RWA brings the world economy on-chain. Some major shifts include:

-

Previously, you had to sell crypto for fiat to buy stocks or bonds. Now, you can keep holding BTC or stablecoins on-chain, move into treasuries or stocks, and self-custody.

-

DeFi escapes the “Ponzi” trap that was the growth engine for many protocols. It brings new revenue sources to DeFi and L1/L2 infrastructure.

The most important change is collateral.

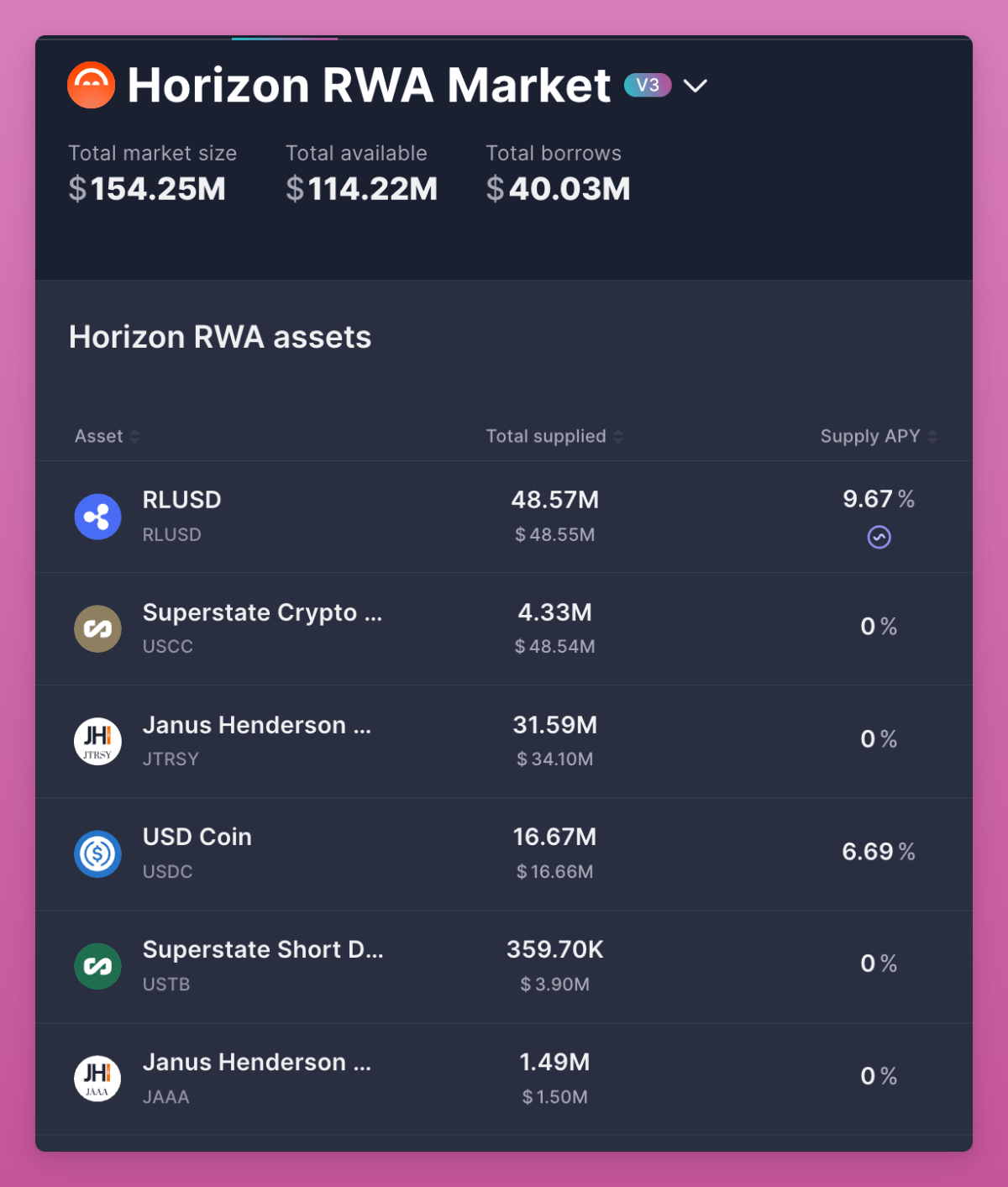

Aave’s Horizon allows you to deposit tokenized assets like the S&P 500 index and use them as collateral for borrowing. But its total value locked (TVL) is still small, only $114 million, meaning RWA is still in a relatively early stage. (Note: Centrifuge is working to bring official SPX500 RWA on-chain. If successful, CFG could perform well. I’m confident in this.)

This is almost impossible for retail in traditional finance.

RWA finally makes DeFi a true capital market. They set benchmark rates through treasuries and credit. They expand global coverage, allowing anyone to hold US Treasuries without a US bank (which is becoming a global battleground).

BlackRock launched BUIDL, Franklin launched BENJI. These are not fringe projects, but bridges connecting trillions of dollars and crypto.

Overall, RWA is the most important structural revolution right now. They make DeFi closely tied to the real economy and build the infrastructure for a world that can run entirely on-chain.

Four-Year Cycle

For crypto-native markets, the most important question is whether the four-year cycle has ended. I hear people around me already selling, expecting it to return. But I believe, as the crypto order changes, the four-year cycle will repeat.

This time is different.

I’m betting my own assets because:

-

ETFs have turned BTC and ETH into institutionally allocable assets.

-

Stablecoins have become geopolitical tools, now entering payments and capital markets.

-

DATs open a path for tokens without ETF support to enter the stock market, while allowing VCs to exit and fund new projects.

-

RWA brings the global economy on-chain and creates benchmark rates for DeFi.

This is not the casino of 2017, nor the mania of 2021.

This is a new era of structure and adoption, with crypto merging with traditional finance, while still driven by culture, speculation, and conviction.

The next round’s winners will not come from a “buy everything” strategy.

Many tokens may still repeat the four-year cycle’s crashes. You need to choose carefully.

The real winners will be those tokens that can adapt to macro and institutional changes while maintaining cultural appeal to retail.

This is the new order.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne