UK Firm B HODL Starts Bitcoin Treasury with 100 BTC Buy

- B HODL Plc entered the Bitcoin treasury market by buying 100 BTC worth $11.3 million.

- The company is listed in London with plans to expand reserves and run Lightning nodes.

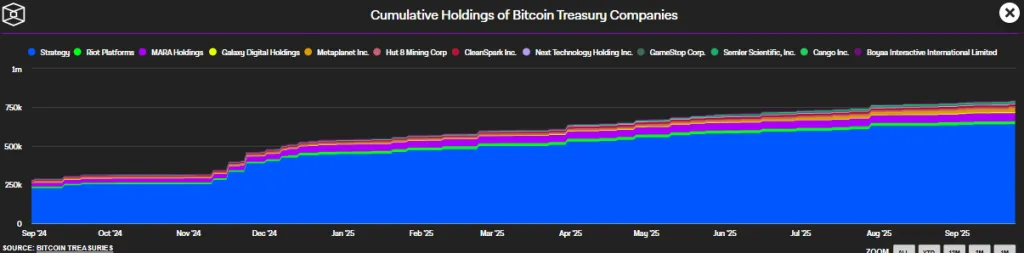

- Corporate BTC holdings exceeded 1 million BTC between September 2024 and September 2025.

UK-listed firm B HODL Plc confirmed on Wednesday that it has purchased 100 BTC at a total cost of approximately £8.4 million ($11.3 million). The bitcoin was bought at an average purchase price of £83,872 ($113,227) per coin, marking the company’s official entry into the global corporate Bitcoin treasury market and securing its position within the top 100 public holders of the digital asset.

Corporate Bitcoin Holdings Continue to Expand

According to Bitcoin Treasuries data, the acquisition positioned B HODL at rank 98 among public companies with Bitcoin reserves. Although the company has achieved a notable milestone with its entry purchase, it still trails the UK’s largest Bitcoin-holding firm, Smarter Web, which currently holds 2,525 BTC valued at $284.4 million and is ranked 29th worldwide.

Source:

The Block

Source:

The Block

Data compiled by The Block shows that corporate Bitcoin holdings have grown steadily from September 2024 through September 2025, with a significant acceleration in late 2024 followed by consistent accumulation throughout this year. By September 2025, more than one million BTC were collectively held by public companies, demonstrating the growing use of Bitcoin in corporate balance sheet strategies.

Major firms such as Riot Platforms, Marathon Digital, Galaxy Digital, and Metaplanet have contributed to this trend. At the same time, smaller allocations have come from companies including Hut 8 Mining, CleanSpark, Next Technology Holding, GameStop, Semler Scientific, Cango, and Boyaa Interactive.

Treasury and Lightning Strategy

B HODL has outlined a strategy that extends beyond simple reserve accumulation by seeking to merge treasury growth with active participation in Bitcoin infrastructure. In a public statement, the company emphasized its commitment to “the disciplined acquisition of bitcoin to build a long-term strategic reserve that also powers B HODL’s Lightning Network operations.”

The company listed on the Aquis Stock Exchange in London under the ticker “HODL” earlier this week after raising approximately £15.3 million ($20.7 million) in capital. Aquis provides a cost-efficient platform for small and mid-sized companies to access public markets, although it remains less liquid compared to the London Stock Exchange. With its listing complete, B HODL plans to gradually increase its Bitcoin holdings while using those reserves to operate Lightning Network nodes.

The company has already entered the Lightning ecosystem, and its nodes are some of the largest in the world in terms of capacity. By expanding these operations, the company will be able to facilitate a scalable Bitcoin payment infrastructure and earn routing fees.

Related: B Hodl Debuts on AQSE to Build Bitcoin and Lightning Model

Although the excitement over corporate Bitcoin treasuries has yet to disappear, analysts have observed that the pace has slowed compared to previous waves of adoption. Studies by K33 have shown that almost 25 percent of publicly traded companies that currently hold Bitcoin are trading at a price below the value of their deposits. K33’s Head of Research, Vetle Lunde, explained that this condition reduces flexibility for firms seeking to expand their reserves.

Although the market has doubts, B HODL’s approach suggests a combination of careful treasury management and infrastructure involvement. The company’s success will rely on prudent capital deployment, the operation of Lightning, and managing volatility in the process of seeking growth in an ever-changing regulatory scenario.

The post UK Firm B HODL Starts Bitcoin Treasury with 100 BTC Buy appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Drops 30%, Revealing 'Panda Phase'—A Mild Bear Market Lacking a Definite Bottom

- Bitcoin fell 30% to $87,080, its steepest two-month drop since 2022, driven by ETF outflows, leverage liquidations, and stablecoin declines. - Institutional confidence waned as asset managers paused accumulation, while retail investors exited en masse, worsening liquidity and market sentiment. - The Crypto Fear & Greed Index hit record lows at 15, reflecting panic amid Fed policy uncertainty and Bitcoin's 0.72 correlation with the Nasdaq 100. - Deribit's $1.76B call condor bet hints at cautious optimism,

Lowe's CEO's Approach to DEI: Embedding Diversity into Operations Rather Than Symbolic Actions

- Marvin Ellison, former Target part-timer and one of eight Black Fortune 500 CEOs, led Lowe's to $20.81B Q3 revenue through operational discipline and AI-driven innovation. - His Total Home strategy integrating services and store productivity, plus 50+ AI models for inventory/price optimization, drives growth amid retail challenges. - Ellison prioritizes action-based DEI reforms like leadership-focused hiring over credentials, rejecting performative gestures post-2020 George Floyd protests. - Despite rais

Bitcoin News Update: Unveiling Layered Risks as Connections Between Crypto and Traditional Finance Deepen

- Bybit temporarily halted CME-linked crypto futures trading after CME Globex disruptions, exposing vulnerabilities in centralized infrastructure linking traditional and digital markets. - CME Group faced scrutiny for technical glitches suspending Bitcoin futures, despite record 9% monthly growth in crypto derivatives volume and 132% YoY expansion in notional value. - Analysts highlight cascading risks from centralized system failures, urging diversified risk strategies as institutional adoption of 24/7 cr

BREAKING: Why Tether’s USDT Is One Bitcoin Crash From Breaking