APAC Leads as Crypto Adoption Grows Across Multiple Regions

Cryptocurrency is spreading rapidly across the globe, with adoption increasing in many regions at once. A recent report from Chainalysis highlights the pace of this growth and identifies the countries and areas driving the expansion.

In Brief

- The Asia-Pacific region leads in on-chain crypto transaction value with India, Pakistan, and Vietnam fueling widespread growth across centralized and decentralized services.

- Latin America sees a 63% increase and Sub-Saharan Africa records a 52% rise in crypto use.

- The global market capitalization reaches over $4 trillion with Bitcoin and Ethereum together accounting for nearly 70% dominance.

Rising Crypto Activity in Asia-Pacific

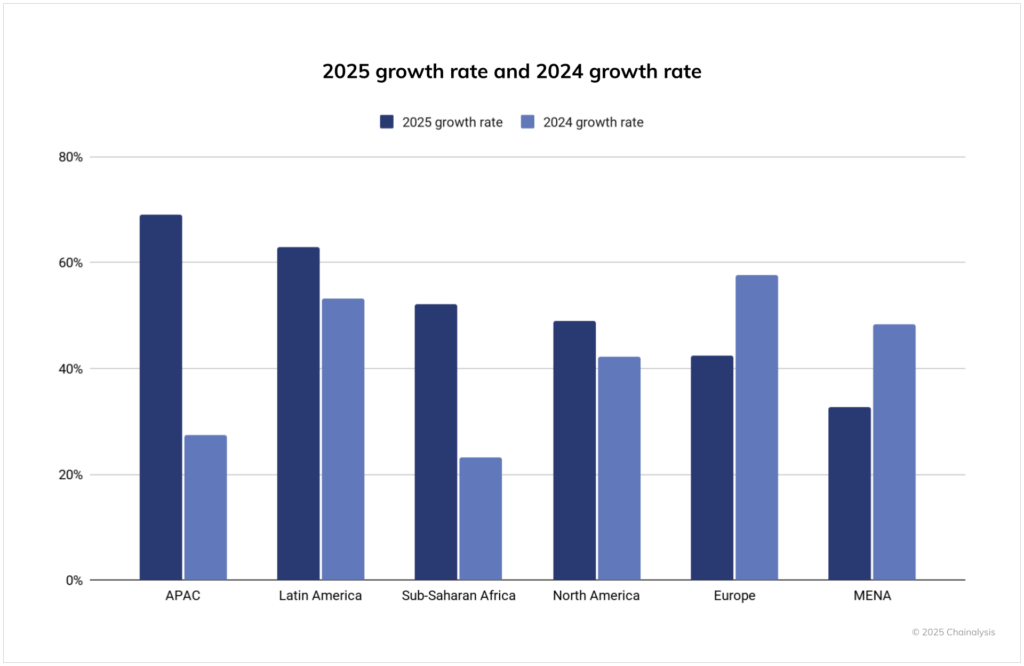

According to Chainalysis, the Asia-Pacific region (APAC) emerged as the fastest-growing market for on-chain crypto activity in the year ending June 2025. The total value received in the region surged 69%, a sharp rise compared with just 27% growth the previous year.

Transaction volumes climbed from $1.4 trillion to $2.36 trillion, with India, Pakistan, and Vietnam standing out as the most active markets driving this expansion.

Growth Beyond Asia-Pacific

Other regions also experienced notable growth. Latin America reported a 63% rise in crypto adoption , improving on the 53% growth seen the year prior. Sub-Saharan Africa posted a 52% increase, with activity largely driven by remittances and everyday payments.

The Middle East and North Africa (MENA) grew at a slower pace, registering a 33% increase. Despite the more modest rate, total transaction volume in MENA still surpassed half a trillion dollars. This shows that cryptocurrencies are gaining traction even in markets with steadier growth.

North America recorded more than $2.2 trillion in total crypto activity. Chainalysis noted that this growth was supported by renewed institutional participation, following last year’s approval of spot Bitcoin and Ethereum ETFs, which provided more structured opportunities for large investors to engage with the market. Europe also maintained strong activity, receiving more than $2.6 trillion in transactions.

APAC tops 2025 crypto growth, outpacing all other regions in global adoption trends.

APAC tops 2025 crypto growth, outpacing all other regions in global adoption trends.

At the same time, individual adoption differs widely across regions. Cointribune reported that only 14% of Americans currently hold or use cryptocurrency , indicating that there is still considerable room for consumer growth in the United States.

Crypto Sees Broad-Based Growth Across Regions

Chainalysis emphasised that the recent surge in adoption is broad-based. The blockchain platform explained that “crypto adoption is broad-based rather than isolated – benefiting mature markets with clearer rules and institutional rails, as well as emerging markets where remittances, dollar access via stablecoins, and mobile-first finance continue to accelerate adoption. In other words, crypto adoption is truly global.”

Supporting this global perspective, CoinGecko reports that the total cryptocurrency market capitalization now stands at $4.01 trillion. Bitcoin accounts for more than 56% and Ethereum makes up 12.5%, giving the two leading cryptocurrencies nearly 70% dominance in the market. Short-term price changes have been modest, with Bitcoin rising about 1% over the past 24 hours and Ethereum slipping roughly 0.8%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump's cryptocurrency empire faces allegations of boosting political sway and posing security risks

- House Democrats accuse Trump's WLFI crypto firm of selling tokens to sanctioned entities like North Korea and Russia, calling it the "world's most corrupt crypto startup." - The firm's $1B in crypto profits and ties to the Trump brand raise national security concerns over political influence and illicit financial activity. - Eric Trump stepped back from WLFI operations in September amid regulatory scrutiny, highlighting conflicts of interest and insider trading risks. - The case underscores broader crypt

South Korea Revamps Cryptocurrency Regulations to Tackle Crime and Strengthen Digital Economy Leadership

- South Korea's Financial Intelligence Unit plans stricter AML measures, including pre-emptive account freezes, to combat crypto crimes by mid-2026. - A $30M Upbit hack linked to North Korea's Lazarus group highlights vulnerabilities, prompting enhanced exchange security protocols and loss coverage pledges. - Terra co-founder Do Kwon faces up to 40 years in South Korea for the $40B crypto crash, reflecting global accountability trends after FTX's collapse. - Regulators push for bank-led stablecoin issuance

Hong Kong’s SFC Approves Hang Feng’s Expansion into Virtual Assets

- Hang Feng's subsidiary HFIAM secured Hong Kong SFC approval to offer virtual asset advisory and management services, expanding its licensed scope to include digital assets. - The upgraded licenses enable HFIAM to manage portfolios with over 10% virtual asset exposure and launch standalone crypto funds, aligning with Hong Kong's innovation-focused regulatory framework. - This strategic move positions Hang Feng to capitalize on institutional demand for digital assets while emphasizing compliance, transpare

Opportunities in Webster, NY: Capitalizing on Infrastructure Funding and Redevelopment Prospects

- Webster , NY, leverages $9.8M FAST NY grants to upgrade infrastructure at a 300-acre brownfield, attracting advanced manufacturing and logistics firms like fairlife®. - Redevelopment of the former Xerox Wilson Campus aims to create 250 jobs by 2025, supported by $650M in reconfiguration and state-backed industrial expansion initiatives. - Parallel urban revitalization at 600 Ridge Road targets mixed-use development, boosting property values and tax revenues while addressing blighted properties in West We