Ethereum Regains Top Spot in USDT as Tron’s Dominance Slips

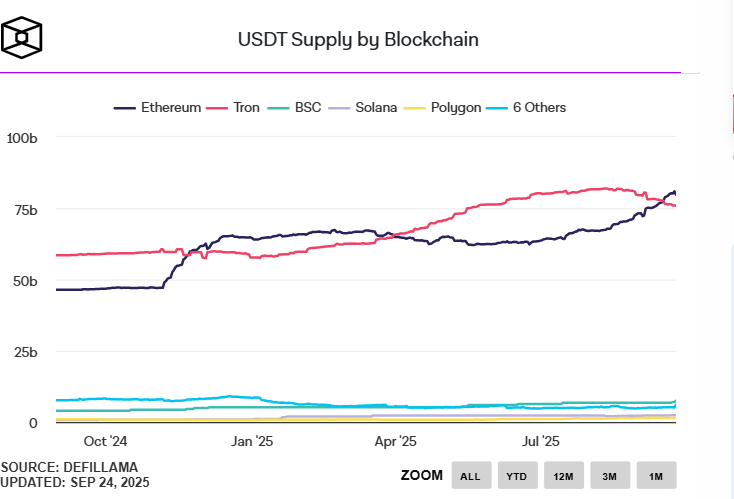

After losing its top position to Tron in March, Ethereum has surged back to reclaim its place as the leading network for USDT, with its supply reaching $80 billion. Although both networks maintained high supply levels of roughly $75–$80 billion for most of the year, this reversal signals a key shift in infrastructure preferences.

In brief

- Ethereum’s USDT supply hits $80B, surpassing Tron after months of close competition in the stablecoin market.

- Daily transactions on Ethereum are near 1M, showing strong use of USDT for payments and settlements.

- Institutions favor Ethereum’s DeFi and infrastructure over Tron’s lower fees, boosting its dominance.

- Other chains like BSC, Solana, Polygon, and Arbitrum hold under $10B USDT each, far behind Ethereum and Tron.

Ethereum Reclaims Lead in USDT Transactions

Data from The Block shows Ethereum processing nearly 1 million transactions per day, suggesting that participants are not just holding USDT , but actively using it for payments and settlements.

Earlier in the year, Tron held a clear lead in USDT dominance as Ethereum’s usage declined. Since late April, however, Ethereum has experienced a steady resurgence, eventually overtaking Tron in August.

Despite their close competition, the ongoing shift highlights how even small advantages in dominance can influence capital flows.

With each holding less than $10 billion, other chains—including BNB Chain (BSC), Solana, Polygon, and Arbitrum—account for smaller portions of the total supply. Although these networks are seeing healthy growth, their combined share remains a fraction of the total compared to Ethereum and Tron.

Institutions and DeFi Fuel Stablecoin Shift from Tron

Ethereum’s resurgence suggests that users are prioritizing its established DeFi ecosystem and institutional-grade infrastructure over Tron’s lower transaction costs. Experts believe that this flip is also driven by renewed activity in DeFi protocols, as well as institutional adoption through ETFs and corporate treasuries.

This shift comes as mainstream financial institutions increasingly tap into stablecoin payment infrastructure. Firms such as PayPal (with PYUSD) and other major players are integrating stablecoins into their frameworks. Many of these companies are leaning towards Ethereum’s more established institutional presence.

With total USDT supply exceeding $100 billion across chains, the contest between Ethereum and Tron remains central to stablecoin market dynamics. Industry watchers are monitoring whether Ethereum can consolidate its lead or if Tron will reclaim the top spot in the months ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Delays Crypto Information Exchange Pending International Coordination

- Switzerland delays crypto tax data sharing with foreign nations until 2027, citing unresolved CARF partner agreements. - The OECD's 2022 framework requires member states to exchange crypto account details, but 75 countries including the EU and UK face implementation challenges. - Transitional measures ease compliance burdens for Swiss crypto firms while awaiting finalized international data-sharing protocols. - Major economies like the U.S., China, and Saudi Arabia remain outside CARF due to non-complian

Bitcoin Updates: SGX Addresses Offshore Perp Shortfall as Bitcoin Decline Increases Demand for Hedging

- SGX launched Bitcoin and Ethereum perpetual futures, becoming a first-mover in regulated onshore crypto derivatives to meet institutional demand. - The $187B/year perp market, dominated by Asia, now gains a regulated alternative to offshore platforms with SGX's 22.5-hour trading window. - Perps enable hedging during Bitcoin's 2025 downturn, with SGX's margin-call system prioritizing investor protection over instant liquidations. - Regulatory caution limits access to accredited investors, aligning with gl

Bitcoin News Update: Institutional ETF Adjustments Challenge Key Bitcoin Support Thresholds

- Analysts warn Bitcoin faces 25% drop risk if key support levels fail amid shifting institutional ETF dynamics. - Texas's $5M IBIT purchase highlights growing government interest, but ETFs fall short of direct BTC ownership criteria. - Technical analysis shows Bitcoin trapped in a broadening wedge pattern, with breakdown below $80,000 risking $53k decline. - Institutional rebalancing sees $66M IBIT outflows vs. $171M FBTC inflows, signaling tactical ETF rotation over accumulation. - Abu Dhabi's $238M ETF

XRP News Today: IMF Cautions That Rapid Tokenized Markets Could Intensify Crashes in the Absence of Regulation

- IMF warned tokenized markets like XRP could worsen flash crashes without regulation, citing risks from decentralized systems lacking traditional safeguards. - Report acknowledged tokenization's potential to cut cross-border payment costs but highlighted volatility risks from rapid liquidity loss seen in crypto markets. - SEC's approval of crypto ETFs signals growing institutional acceptance, though regulators emphasize oversight frameworks to mitigate systemic risks. - IMF proposed a global digital marke