Key Market Insights for September 25th, how much did you miss out on?

Top News

1. Plasma has transferred over 1 billion USDT to USDT0 to prepare for mainnet launch

2. XPL surges over 15% in pre-market trading, now trading at $0.8443

3. Cryptocurrency market continues to slump, with Ethereum flirting with the $4000 mark

4. Naver, South Korea's largest portal site subsidiary, is engaging in a comprehensive stock swap with Upbit's parent company Dunamu

5. GoPlus: GAIN's abnormal minting event bears resemblance to the Yala incident

Featured Articles

1.《Plasma, highly anticipated, goes live tonight. Can it change the landscape of on-chain payments?》

A funding news piece from stablecoin giant Tether is enough to hold the entire traditional financial industry's breath. According to Bloomberg, the "central bank of the crypto world" managing nearly $173 billion USDT is seeking a valuation of up to $500 billion in a round of $15-20 billion private funding. What does this number mean? It means that Tether's scale will directly rival global top-tier tech unicorns like OpenAI and SpaceX, while its staggering $4.9 billion net profit for a single quarter puts many traditional financial institutions to shame. This is not just funding; this is a "hidden whale" rising from the crypto world, making a formal value declaration to the traditional financial system.

2. "Plasma, Highly Anticipated, Goes Live Tonight, Can It Change the On-Chain Payment Landscape?"

We have all heard the classic business metaphor: "It is better to be the head of a chicken than the tail of a phoenix." Plasma embodies this in the world of on-chain payments and revenue opportunities. Rather than being another all-purpose chain, competing with impractical technical innovations, Plasma laser-focuses on becoming infrastructure for institutional use.

On-Chain Data

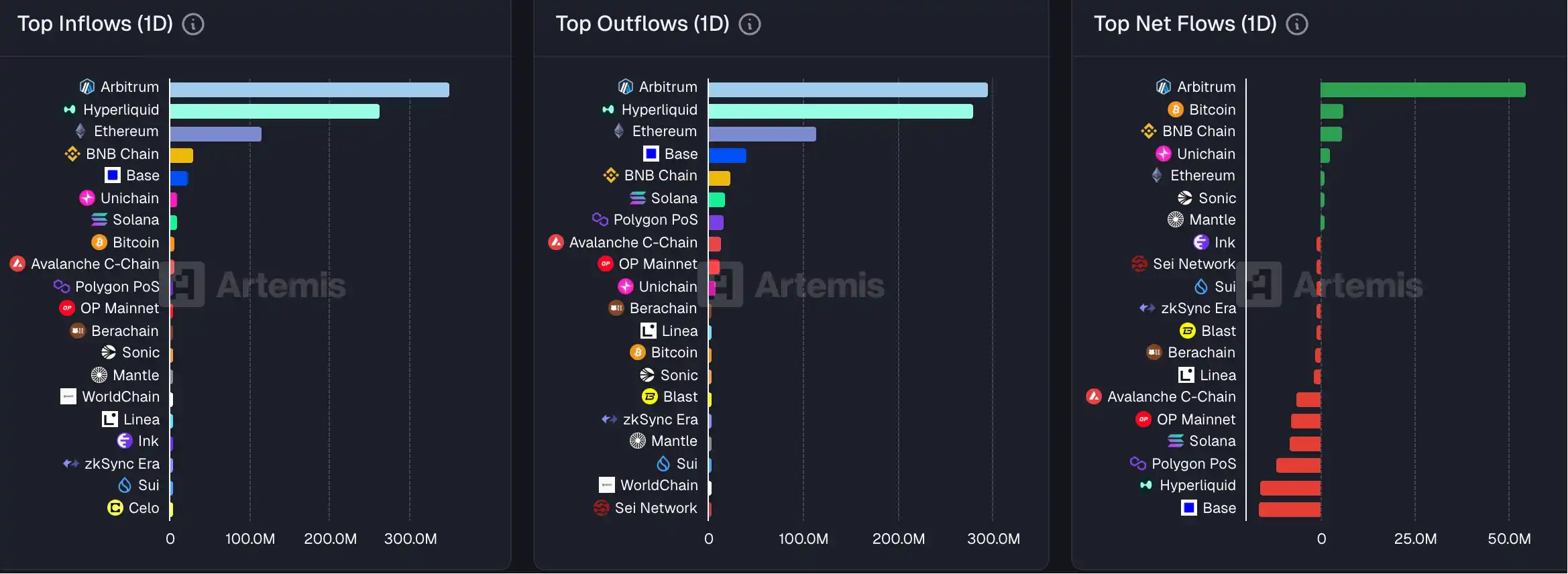

On-Chain Fund Flow on September 25th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential

Unlocking Potential: The Impact of Targeted Grants and Public-Private Partnerships on Transforming Medium-Sized Real Estate Markets in the U.S.

- U.S. mid-sized cities leverage infrastructure investment and PPPs to drive commercial real estate growth, outpacing large cities in value creation. - Federal programs like IIJA enable upgrades in transportation and broadband, reducing business costs while boosting property values in Tampa and Grand Rapids. - PPPs in cities like Montgomery County combine affordable housing incentives with CRE development, balancing equity and economic resilience through data-driven strategies. - Market projections show $2

Modern Monetary Theory and the Transformation of International Markets: Inflation Trends, Asset Movements, and Currency Shifts in 2025

- Modern Monetary Theory (MMT) reshapes fiscal-monetary coordination, linking government spending to inflation and resource constraints in post-pandemic economies. - Central banks face challenges anchoring inflation expectations as CPI lags asset market pressures, risking self-fulfilling inflationary spirals amid eroding public trust. - Currency valuations shift with fiscal stimulus (e.g., euro's 2025 rebound) and U.S. dollar uncertainty, compounded by gold reserve diversification and rising bond yields. -