Curve DAO backs $60 million crvUSD credit line for new protocol

Curve DAO has approved a proposal to provide a $60 million crvUSD stablecoin credit line before the launch of the new protocol Yield Basis developed by Curve founder Michael Egorov. Under the plan, three pools - WBTC, cbBTC, and tBTC - will go live on Ethereum based on Yield Basis' automated market maker (AMM) framework. Curve Finance stated that the initial cap for these pools is $10 million each.

The plan aims to expand Curve's ecosystem by further integrating its native stablecoins into DeFi infrastructure. Additionally, it also aims to increase potential fee streams for veCRV token holders. veCRV tokens are the voting escrow version of Curve Finance's governance token CRV.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE: New Address Goes 10x Long, Holds 207,497 Tokens Worth $4.72M with a $13.681 Liquidation Price

LUNA-Tied Terraform Labs Collapse: Jump Trading Hit with $4 Billion Lawsuit Over 2022 Fallout

ICE eyes $5b bet on MoonPay as Wall Street dives deeper into crypto

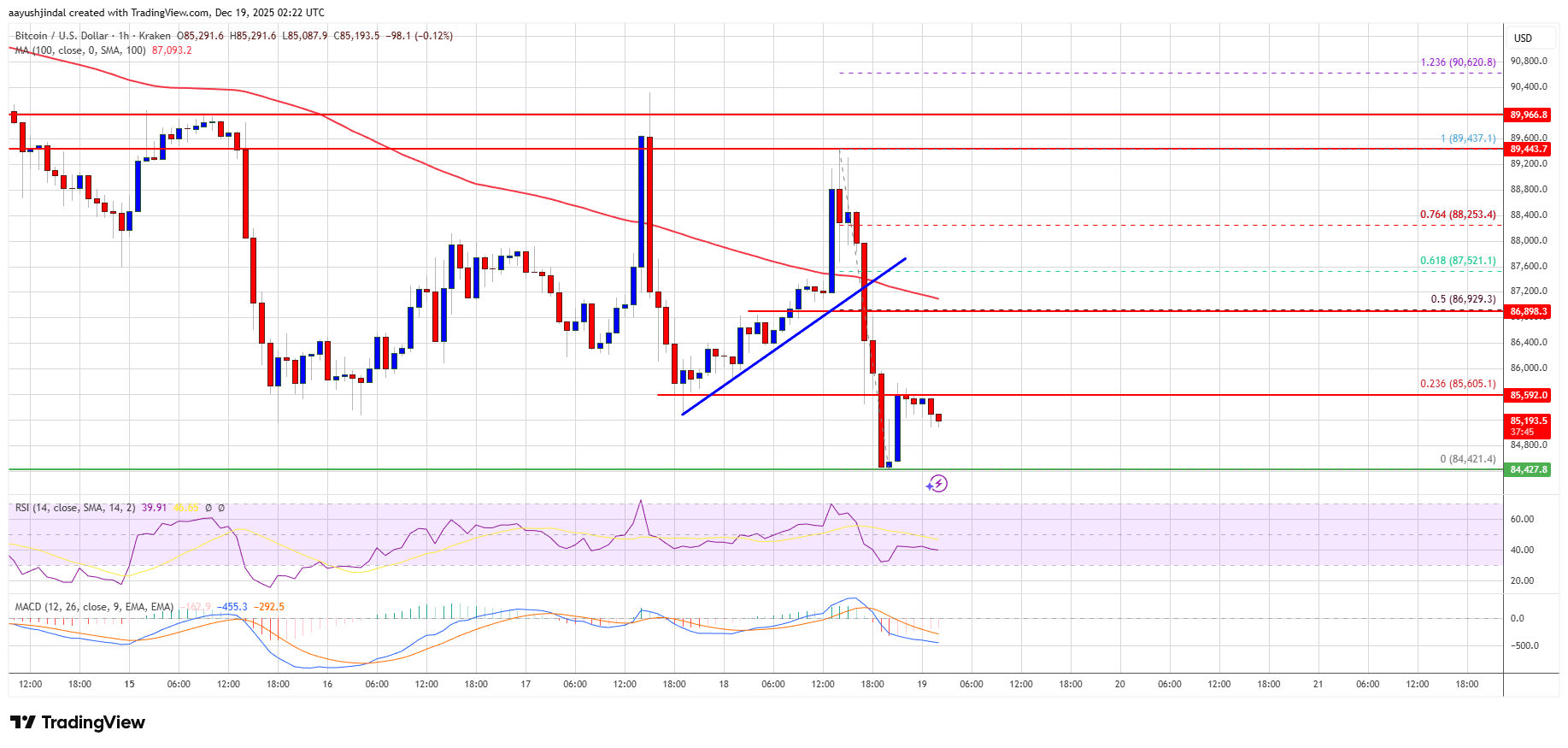

Bitcoin Price Retests Support—Is the Market Bracing for Volatility?