Key Market Intelligence Gap on September 25th - A Must-See! | Alpha Morning Report

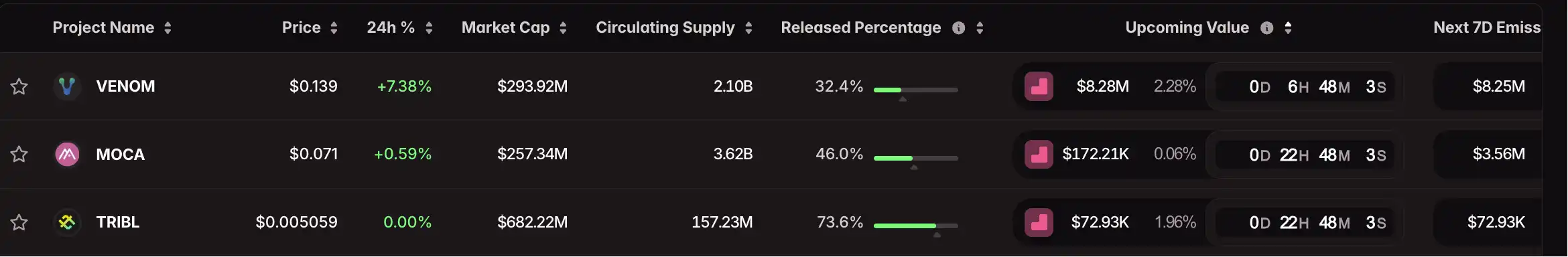

1. Top News: Fed Chair Powell Suggests Further Rate Cut May Be Needed 2. Token Unlock: $VENOM, $MOCA, $TRIBL

Top News

1. Fed's Daly Says Further Rate Cuts May Be Needed

2. Bitlight Labs Releases Token Symbol LIGHT, TGE Coming Soon

3. US SEC and CFTC to Hold Joint Roundtable Next Monday to Coordinate Crypto Regulation Policy

4. UXLINK: New Token Contract Ready, Users Holding Legal UXLINK Can Swap for New Tokens at 1:1 Ratio

5. Binance Alpha's New Coin GAIN Plunges to Zero on First Day, Abnormal Additional Circulation of About 5 Billion Tokens Causes Massive Sell-off

Articles & Threads

1. "Post-Rate Cut Big Pullback, Has the Crypto Bull Market Ended? | Traders' Observation"

Driven by loose expectations, the US stock market has repeatedly hit new highs, while the crypto market has presented a completely different picture. On September 22, the crypto market saw a single-day liquidation amount of up to $1.7 billion, marking the largest settlement scale since December 2024. Next, BlockBeats has compiled traders' views on the upcoming market situation to provide some directional references for your trading this week.

2. "Aiming for a $700 Million Airdrop, How to Optimize Aster S2?"

In just one week, the Aster platform has surpassed the milestone of 710,000 new users, with a 24-hour perpetual contract trading volume of $21.112 billion, directly surpassing the well-established DeFi derivatives platform Hyperliquid by more than double. The platform's TVL has reached $17.44 billion, with a 24-hour revenue of $7.12 million, ranking just below stablecoin giants Tether and Circle on the overall revenue leaderboard. In addition to "Can I still buy ASTER?" another commonly asked question is "Can I still farm Aster?" The second season of Aster's airdrop has 11 days remaining, with the airdrop pool accounting for 4% of the total supply, approximately 320 million ASTER tokens. This also means that as of the time of writing, calculated at a price of $2.3 per ASTER, the S2 airdrop is valued at over $700 million. Against this backdrop, BlockBeats has compiled the most core airdrop strategies for Aster at present.

Market Data

Daily Market Overall Capital Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Token Unlocks

Funding Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Investors Turn to Presales to Manage Crypto Fluctuations, Focusing on Reliable Token Structures and Cutting-Edge Developments

- Crypto investors shift capital to presales like Bitcoin Munari and Mutuum Finance amid market volatility, seeking predictable tokenomics and innovation. - Bitcoin Munari (BTCM) offers a multi-stage $0.10–$3.00 presale with Solana deployment and privacy-focused smart contracts, allocating 53% of tokens to public sales. - Bitcoin Cash (BCH) gains 10% after $500M institutional investment and quantum-resistant Quantumroot integration, while Bitcoin Hyper raises $28.3M for BTC programmability on Solana. - Pre

XPENG and XP Inc. Pursue Distinct Strategies for Expansion in the Third Quarter

- XPENG and XP Inc. reported strong Q3 2025 growth through divergent strategies, with XPENG focusing on EV sales expansion and XP Inc. on digital financial services. - XPENG achieved 101.8% revenue growth (RMB20.38B) driven by 149.3% vehicle delivery surge and 690-store sales network expansion. - XP Inc. saw R$29B client asset inflows and 16% YoY growth, maintaining 74 NPS while navigating 18% YoY retail inflow decline. - Both companies narrowed losses (XPENG: RMB0.38B vs RMB1.81B) and demonstrated resilie

Fed's Data Setbacks and Internal Disagreements Dash Expectations for a December Rate Reduction

- Fed's December rate cut probability drops to 33% due to delayed labor data from government shutdown and internal policy divisions. - September jobs report showed 119,000 hires but rising 4.4% unemployment, creating mixed signals about economic resilience. - Market selloff intensifies with Bitcoin falling to $89,000 and dollar strengthening as traders anticipate prolonged hawkish stance. - Goldman Sachs suggests December cut remains possible if Fed prioritizes unemployment, but delayed November data compl

Bitcoin’s Abrupt Pullback: Causes Behind the Drop and Future Outlook

- Bitcoin's 7-day 2025 price correction erased most gains, driven by Fed policy shifts, regulatory uncertainty, and ETF outflows. - Fed's December 1 QT end decision coincided with a 43-day government shutdown, creating an "information vacuum" and risk-off market sentiment. - U.S. Bitcoin ETFs saw $3.79B in November 2025 outflows, with BlackRock's IBIT losing 63% of total redemptions amid bearish technical signals. - Market structure vulnerabilities exposed by ETF outflows and Bitcoin's seven-month low ($83