JPMorgan Sees a Stressed Economy and Bets on Stablecoins

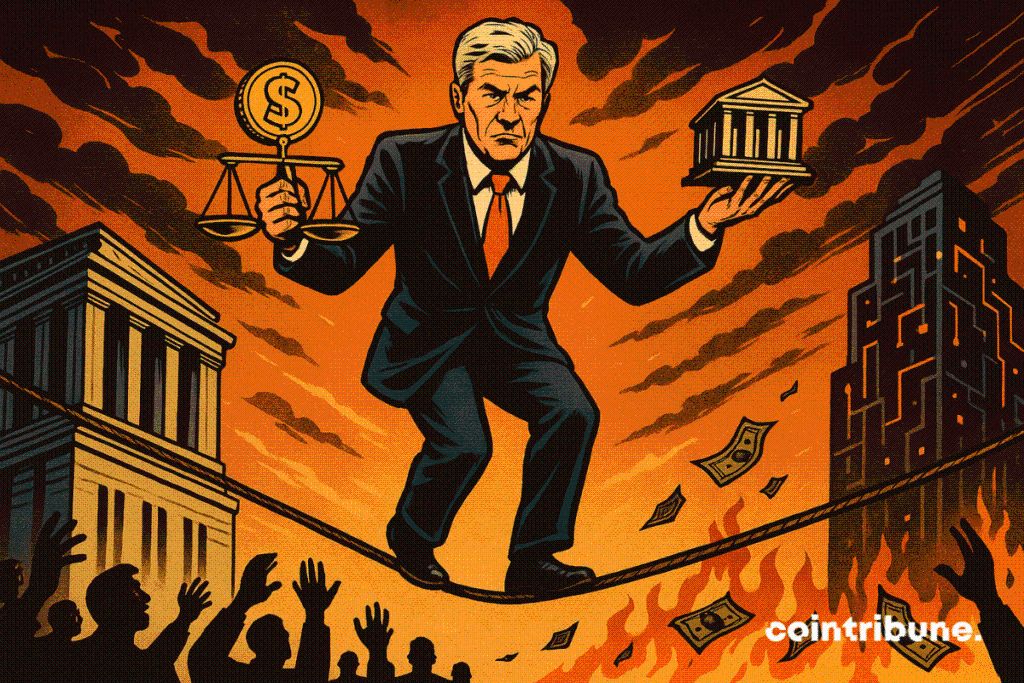

JPMorgan CEO Jamie Dimon calms the markets’ eagerness on rates and embraces without fear the rise of stablecoins. This hybrid stance says a lot about JPMorgan’s strategy in a context of global monetary change. All the details follow !

In brief

- JPMorgan considers rate cuts premature as long as inflation remains above 3%.

- Jamie Dimon sees stablecoins as useful internationally, without direct threat to banks.

JPMorgan slows the euphoria around rates

Despite a first cut of 25 basis points, Jamie Dimon believes the Fed will not ease further as long as inflation does not fall below 3%. The latest data show a 0.4% increase in August, or 2.9% over 12 months (above the 2% target). The gap remains too wide to consider a more accommodative monetary policy.

David Kelly, JPMorgan’s global strategist, reinforces this position. He warns of the risk of a biased perception. The fact is that a Fed influenced by political pressures would lose credibility. He notably cites the contested appointment of Stephen Miran to the Fed board as a concerning signal.

In this climate, a too rapid cut could therefore make inflation jump. But not only that ! It would also cause tensions on the dollar and weaken bond markets.

Faced with this situation, the scenario chosen by JPMorgan remains gradual: three new cuts by 2026, but conditioned on reliable economic data. Far from some actors’ expectations that foresee up to five rate cuts, this cautious stance seeks to preserve the balance between price stability and support for employment.

Stablecoins, a mastered strategic bet

On another front, Jamie Dimon does not see stablecoins as a threat to bank deposits. He even supports that their use responds to a logic of efficiency, especially internationally. The reason is that users find a simple way to access digital dollars without needing a bank account in the United States.

In this sense, JPMorgan is considering the creation of a banking consortium around stablecoins. This project aims to :

- regulate the use of these digital assets ;

- explore concrete use cases.

This approach therefore reflects a change of mindset: integrating these technologies instead of confronting them.

However, the development of stablecoins raises major regulatory issues :

- a constantly evolving legislation ;

- persistent uncertainties regarding supervision, anti-money laundering, or compliance with KYC standards.

According to JPMorgan, closer links between institutions could allow better coordination in the face of these challenges.

One thing is certain : JPMorgan today outlines a hybrid positioning. A dynamic that other financial players may soon follow, as the boundary between traditional finance and innovation blurs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services