Date: Tue, Sept 23, 2025 | 05:45 AM GMT

The cryptocurrency market is experiencing heavy selling pressure, with over $1.45 billion in liquidations recorded in the past 24 hours. Ethereum (ETH) has slumped more than 2% with a 7% weekly drop, sliding down to the $4200 level. Unsurprisingly, major memecoins are also feeling the brunt of this downturn, including Dogwifhat (WIF).

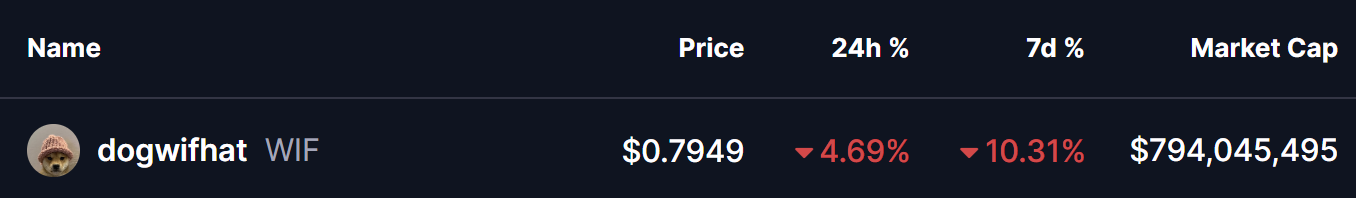

WIF has declined by 4% today, extending its weekly loss to more than 10%. More importantly, the coin is now testing a pivotal technical level that could decide its next move.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Triangle in Play

On the daily chart, WIF has been consolidating inside a symmetrical triangle pattern — a neutral structure that often precedes a sharp breakout in either direction.

The ongoing correction has dragged WIF toward the lower boundary of this triangle near $0.7717, where buyers are showing resilience by holding the support. At the time of writing, the token is trading around $0.7953. Notably, this support aligns with the 200-day moving average ($0.7911), making it a key technical level that bulls must defend.

Dogwifhat (WIF) Daily Chart/Coinsprobe (Source: Tradingview)

Dogwifhat (WIF) Daily Chart/Coinsprobe (Source: Tradingview)

This trendline has acted as dynamic support for months, and holding above the 200-day MA could be the first step for bulls to maintain control and prepare for a rebound.

What’s Next for WIF?

If buyers successfully defend the $0.77 support, WIF could attempt a rebound toward the upper resistance of the triangle near $1.20. Breaking above this zone would be a bullish trigger, potentially unleashing momentum for a larger rally.

However, if WIF fails to hold $0.77 and slips below the triangle, it would confirm a bearish breakdown, likely exposing the token to deeper losses and triggering panic selling.