HBAR’s Week Ahead Looks Bleak as Hedera Stablecoin Market Cap Crashes 50%

HBAR faces mounting pressure as Hedera’s stablecoin liquidity shrinks and sentiment turns negative. Holding $0.212 is crucial to avoid deeper losses.

Hedera Hashgraph’s native token, HBAR, has slipped 7% over the past week as investor sentiment weakens and broader market demand for the altcoin fades.

On-chain data reveals a sharp decline in liquidity across the Hedera network and growing pessimism among HBAR holders—factors that could push the token further to the downside in the short term.

Liquidity Exodus Hits Hedera

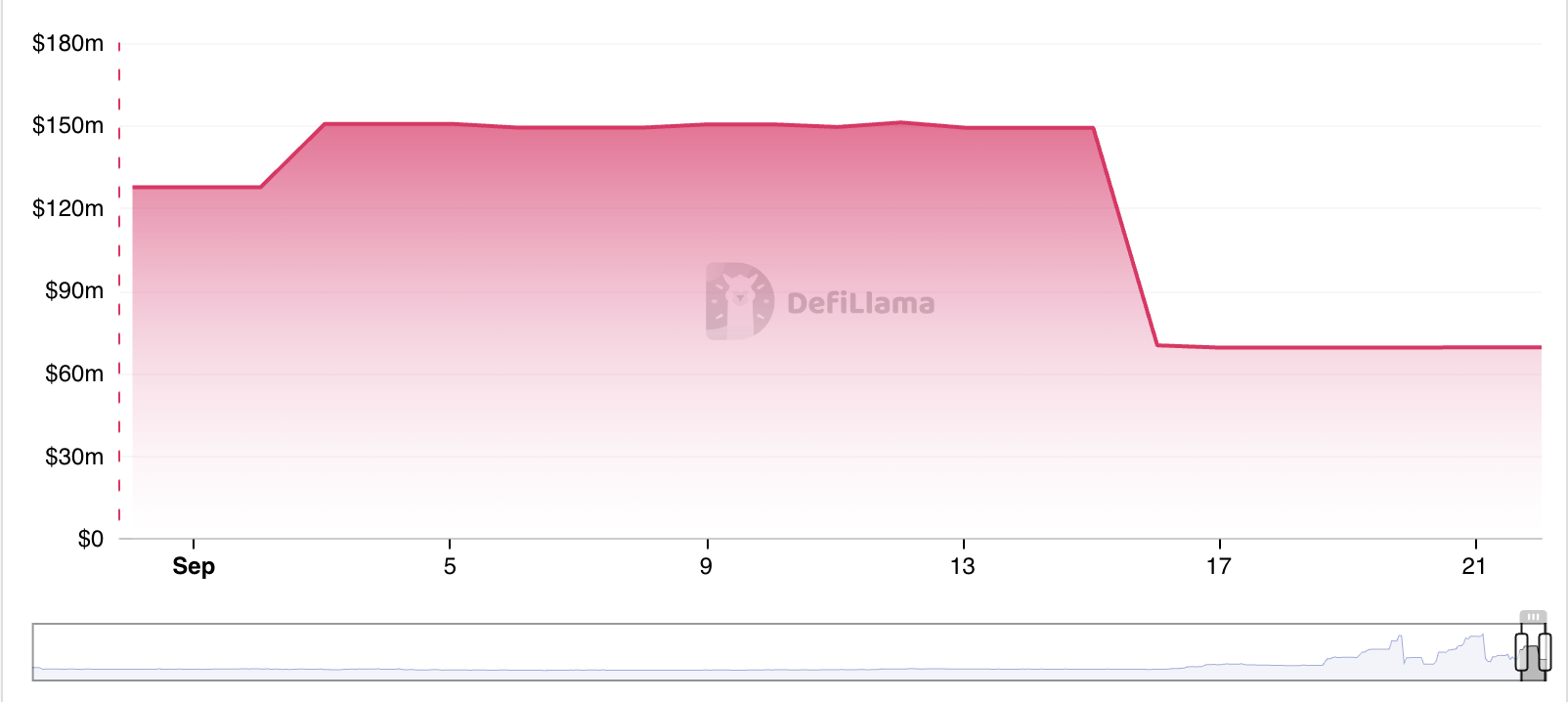

According to DefiLlama, Hedera’s stablecoin market cap has plunged 53% in the past week, dropping to $70 million. The sharp decline signals a significant liquidity exit from the network within just seven days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Stablecoin Market Cap. Source:

HBAR Stablecoin Market Cap. Source:

HBAR Stablecoin Market Cap. Source:

HBAR Stablecoin Market Cap. Source:

A fall in stablecoin market cap points to reduced on-chain activity, since stablecoins are essential for trading, payments, and other decentralized finance operations. Therefore, lower stablecoin presence suggests fewer participants are engaging with the network, a trend that translates into weaker transaction volumes.

For HBAR, this liquidity decline raises the risk of further downward pressure on price as demand across the Hedera ecosystem continues to weaken.

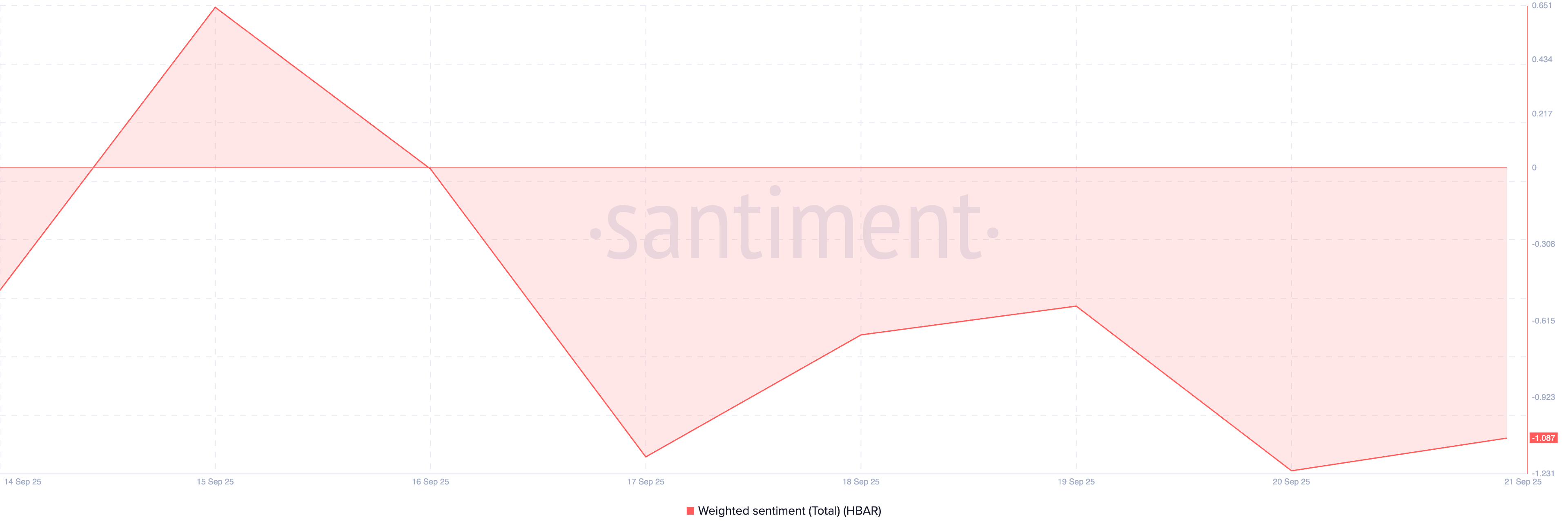

Further, HBAR’s weighted sentiment remains below zero, confirming the growing bearish bias toward the altcoin. As of this writing, the metric stands at -1.08.

HBAR Weighted Sentiment. Source:

HBAR Weighted Sentiment. Source:

HBAR Weighted Sentiment. Source:

HBAR Weighted Sentiment. Source:

The weighted sentiment metric tracks the ratio of positive to negative commentary around an asset by combining the volume of social discussions with their tone. A reading above zero reflects optimism and positive chatter, while a value below zero signals that negative emotions dominate the conversation.

HBAR’s current weighted sentiment suggests that its traders and community members are largely skeptical about the token’s near-term prospects. This can continue to limit their buying interest, worsening the downward momentum in HBAR’s price.

$0.212 Support Decides HBAR’s Next Move

As of this writing, HBAR is trading at $0.225, hovering above the $0.212 support floor. If the bears pull the token’s price toward this level and the bulls fail to defend it, further declines, possibly towards $0.192, could result.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, a rebound in new demand for the altcoin will invalidate this bearish outlook. If buy-side pressure regains momentum, HBAR could reverse its downtrend and climb to $0.232.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple’s Trust Bank Review Nears Finish Boosting XRP Sentiment

Quick Take Summary is AI generated, newsroom reviewed. The conclusion of the 120-day OCC review for Ripple National Trust Bank is set for October 30. Approval could allow Ripple to manage digital assets under a national banking license and integrate its blockchain with the U.S. financial system. Ripple's strong compliance and utility-based approach, including its RLUSD stablecoin, may fast-track the approval process. The potential bank approval is seen by investors as a major validation of Ripple's long-te

Whoever can help the US reduce its debt with cryptocurrency will become Powell's successor.

The article explores the true motivation behind the change in the Federal Reserve chair, pointing out that the core issue is the massive U.S. national debt and fiscal deficit, rather than inflation. Trump has hinted at the possibility of using cryptocurrencies to address the debt problem, and the next chair may promote the integration of digital assets as national financial tools. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

Chillhouse Leads the Rally Alone: The Past and Present of "Web3 Fun Seekers"

How does it bring together Base, pump.fun, and Solana for a joint performance?

Trump's Truth Social Enters Prediction Market, Competing Directly with Polymarket

As Truth Predict is launched, Polymarket is planning to return to the US market.