Securities fund managers increased their net long positions in the S&P 500 to 891,634 contracts.

ChainCatcher news, according to Golden Ten Data, data from the U.S. Commodity Futures Trading Commission (CFTC) shows that as of the week ending September 16, securities fund managers increased their net long positions in the S&P 500 Index CME by 9,074 contracts, reaching 891,634 contracts. Meanwhile, securities fund speculators increased their net short positions in the S&P 500 Index CME by 55,766 contracts, reaching 475,397 contracts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

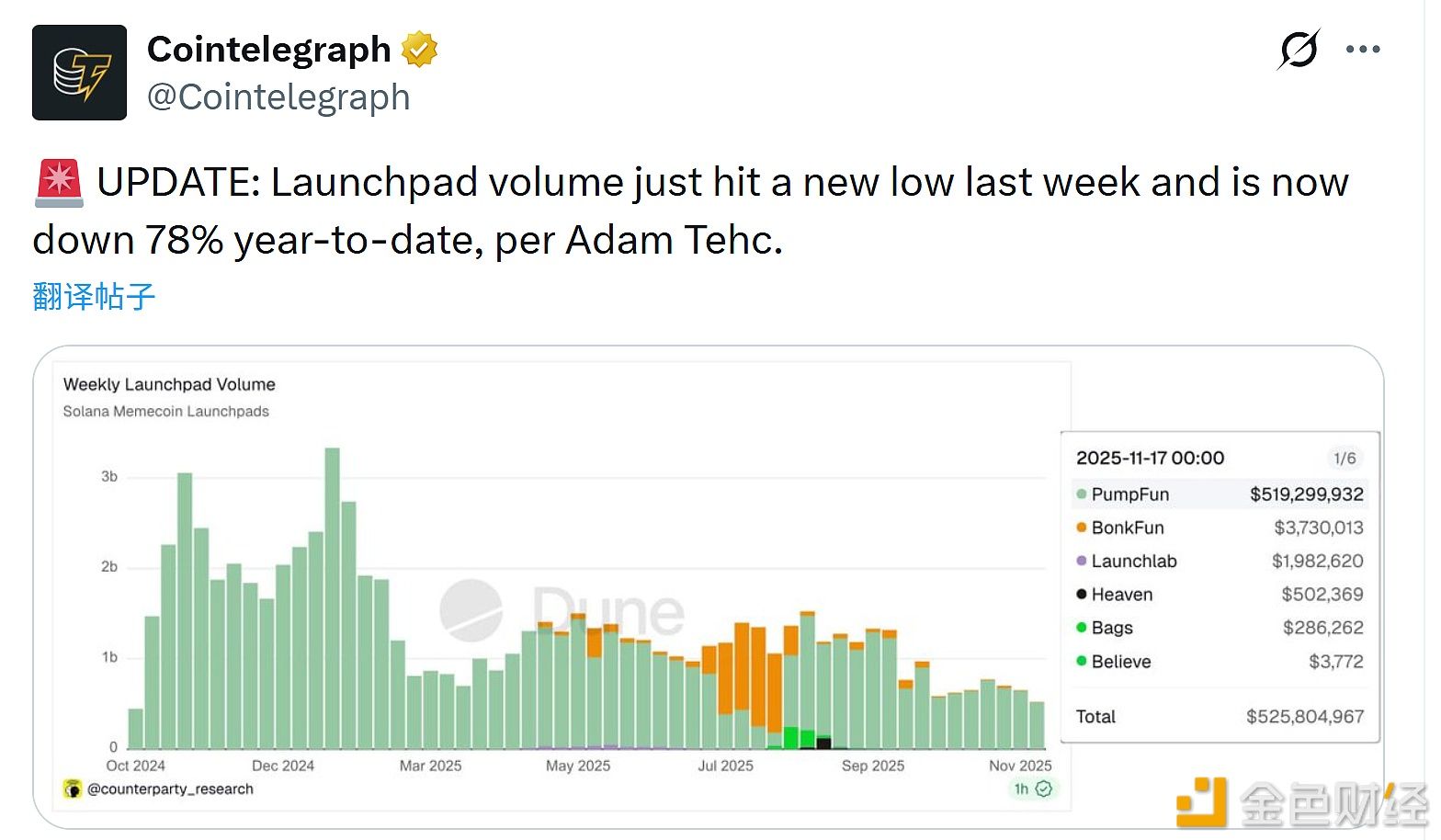

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93

Tether suspends Bitcoin mining operations in Uruguay due to rising energy costs