Why MemeCore’s All-Time High Might Be the Beginning of Its Next Weak Phase

MemeCore’s M token soared to a record high but faces resistance at $2.99 as profit-taking and bearish signals suggest a pullback ahead.

M, the coin powering the Layer-1 blockchain built specifically for meme coins, MemeCore, has emerged today’s top gainer after soaring 20% in the past 24 hours. The move extends its strong weekly rally, which saw the altcoin clinch a new all-time high just yesterday.

However, warning signs are beginning to surface that suggest profit-taking is underway. This threatens M’s sustained rally and hints at a potential pullback in the near term.

MemeCore’s Rally Faces Exhaustion

Despite the hype surrounding M’s recent rally, in-chain data points to mounting sell pressure beneath the surface.

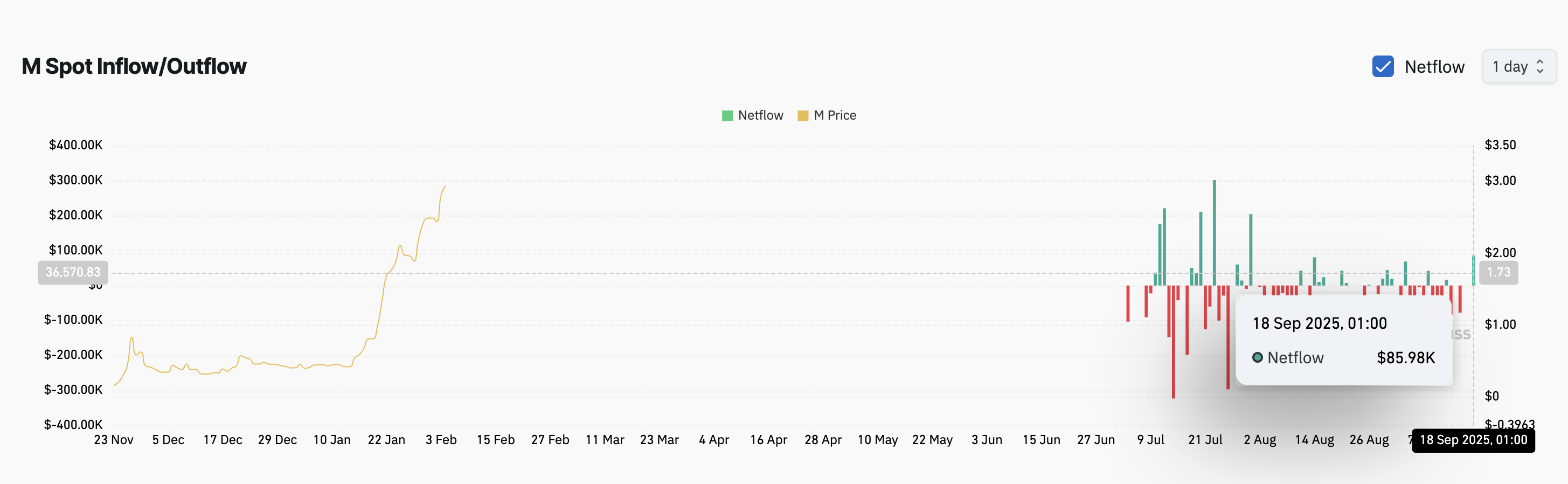

According to Coinglass, spot exchange inflows have rocketed to multi-week highs, indicating that investors have increasingly moved tokens onto exchanges to cash out from M’s rally to a new peak.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

M Spot Inflow/Outflow. Source:

Coinglass

M Spot Inflow/Outflow. Source:

Coinglass

Typically, when an asset sees a rise in spot exchange inflows, it reflects a shift in sentiment from accumulation to distribution. Rather than holding tokens in private wallets, traders are depositing them on exchanges in preparation to sell.

This behavior signals that M’s bullish momentum is close to exhaustion and could give way to near-term weakness.

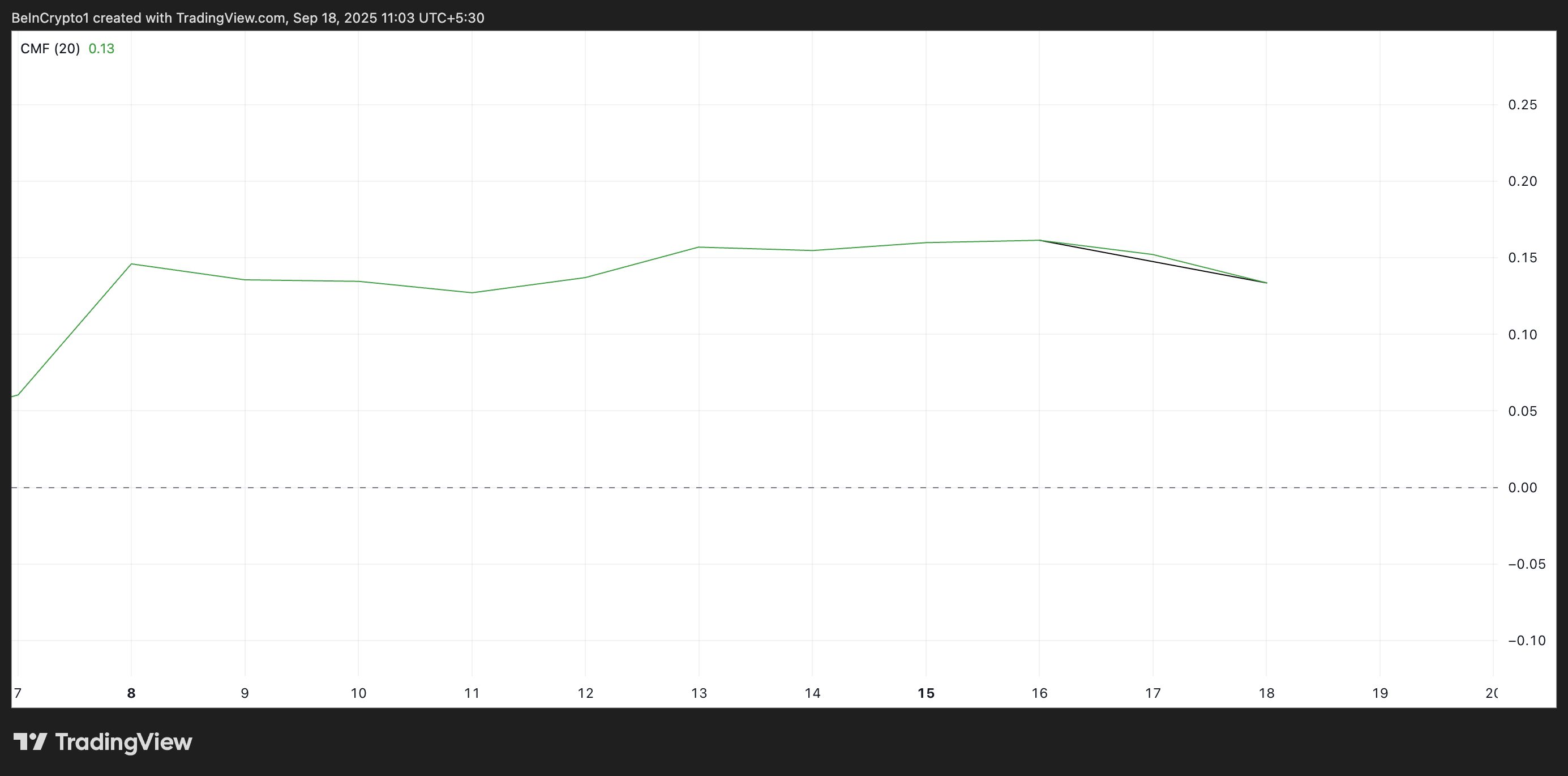

Furthermore, M’s Chaikin Money Flow (CMF) has trended downward since September 16, gradually forming a bearish divergence with the token’s climbing price.

MemeCore CMF. Source:

TradingView

MemeCore CMF. Source:

TradingView

The CMF measures the flow of capital into and out of an asset by combining price action with trading volume. It forms a bearish divergence when its value trends lower while an asset’s price continues to climb.

Historically, such divergences precede slowdowns and price reversals, as they reveal that although buyers are still pushing the price higher, capital inflow into the asset is declining steadily.

This puts M’s rally at risk of stalling in the near term.

MemeCore Stalls Below ATH as $2.99 Wall Strengthens

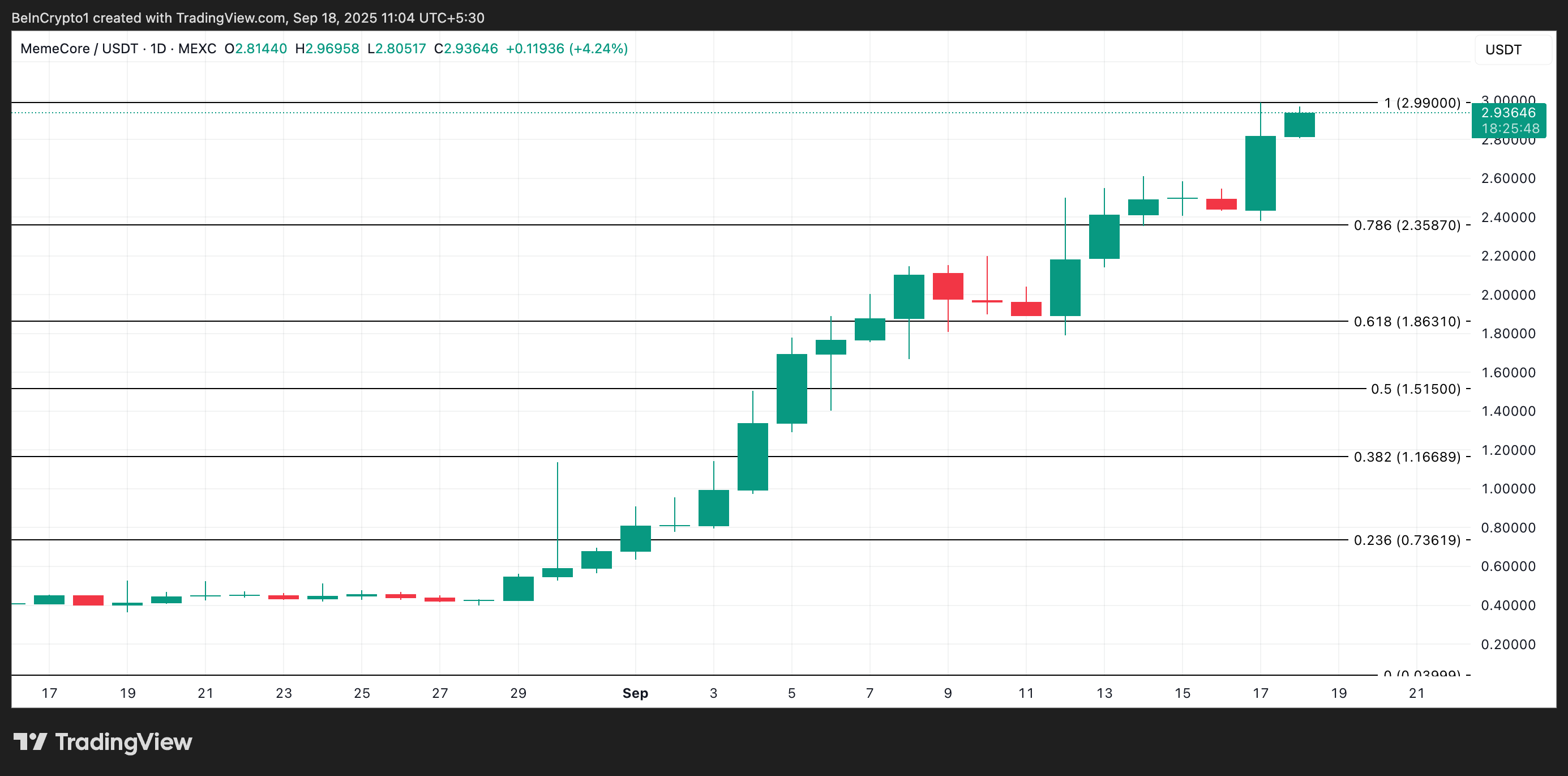

At press time, M trades at $2.94, just shy of its all-time high at $2.99, which has now formed a key resistance wall.

If the underlying bearish momentum continues to build, this barrier will only strengthen, forcing M to retreat toward support at $2.35. A breakdown below that level could worsen losses and drag the token to $2.35.

MemeCore Price Analysis. Source:

TradingView

MemeCore Price Analysis. Source:

TradingView

Conversely, if renewed demand surges, M could reclaim its all-time high and open the door to fresh price peaks, extending its bullish streak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne