The SEC Clearance, Cryptocurrency ETP Poised for Explosive Listing

SEC Clears Path for Universal Listing Standards: Crypto ETPs Can Be Listed in as Fast as 75 Days

Original Title: "US SEC Greenlights, Crypto ETP Set to Explode on the Market!"

Original Source: BitPush

On September 17, local time, the U.S. Securities and Exchange Commission (SEC) "accelerated approval" of the generic listing standards for cryptocurrency exchange-traded products (ETPs), paving the way for such products to go public and trade.

1. Generic Listing Standards: From "Case-by-Case Approval" to "One-Click Listing"

Previously, the listing of crypto ETPs was a long, expensive, and high-risk process. Issuers had to submit a special application for each new asset, demonstrating that its market had sufficient liquidity and would not be manipulated, with SEC review periods lasting as long as 240 to 270 days.

The impact of generic listing standards is revolutionary:

Simplified and accelerated process: ETPs only need to meet certain SEC-specified requirements for their approval to be almost guaranteed, with the process time drastically shortened to 75 days or less. They also allow compliant crypto ETPs (Exchange-Traded Products) to list for trading without the 19b-4 form.

Exchange Platform Options: Most industry proposals for generic listing standards suggest that the underlying assets must have futures contracts trading on regulated U.S. futures exchanges. Eligible trading platforms may include CME, Cboe, and potentially Coinbase Derivatives Exchange and Bitnomial.

First Movers: The SEC has approved exchange platform listing standards and quickly approved the trading of Grayscale Digital Large Cap Fund (with major holdings in BTC, ETH, etc.).

2. Product Explosive Growth: History Repeats Itself

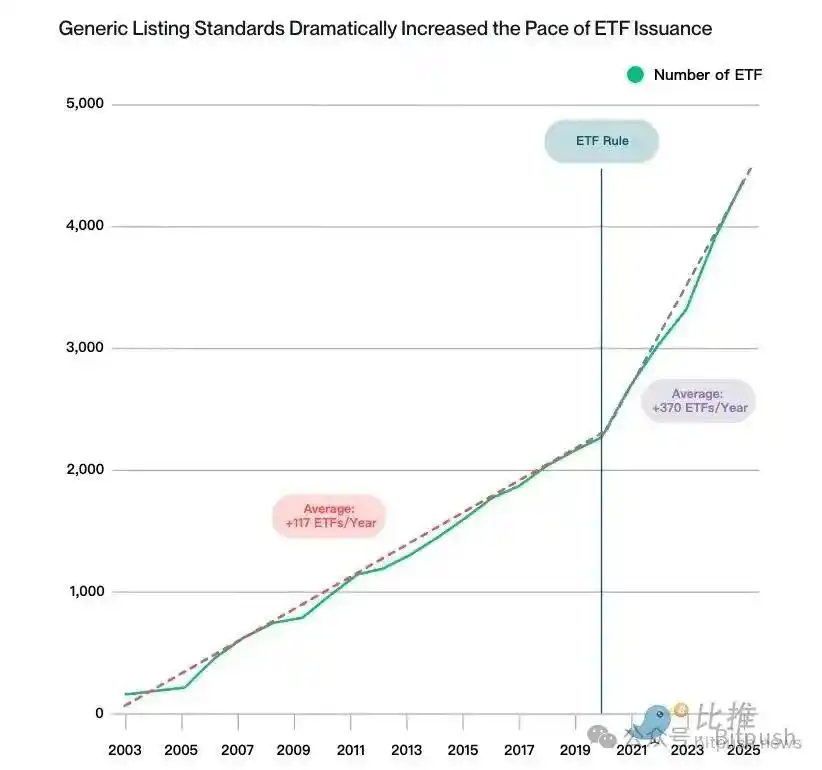

Bitwise Chief Investment Officer Matt Hougan predicts that generic listing standards will trigger an explosive growth in the number of crypto ETPs, and historical precedents support this view:

Traditional ETF Precedent: At the end of 2019, after the SEC approved "ETF Rule" creating generic standards for stock and bond ETPs, the speed of new ETF launches more than tripled, skyrocketing from an average of 117 per year to 370 per year.

Crypto Market Outlook: The crypto ETP sector is also expected to experience a similar expansion. Altcoins that meet futures contract criteria, such as Solana, XRP, Chainlink, Cardano, Avalanche, Polkadot, etc., will all see ETPs and attract a large number of traditional asset management companies into this space.

III. Macro Double Boost: Rate Cuts and the ETP Wave

The regulatory breakthrough in ETPs comes at a time when there is a shift in US macro policy:

Fed Pivot: The Federal Reserve announced a rate cut on the same day, with Powell calling it a "risk management-style rate cut" and clearly stating that the labor market "doesn't need further softening." This marks a shift in Fed policy focus from inflation control to job protection, and is expected to kick off a rate cut cycle with ample liquidity.

Liquidity and Channels: The rate cut cycle will release more capital into risk assets; and ETP standardization provides the most convenient channel for accessing this capital.

IV. Impact on Crypto Asset Prices

Bitwise Chief Investment Officer Matt Hougan stated in his report that the presence of ETPs does not guarantee fund inflows, but it prepares assets for "ignition."

Unlocking Traditional Capital: The majority of the world's funds are controlled by traditional investors. With ETPs, these investors can easily allocate to crypto assets through their brokerage accounts without dealing with complicated wallets and private keys.

Reducing the "Mystery": ETPs transform cryptocurrencies from "geek-exclusive strange tokens" into trusted stock codes. This reduces the threshold and fear for ordinary investors, making it easier to connect applications like Chainlink's collaboration with Mastercard and stablecoins.

Fund Pool: ETPs act as a massive fund pool for assets. Once the fundamentals of an asset (e.g., Solana's activity, Ethereum's ecosystem development) start to improve, capital will flow in at a rapid pace and large scale, triggering a quick price surge.

In conclusion, with the elimination of SEC regulatory barriers and the start of the Fed's rate cut cycle, this "ETP explosion" will completely unleash suppressed crypto capital and innovation, accelerating the mainstreaming process of cryptocurrency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Bitcoin price eyes $112K liquidity grab as US government shutdown nears end

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.