With the interest rate cut in place, is it time to celebrate?

The Federal Reserve's 25 basis point rate cut has caused market turmoil, rooted in political interference behind decision-making and internal divisions within the Fed, resulting in unexpected attention for bitcoin. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

In the early hours of September 18, 2025, in the East 8th time zone, Wall Street traders held their breath. When the Federal Reserve announced a 25 basis point rate cut as expected, the market’s initial reaction was textbook: U.S. Treasury yields fell, the dollar weakened, and risk assets rejoiced. However, just an hour later, as Chairman Jerome Powell took the stage at the press conference, everything reversed. The dollar index made a V-shaped rebound, gold plunged from historic highs, and U.S. stocks were mixed—leaving the market in utter confusion.

The root of this chaos was not the 25 basis point rate cut itself. After all, according to CME’s FedWatch tool, the market had priced in a 96% probability for this rate cut, making it almost a certainty. The real trigger was a carefully orchestrated yet flawed display of “unity” behind the decision. Especially the lone dissenting vote from White House “envoy” Stephen Miran, which struck like lightning, tearing apart the “emperor’s new clothes” of the Federal Reserve’s so-called “independence”—the core institution of traditional finance—and inadvertently held an unexpected coronation for bitcoin in a parallel universe.

The Shift to “Data Dependence”: Why Was a Rate Cut Inevitable?

Before exploring the “peculiarities” of this meeting, it’s essential to clarify why the Federal Reserve stepped on the easing pedal at this moment. The answer is simple: the job market is flashing red.

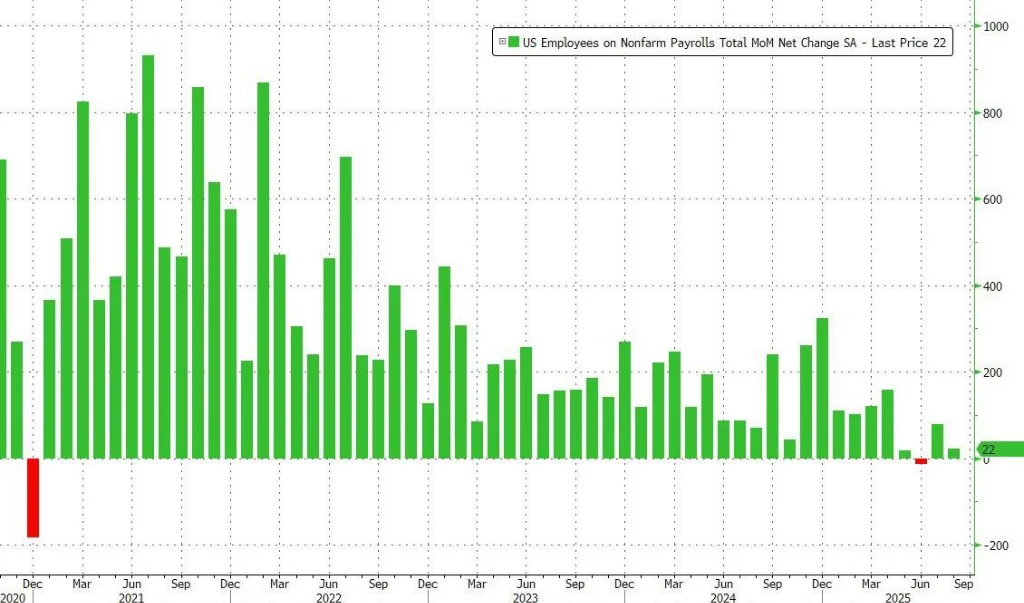

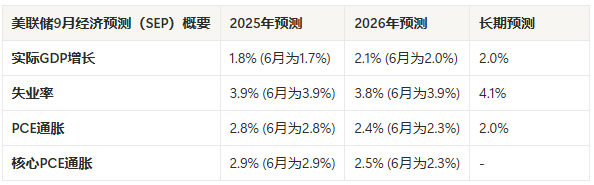

Data from the Department of Labor paints a worrying picture: in the three months ending in August, the average monthly increase in jobs was only about 29,000—the weakest growth since 2010 (excluding the pandemic period). Deeper indicators show that initial jobless claims hit a nearly four-year high, while the number of long-term unemployed (over 26 weeks) reached its highest point since November 2021. Powell himself had already laid the groundwork for this at the Jackson Hole Symposium at the end of August, stating clearly: “Downside risks to employment are rising.” This makes it clear that the balance within the Federal Reserve has shifted significantly from fighting inflation to defending its mission of “full employment.”

However, just as the market thought this was a natural “dovish” turn, three major uncertainties pushed this meeting into unprecedented complexity.

A Divided Dot Plot and the Potential Rate Cut Path

The first uncertainty, and the market’s core concern: How many more rate cuts will there be this year?

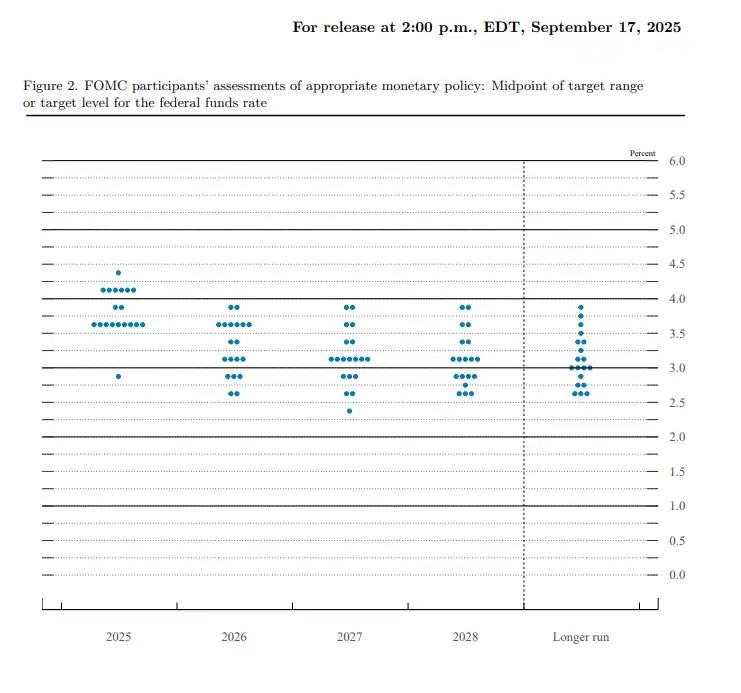

Since the 25 basis point rate cut was fully priced in, traders’ real focus was on the “dot plot” that signals the future rate path. On the surface, the median of the dot plot shows that policymakers expect two more rate cuts this year, totaling 50 basis points. This seems like clear guidance.

However, beneath this median “veil” lies significant division. Of the 19 voting members, 9 expect two more rate cuts, but almost as many (9) think there will be at most one more, and some even support a rate hike. More extremely, one forecast (widely believed to be from Miran) calls for a further 125 basis points of cuts this year. Economists at Goldman Sachs had previously warned that while the dot plot might point to two cuts, the prediction that “the division will be small” was clearly too optimistic. This almost “split” distribution of forecasts greatly diminishes the dot plot’s guiding significance.

This official ambiguity stands in stark contrast to the market’s aggressive pricing. CME’s interest rate futures show that traders ignored this division and quickly priced in over a 70% probability for further rate cuts in October and December after the meeting. This sets up two completely different potential paths for the future: either the Federal Reserve sticks to its cautious stance and clashes with the market’s aggressive expectations, triggering a new round of volatility; or the Fed ultimately compromises under continued political and market pressure, starting an easing cycle faster than expected. In either scenario, uncertainty will be the main theme in the coming months.

The second uncertainty is Powell’s “tone-setting.” Facing enormous internal and external pressure, he defined this rate cut as a “risk management” action. The brilliance of this rhetoric is that it tries to dance on two eggs. Internally, by acknowledging the weakness in the job market, it legitimizes the rate cut; externally, it emphasizes inflation risks, implying that subsequent easing will be cautious, thus pushing back against White House pressure. However, this attempt at all-around balance has left the market in a state of “schizophrenia.” As Powell admitted at the end of the press conference, “There is no risk-free path now.” Cut too much and you risk inflation, cut too little and you risk angering the president—Powell has not untied this knot.

Amid Macro Chaos, Bitcoin’s “Self-Fulfilling” Narrative

The third uncertainty, and the real “elephant in the room” behind this meeting—unprecedented political intervention.

Stephen Miran, Trump’s chief economic adviser, was sworn in just a day before the meeting, promptly gaining voting rights. This was widely seen as a direct reflection of the White House’s desire to cast a key vote in favor of “substantial rate cuts” at the September meeting. Meanwhile, Trump’s attempt to fire Federal Reserve Governor Lisa Cook was temporarily blocked by the courts, but litigation is ongoing. These events are no longer mere rumors, but a naked encroachment of executive power on central bank independence. Miran’s lone dissenting vote is the ultimate revelation of this encroachment.

While Wall Street is still struggling with the Fed’s dot plot and contradictory economic forecasts (cutting rates while raising future inflation expectations), believers in the crypto world see a grander and deeper narrative. On January 3, 2009, when Satoshi Nakamoto left the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” in bitcoin’s genesis block, he was criticizing the vulnerability of the centralized financial system in the face of crisis and its disregard for rules.

Sixteen years later, Miran’s appearance has pushed this questioning of the system from the economic to the political level. When the monetary policy of the world’s most important central bank may no longer be based entirely on data, but is directly influenced by short-term political agendas, the long-term credibility of its fiat currency is fundamentally undermined. The concept of “code is law” and “rules before power” represented by bitcoin becomes especially precious in this context. Its fixed cap of 21 million, predictable issuance schedule, and immunity from control by any single entity form a “certainty oasis” in stark contrast to the current macro chaos.

Short-Term Risks After the “Shoe Drops”

Although the macro backdrop provides strong support for bitcoin’s long-term value, answering the question “Is it time to celebrate?” requires distinguishing between long-term narratives and short-term trading. The market’s V-shaped reversal after the rate cut “shoe dropped” is a vivid reflection of short-term risk.

First, this was a rate cut that was overly anticipated by the market. When an event is priced in at a 96% probability, its occurrence can hardly be a new positive, but rather provides an excellent opportunity for profit-taking—the classic “buy the rumor, sell the news.” Second, Powell’s ambiguous “risk management” rhetoric and the huge division in the dot plot failed to provide the market with a clear signal for a new round of easing, disappointing speculative bulls who tried to front-run the move.

Bitcoin’s price action played out the market’s entanglement and division in a more dramatic way. As shown below, at 2:00 a.m. (UTC+8) when the decision was announced, the market’s first reaction was disappointment, with bitcoin prices plunging to around $114,700, a classic “sell the news” move. However, unlike gold and mainstream U.S. stocks, as Powell began his press conference, the market seemed to interpret more dovish signals, and bitcoin made a V-shaped rebound, surging past $117,000 (UTC+8), staging a “bottoming and recovery” move distinct from traditional risk assets.

This fully demonstrates that in the short term, bitcoin is still regarded by the market as a high-beta risk asset, with its price volatility highly correlated with macro liquidity expectations. Therefore, market volatility may intensify in the short term, and any employment or inflation data that deviates from mainstream expectations could trigger sharp corrections in risk assets, including cryptocurrencies.

Conclusion: The Real Focus Beyond the Dot Plot

So, with the rate cut in place, is it time to celebrate?

From a short-term trading perspective, the answer is no. With the Federal Reserve’s future path full of uncertainty and the benefits of the first rate cut already priced in, it is wiser to remain cautious and alert to volatility.

However, from the perspective of long-term value investing and macro narrative, this drama is just beginning. Every attempt at political intervention, every contradiction and struggle in decision-making, sounds the alarm for the decentralized world and adds to the long-term value proposition of crypto assets. Rather than predicting the chaotic dot plot, it is better to observe the “game of power” unfolding within the Federal Reserve. Because its outcome will not only determine the future of the dollar, but will also largely define the true role of the crypto world in the next macro cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google executive makes millions of dollars overnight through insider trading

Insider addresses manipulated Google's algorithm by referencing prediction market odds.

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically