Ethereum Tests Support: Holder Conviction Sets Stage for a Rebound to $4,775

Ethereum price slipped below $4,500, but nearly $8 billion in maturing ETH supply signals strong investor conviction. If ETH reclaims support, a rally toward $4,775 and new highs could follow.

Ethereum has seen a 4% decline in recent days, pulling the altcoin king just under $4,500.

While this short-term dip may concern some traders, the long-term outlook remains bullish as strong fundamentals and investor behavior suggest resilience ahead.

Ethereum Supply Is Maturing

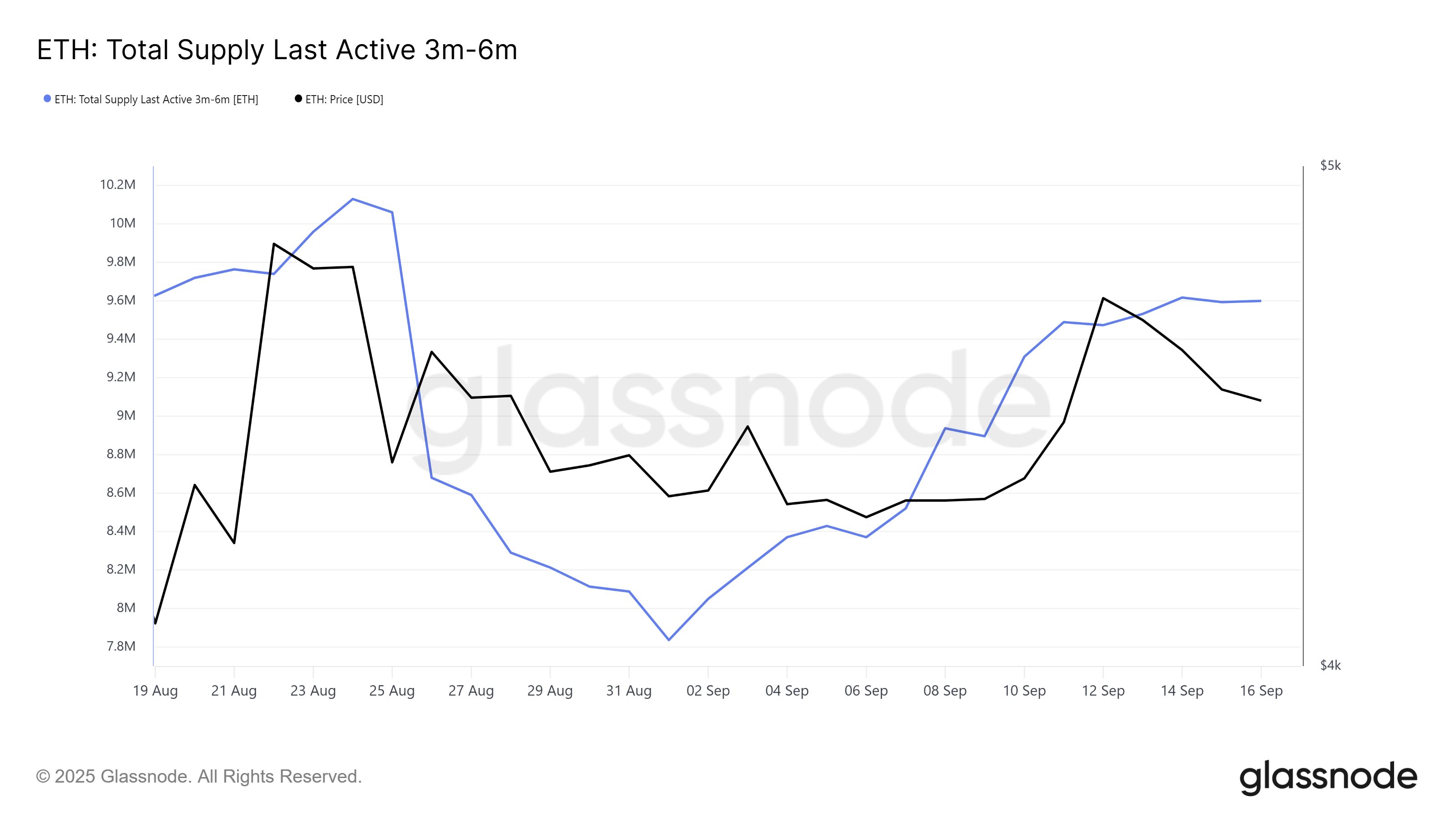

Ethereum supply has matured significantly, reinforcing investor confidence in the asset’s long-term strength. Since the beginning of the month, the 3-6 month-old supply has grown by 1.76 million ETH, now valued at nearly $8 billion. This indicates that holders refrained from liquidating even during market volatility.

Such conviction suggests that investors anticipate higher prices and are willing to ride out short-term declines. By keeping ETH locked, these holders are reducing the circulating supply, which can create favorable conditions for upward price momentum when demand returns. This behavior is a bullish foundation for Ethereum’s growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

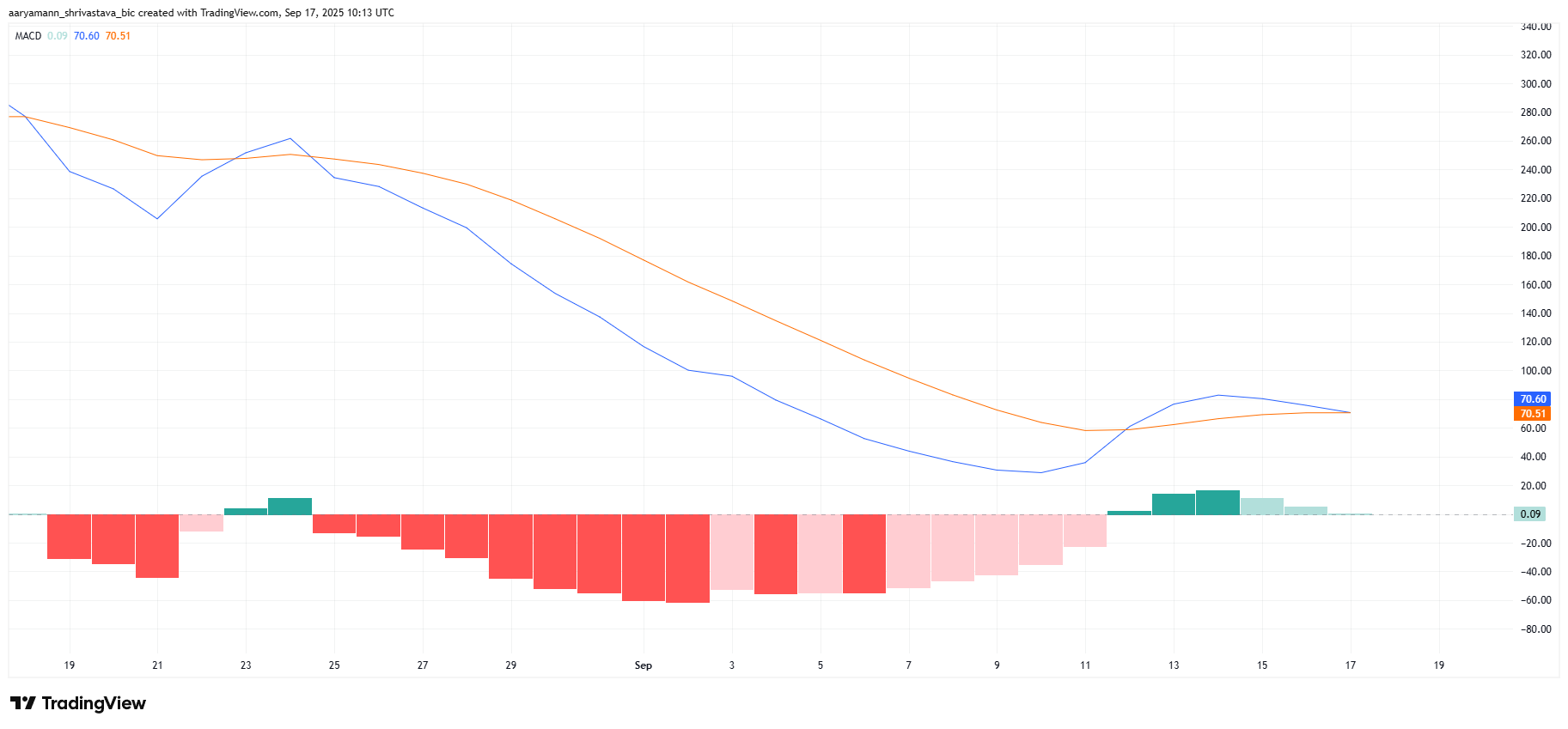

On the technical side, Ethereum’s momentum appears mixed in the near term. The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover, signaling the possibility of short-lived downside pressure. This aligns with ETH’s recent price slip below the $4,500 level.

However, the broader market cues remain constructive. Even if the MACD confirms a bearish crossover, investor sentiment and maturing supply could support a quick recovery. Such dynamics highlight that any decline would likely be temporary, with ETH primed for a strong rebound soon after.

ETH MACD. Source:

TradingView

ETH MACD. Source:

TradingView

ETH Price Could Bounce Back

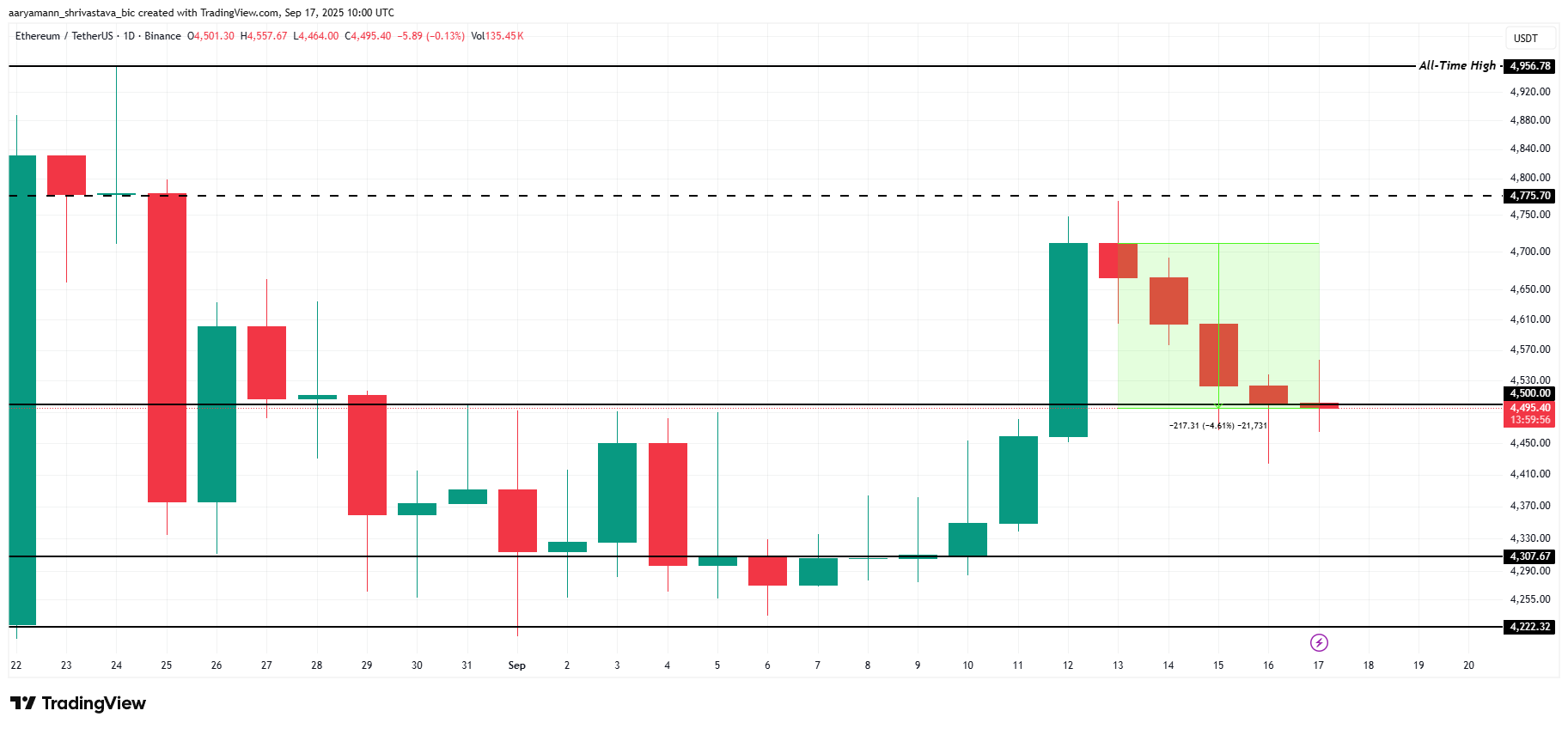

Ethereum is currently trading at $4,495, just below the $4,500 support line. It has not yet closed below $4,500, so the support is still valid.

The maturing supply and bullish long-term outlook indicate that Ethereum could bounce from the support. With fewer coins entering circulation, the altcoin has structural support for renewed upward momentum to $4,775 despite short-term volatility.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if the price closes below the support, ETH may slip toward $4,307, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.