U.S. and Canada handle a quarter of all crypto transactions: Chainalysis

The latest report by Chainalysis shows that North America continues to play a central role in the crypto ecosystem.

- U.S. and Canada accounted for 26% of all global crypto activity between July 2024 and June 2025

- Tokenized treasuries exploded in value, growing from from $2 billion to $7 billion

- The likely catalyst for these inflows is the election of Donald Trump as U.S. President

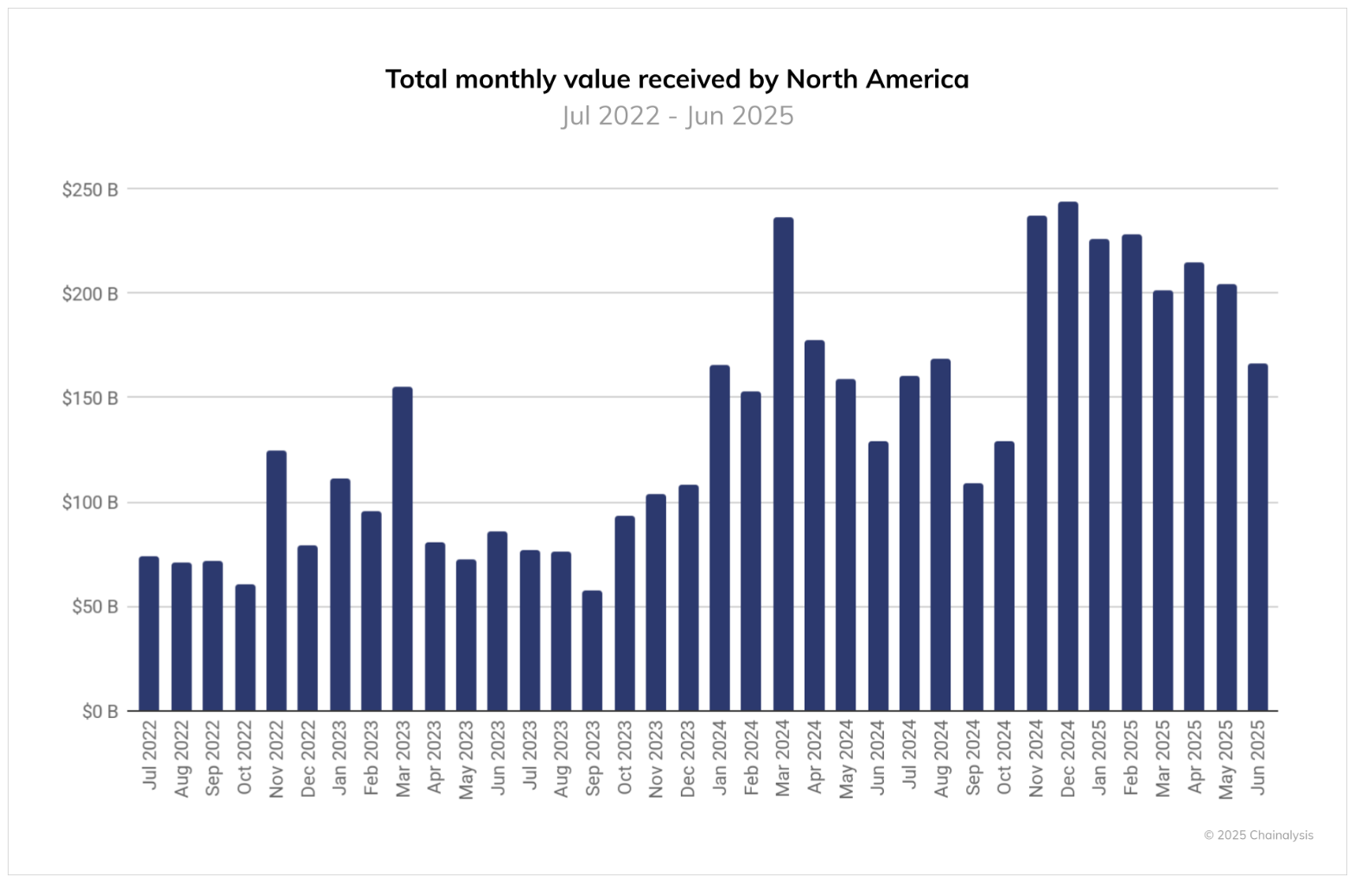

U.S. and Canada continue to dominate the crypto ecosystem. On Wednesday, September 17, Chainalysis published a report highlighting North America’s role in the digital assets sector. Between July 2024 and June 2025, the region handled $2.3 trillion in crypto transactions, representing 26% of all global activity.

This activity peaked in December 2024, with wallets based in North America receiving $244 billion in inflows. According to Chainalysis, the majority of this activity came from stablecoin transfers. The month set a record for stablecoin transactions, which still stands.

The likely catalyst for this surge in activity was the election of President Trump in November 2024. Markets viewed the election of a pro-crypto president as a bullish signal and expected greater regulatory clarity. Another contributing factor was quantitative easing in the fourth quarter of 2024, which increased risk appetite across the market.

North America also saw higher volatility in crypto transactions, largely due to more institutional capital and active trading. For instance, September recorded a 35% monthly decline, while November saw an 84% spike.

Tokenized U.S. treasuries explode in value: Chainalysis

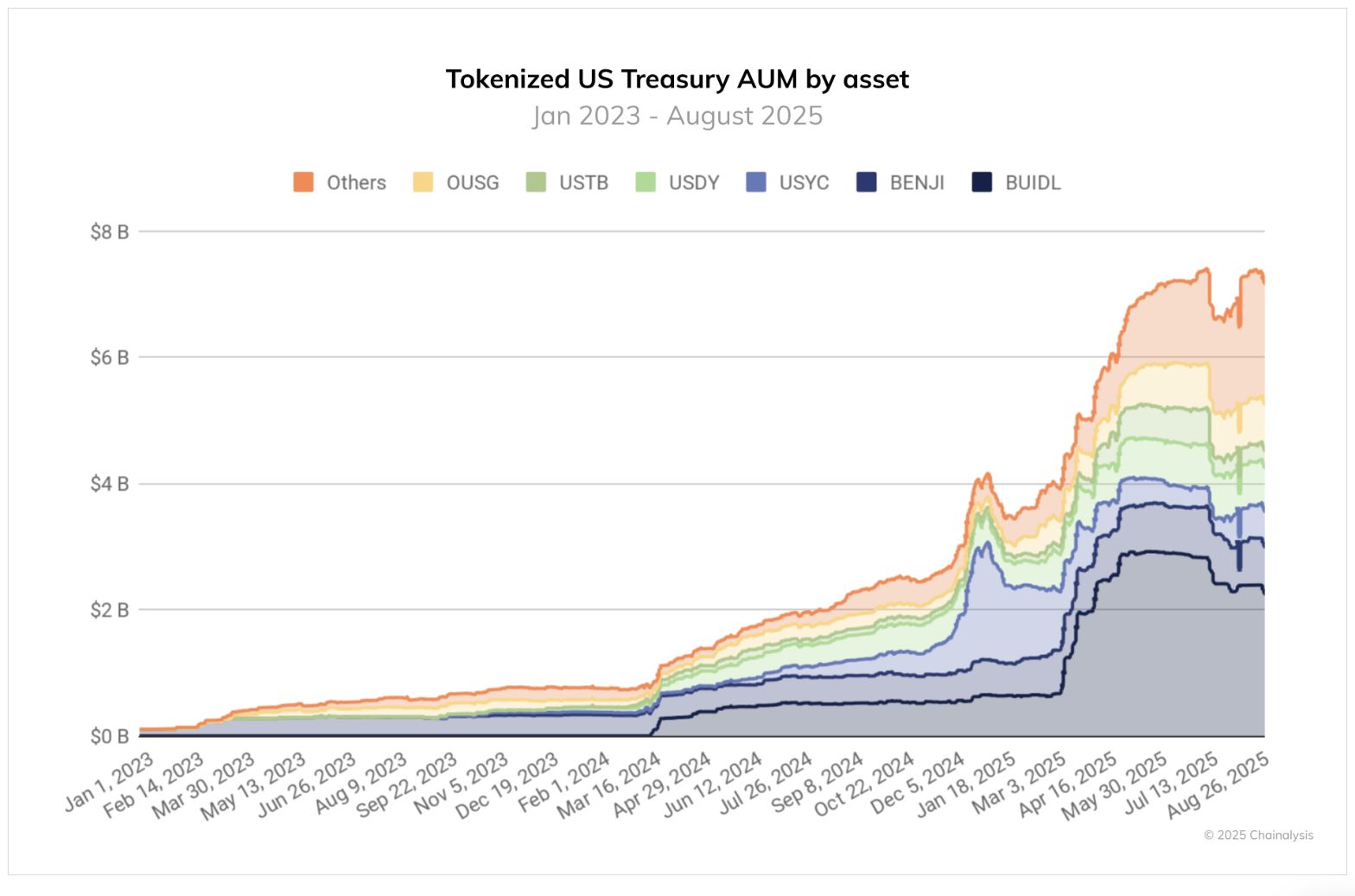

U.S. Treasuries became one of the most significant segments of the tokenized asset market. Assets under management of these funds grew from $2 billion in August 2024 to more than $7 billion in August 2025.

Tokenized U.S. Treasury assets under management by asset | Source: Chainalysis

Tokenized U.S. Treasury assets under management by asset | Source: Chainalysis

While tokenized treasuries remain a small segment of the broader U.S. bond market, their growth highlights strong investor demand for accessible investment vehicles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.