ETH Exit Queue Hits All-Time High After Kiln Withdrawal Sparks $11 Billion Unstake

More than 2.5 million ETH worth $11.3 billion are waiting to exit Ethereum validators, creating a 44-day backlog and sparking debate over security, profit-taking, and scalability.

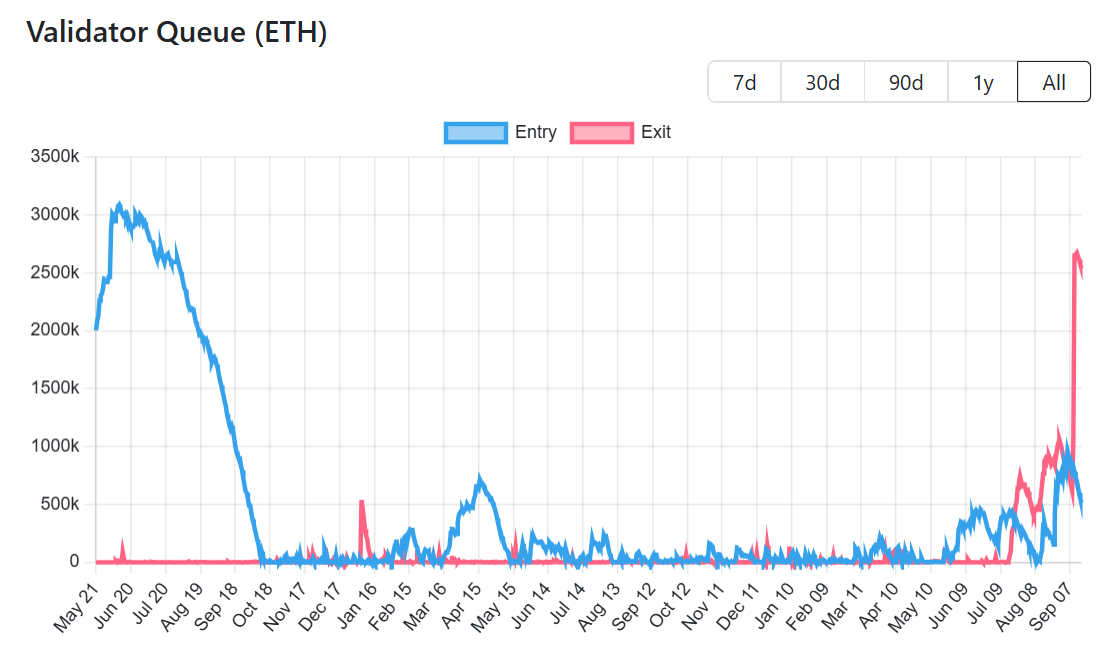

Ethereum’s validator system is under unusual strain. More than 2.5 million ETH, worth roughly $11.3 billion, are currently waiting to exit the network’s staking mechanism, stretching the exit queue to 44 days, the longest on record.

The backlog was triggered when Kiln, a major staking infrastructure provider, withdrew all of its validators on September 9 as a security precaution.

Record Exit Queue for Staked Ethereum

According to Figment’s Benjamin Thalman, around 4.5% of all staked Ethereum (ETH) is now in line to exit.

“Ethereum’s validator exit queue has spiked, reaching new highs, raising fair questions about timelines and rewards,” Thalman noted in a recent report.

Ethereum Validator Queue. Source:

validatorqueue.com

Ethereum Validator Queue. Source:

validatorqueue.com

He emphasized that Ethereum functions as designed, with rate-limiting exits protecting network stability and allowing stakers to plan around predictable delays.

Kiln’s decision followed unrelated incidents, the NPM supply chain attack, and the SwissBorg breach, which raised security concerns across infrastructure providers.

1/10 🧵 Following our announcement yesterday regarding the Solana incident involving SwissBorg, Kiln is taking additional precautionary measures to safeguard client assets across all the networks.

— Kiln 🧱🔥

Ethereum educator Sassal articulated that Kiln’s decision to exit all ETH validators was voluntary, citing security concerns specific to Kiln’s setup.

Reportedly, the move had nothing to do with the Ethereum network itself.

Getting ahead of the fud before it festers…The validator exit queue is going to jump up a lot in the coming days (it just jumped up by ~700,000 ETH) because @Kiln_finance has decided to voluntarily exit all of their ETH validators due to security concerns (that are specific…

— sassal.eth/acc 🦇🔊

Though Figment itself was not impacted, the coordinated exit sent 1.6 million ETH tokens into the queue in a single move.

Security, Profit-Taking, and Institutional Shifts

While security is the immediate catalyst, analysts argue that profit-taking is also in play. The Ethereum price has rallied more than 160% since April, tempting institutional treasuries and funds to rebalance.

At the same time, new drivers of staking demand are emerging. The SEC’s May statement that protocol staking is not a security boosted ETH delegations.

“It is the Division’s view that “Protocol Staking Activities” in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”),” the statement read.

Meanwhile, anticipation of staked ETH ETFs could add another 4.7 million Ethereum tokens to validator queues once approved.

The process is complex. Validators in the exit queue continue to earn rewards, but once they formally exit, they face a 27-hour “withdrawability delay” followed by a withdrawal sweep that can take up to 10 days.

If large portions of the existing ETH return to staking, where Figment estimates as much as 75%, nearly 2 million ETH would flood the activation queue.

Combined with future ETF demand, activation wait times could stretch past 120 days.

That delay raises questions about Ethereum’s readiness to host global-scale financial infrastructure.

“Unclear how a network that takes 45 days to return assets can serve as a suitable candidate to power the next era of global capital markets. On Solana, it takes approximately 2 days to unstake,” Marcantonio of Galaxy stated.

For Ethereum, long queues are not necessarily a flaw. They are intentional throttles designed to preserve consensus security during heavy entry or exit periods.

“Ethereum is functioning as intended,” Thalman noted.

Still, the bottlenecks highlight trade-offs between resilience and user experience.

For institutional players weighing billions in exposure, weeks-long delays and potential reward gaps during reactivation may complicate portfolio strategies.

The next few months will test whether Ethereum’s validator system can balance security with capital efficiency. This is especially true as corporate treasuries, Ethereum ETFs, and infrastructure providers crowd into the same queues.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] GAIB (GAIB) will be listed in Bitget Innovation and AI Zone

New spot margin trading pair — ALLO/USDT, MET/USDT!

[Initial Listing] Bitget Will List Datagram (DGRAM) in the Innovation and DePIN Zone

Bitget Spot Margin Announcement on Suspension of L3/USDT, ULTI/USDT Margin Trading Services