3 Reasons Crypto Traders Face Major Liquidation Risk This September

The latest derivatives data for Bitcoin and the broader altcoin market indicate that traders face a major liquidation risk in September 2025.

How should traders prepare for this threat? This article examines the latest data and insights from experienced market participants.

September Derivatives Market Overheats With More Than $220 Billion in Open Interest

The first reason lies in the record-high Open Interest in September. This figure represents the total value of open positions in the market and signals potential liquidation risk at any moment.

According to data from CoinGlass, total crypto futures Open Interest surpassed $220 billion, setting a new monthly high. Short-term traders are aggressively increasing leverage, with open positions rising sharply on expectations of upcoming economic events.

The second reason confirms that derivatives trading now dominates spot trading.

CoinGlass data shows the trading volume ratio of Bitcoin Perpetual Futures to Spot remains elevated, with futures volumes eight to ten times higher than spot.

These metrics signal the possibility of record liquidations, especially as key interest rate decisions approach.

The third reason stems from unexpected volatility, even though most traders believe they already know how the Federal Reserve will decide.

While debates continue over whether the market will trend after the FOMC meeting, analyst Crypto Bully noted on X that the FOMC outcome does not guarantee price direction. Instead, it mainly brings volatility. This volatility can trigger losses for long and short positions, leading to mass liquidations.

FOMC does not bring guaranteed upside or downside

— Crypto Bully 🔥 (@BullyDCrypto) September 16, 2025

It brings volatility. And that’s where opportunity lies for traders

Notes on chart + How to use:

– Delta

– Price Action

– Open Interest

Here’s how you trade FOMC and News events profitably pic.twitter.com/Klg8Q8kGeY

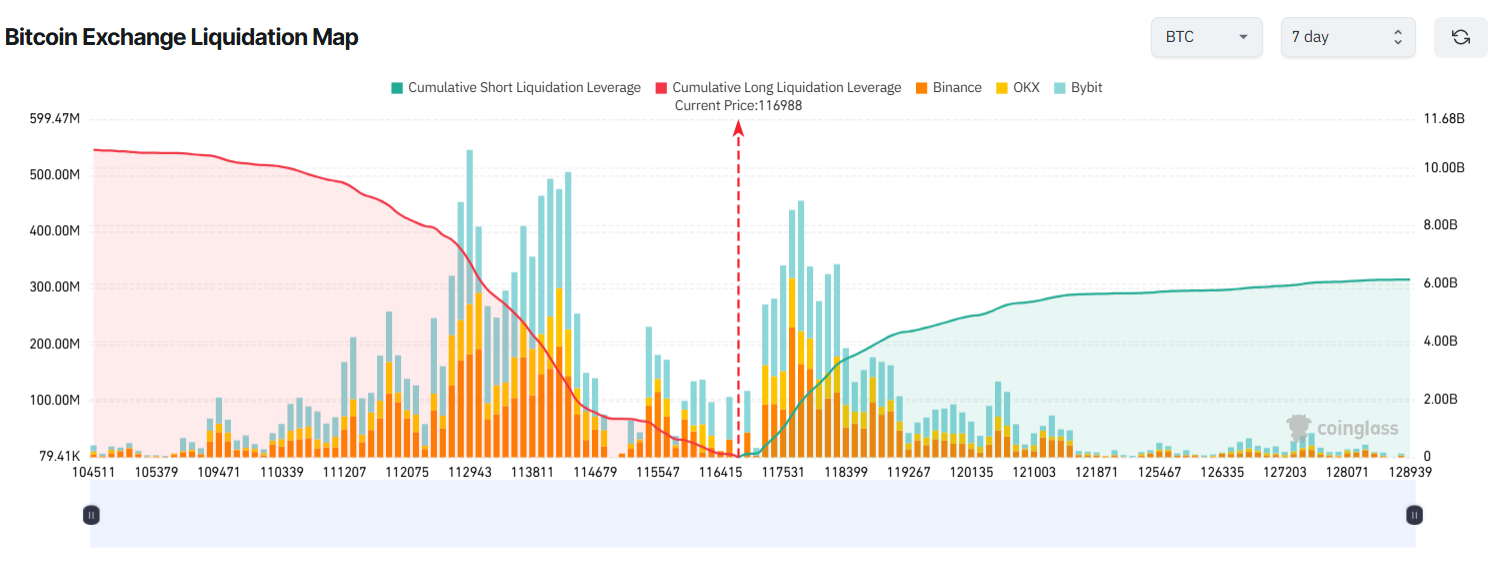

CoinGlass further reports that clusters of liquidation-heavy positions lie above and below Bitcoin’s current price level.

“High leverage liquidity. Both long and short high leveraged positions will be liquidated,” CoinGlass predicted.

Bitcoin’s massive derivatives exposure could trigger record liquidations across the market. The liquidation map shows that if BTC falls to $104,500 this month, the cumulative liquidation volume for long positions could exceed $10 billion.

Conversely, if BTC rises and sets a new high above $124,000, short positions could face more than $5.5 billion in losses.

BeInCrypto also highlighted several altcoins that face significant liquidation risk this week.

What can traders do to minimize losses? Analyst Luckshury explained that trading derivatives means competing directly against exchanges. Traders must therefore identify price zones likely to trigger mass liquidations and limit their position sizes accordingly.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services