Solana reaches $4 billion in corporate treasury reserves

Bitcoin and Ethereum are no longer the only ones capturing the attention of large institutional investors. Solana is now positioning itself as a new leading player among this elite. According to the latest data published by the Strategic Solana Reserve, corporate treasuries now hold more than 17 million SOL tokens, a value exceeding 4 billion dollars.

In brief

- Strategic Solana reserves reach $4.03 billion with 17.11 million SOL tokens held by companies.

- Forward Industries leads the race with 6.8 million SOL valued at $1.61 billion.

- These reserves represent nearly 3% of Solana’s circulating supply, i.e., more than 600 million tokens.

Corporate treasuries betting on Solana

The latest figures published Tuesday by Strategic Solana Reserve, the reserve tracking tool, confirm a strong trend: corporate treasuries linked to Solana now hold 17.11 million SOL tokens , worth more than 4 billion dollars at the current rate.

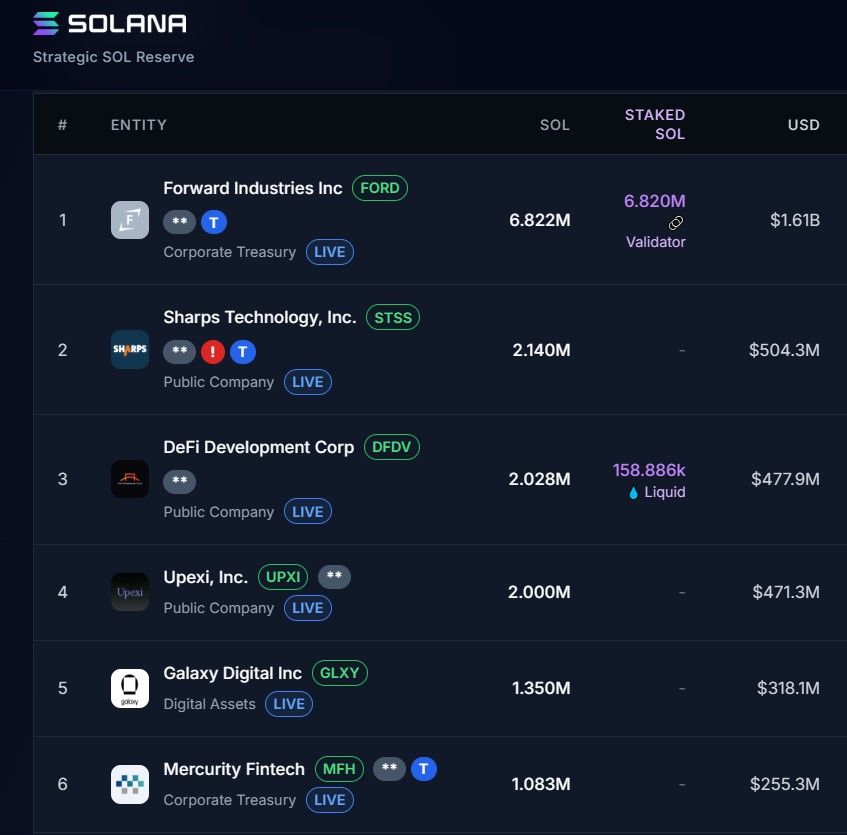

This represents nearly 3% of the circulating supply , valued at over 600 million tokens. Forward Industries alone accounts for the largest share, with 6.8 million SOL, valued at $1.61 billion.

Behind this giant, other actors are also standing out: Sharps Technology, DeFi Development Corp., and Upexi, each having accumulated about 2 million SOL, amounting to more than 400 million dollars.

This institutional frenzy is not new. As early as September, Forward Industries announced the creation of its strategic reserve, supported by heavyweights such as Galaxy Digital, Multicoin Capital, and Jump Crypto. Shortly after, Galaxy acquired $306 million worth of SOL in a single day.

The momentum continued with the arrival of Helius Medical Technologies, which established a reserve of $500 million. These initiatives illustrate a clear point: corporate treasuries now consider Solana a credible strategic reserve, akin to Bitcoin or Ethereum.

Main institutional reserves in Solana. Source: Strategic Solana Reserve

Main institutional reserves in Solana. Source: Strategic Solana Reserve

Sol, between market lag and strategic opportunity

Solana still shows a significant lag compared to its elders. Bitcoin dominates with 3.71 million BTC in treasury, representing $428 billion, which is 17% of its total supply.

Ethereum is not far behind: companies hold nearly 5 million ETH valued at more than $22 billion, a figure rising to $30 billion including ETFs.

Yet, these gaps tell only part of the story. Technically, Solana clearly outpaces Ethereum with 2,600 transactions per second compared to about fifteen for its competitor. Almost zero fees and a staking yield of 6.8% (versus 3% for Ethereum) increase its attractiveness.

This superiority is already attracting institutional giants. PayPal selected Solana to build the infrastructure for its stablecoin, a resounding validation of the network’s strength.

In the same spirit, the agreement with the fintech R3 paves the way for strategic partnerships with leading players like HSBC, Bank of America, and the Monetary Authority of Singapore.

The institutional bet on Solana therefore does not rest solely on its technical performance. It expresses a deeper conviction: the idea that performance and innovation will ultimately prevail over precedence.

With already $4 billion accumulated in corporate treasuries, Solana crosses a major psychological threshold and confirms its status as a next-generation blockchain, now taken seriously by the biggest players.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services

Bitget Spot Margin Announcement on Suspension of MAVIA/USDT, BADGER/USDT, BAN/USDT, PONKE/USDT, FLOCK/USDT Margin Trading Services