Date: Wed, Sept 17, 2025 | 05:58 AM GMT

The cryptocurrency market is trading cautiously ahead of the key US Federal Reserve meeting today, with Bitcoin (BTC) and Ethereum (ETH) both moving flat. Meanwhile, several altcoins are feeling the pressure — including Ethena (ENA).

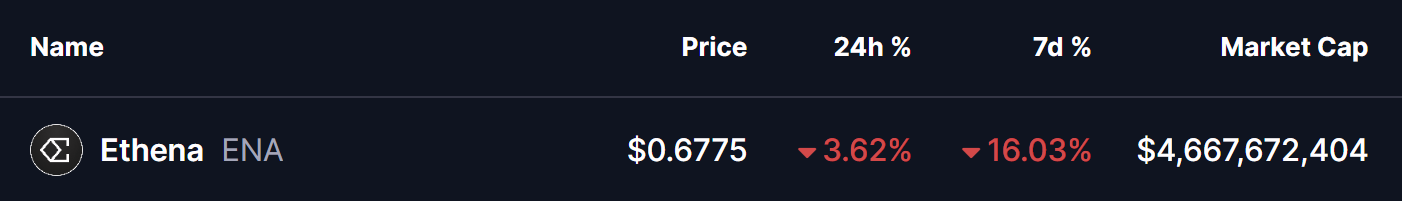

ENA is trading in red, extending its weekly losses to over 16%. More importantly, this pullback has placed the token at a critical support zone that could either trigger a rebound or open the door for deeper declines.

Source: Coinmarketcap

Source: Coinmarketcap

Ascending Triangle Pattern in Play?

On the daily chart, ENA appears to be forming a classic ascending triangle — a bullish continuation pattern that typically signals the potential for an upside breakout.

After multiple rejections from the upper resistance line at $0.87, ENA has now pulled back to around $0.67, testing the ascending support trendline. This level is crucial, as a successful bounce from here would reinforce the bullish structure and could set the stage for another breakout attempt.

Ethena (ENA) Daily Chart/Coinsprobe (Source: Tradingview)

Ethena (ENA) Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for ENA?

If ENA holds its support trendline near $0.67, buyers could step in and drive the token higher toward the upper resistance around $0.85. A breakout above this resistance could then trigger a stronger rally, keeping the bullish continuation pattern intact.

On the other hand, a decisive drop below this support line would weaken the setup and could lead to a bearish double-top formation. In that scenario, ENA might fall back to the next key support levels at $0.62 and $0.5169, near its 100-day moving average.