MetaMask launches stablecoin mUSD: How will it transform into a DeFi super app?

Author: angelilu, Foresight News

Original Title: More Than Just a Wallet, MetaMask Also Launches a Stablecoin

When you ask friends who have entered the crypto space what their first on-chain application was, without a doubt, it must be the MetaMask wallet. A plugin wallet with a cute little fox head image, backed by the technically powerful Ethereum ecosystem company Consensys.

In 2016, under the leadership of MetaMask founder Aaron Davis, this little fox that took the blockchain world by storm was born. Now, nine years later, although the community has long been full of anticipation for MetaMask to issue a native token, MetaMask took an unexpected move by betting first on the stablecoin track.

Against the backdrop of the U.S. "GENIUS Act" bringing unprecedented clarity to stablecoin regulation, MetaMask seized the opportunity and announced yesterday (September 15) the official launch of its native stablecoin, MetaMask USD (abbreviated as mUSD).

mUSD's Technical Architecture and Partners

MetaMask first revealed its plan to launch a stablecoin in a governance proposal in early August, and less than a month and a half later, on September 15, the MetaMask stablecoin mUSD was officially launched. This rapid release could not have happened without mUSD's partners.

mUSD adopts a tripartite cooperation model for issuance: Bridge, a company under Stripe, acts as the issuer; the on-chain part is technically supported by M0; and MetaMask is responsible for deeply integrating the stablecoin into its wallet ecosystem.

In its issuance architecture, M0 plays a crucial role. Relying on M0 technology, it separates stablecoin reserve management from programmability, allowing regulated entities to connect to the platform to hold and manage reserves, while developers use the platform to control how their stablecoins operate: defining who can mint, hold, and transfer, while customizing new revenue streams and loyalty opportunities.

M0 is responsible for the on-chain programmability part in this mUSD issuance. At the end of August this year, M0 announced the completion of a $40 million financing round, bringing the total financing to $100 million. In addition to supporting MetaMask in issuing the stablecoin mUSD, it also participated in the issuance of the RWA blockchain Noble's stablecoin USDN and the stablecoin protocol Usual's USD0. Moreover, the neobank platform KAST and the gaming platform operating system Playtron are also using M0 to build their own stablecoins.

So who is the regulated entity actually responsible for issuing mUSD? Without a doubt, it is Bridge, which provides compliant licensing, monitoring, and strict reserve management for mUSD. Bridge was acquired by payment giant Stripe for $1.1 billion in October last year and can provide comprehensive support and solutions for enterprises to issue customized stablecoins.

In this mUSD issuance, Bridge co-founder and CEO Zach Abrams stated, "It used to take more than a year and complex integrations to issue a custom stablecoin. With our issuance technology, we've shortened this to just a few weeks."

mUSD Positioning and On-Chain Ecosystem Layout

mUSD is positioned as a "wallet-native, self-custodial, highly practical" stablecoin. Its biggest difference from traditional stablecoins lies in its seamless integration experience with the wallet. mUSD will play a role in two core scenarios:

-

On-chain applications: providing seamless deposit, exchange, transfer, and cross-chain capabilities;

-

Real world: expected to support usage at millions of Mastercard-accepting merchants worldwide via the MetaMask card by the end of 2025.

MetaMask Product Lead Gal Eldar stated, "mUSD is a key step in bringing the world on-chain. It will help us break through some of the most stubborn barriers in web3, reducing entry friction and costs for users. We're not just bringing people on-chain, we're building reasons they'll never want to leave."

mUSD will initially be deployed on Ethereum and Linea, with Linea being an EVM-compatible Layer 2 network developed by Consensys. On Linea, mUSD will play an infrastructure role, integrated into various core DeFi protocols, including lending markets, decentralized exchanges, and custody platforms, providing users with deep liquidity. The official statement also said that the introduction of mUSD will help drive continuous growth in Linea's TVL and protocol activity.

Stablecoins have always been the backbone of DeFi, but they have always existed outside of wallets. This stablecoin initiative demonstrates Consensys' ambition—not only to build a wallet but also to create a complete on-chain financial ecosystem.

Moreover, although mUSD currently does not disclose any yield features, MetaMask has previously launched savings and yield features for stablecoin Earn, so mUSD's yield potential is worth imagining.

Cross-chain ecosystem is also an important development direction for mUSD. Wormhole has confirmed it will serve as an interoperability partner, and will support mUSD's multi-chain expansion in the future, further enhancing its liquidity and application scenarios across different blockchain ecosystems.

mUSD Reserve Mechanism and Data

For stablecoins, reserve composition is crucial. Although MetaMask has not yet explicitly stated mUSD's reserves, M0, as the technical support provider, implements an on-chain proof-of-reserves mechanism, allowing users to verify in real time the correspondence between mUSD's issuance and reserve assets.

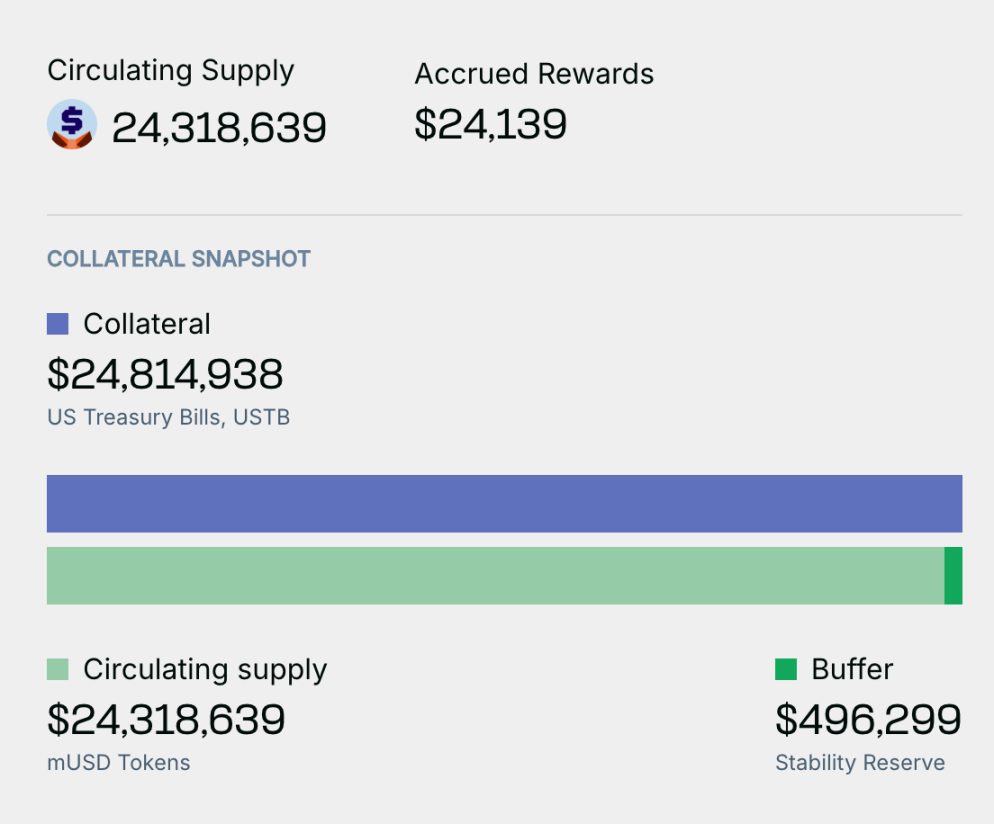

On the page disclosed by M0, it shows that mUSD adopts an over-collateralization model, with collateral value ($24,814,938) exceeding the circulating supply ($24,318,639), an over-collateralization rate of about 102%, and the system has set nearly $500,000 in stability reserves as an additional buffer to withstand market volatility. mUSD's collateral is entirely composed of highly liquid, low-risk assets such as U.S. Treasury bonds.

Currently, the official MetaMask website already provides a purchase and exchange interface for mUSD. Less than 24 hours after mUSD went live, according to Etherscan data, as of the time of writing, mUSD's current circulating supply is 24.36 million, with 179 holders and 1,539 transactions.

Consensys has not yet disclosed the specific business model and revenue sources for mUSD. According to industry practice, stablecoin issuers usually profit from interest income generated by reserve assets, transaction fee sharing, or ecosystem value capture.

Towards a DeFi Super App

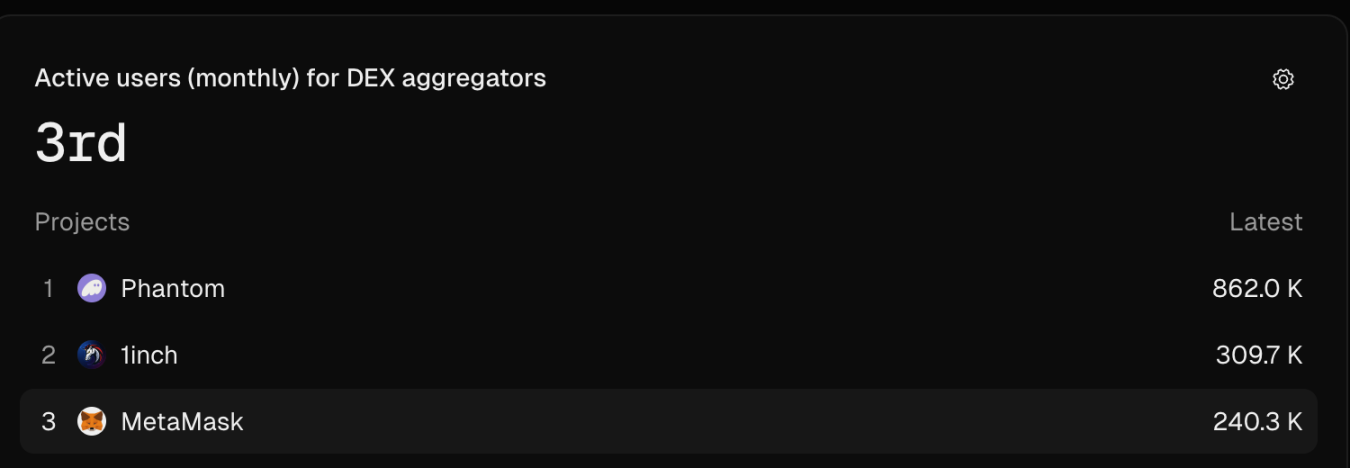

MetaMask was once the undisputed leader in the wallet track, setting a brilliant record of 30 million monthly active users during the 2021 bull market and the peak in January 2024. However, according to Token Terminal data, its monthly active users in recent months have hovered around 250,000, with its market share dropping to 14.8%, falling to third place among similar products.

Meanwhile, looking at DeFi applications during the same period, Uniswap and Aave are evolving from single-function tools to comprehensive platforms: Uniswap is developing into a trading super app with its own wallet, cross-chain standards, and routing logic; Aave has issued its own stablecoin and integrated lending, governance, and credit functions. The market clearly shows that single-function products are giving way to ecosystem super apps.

In this context, as one of the most iconic wallets in the Ethereum ecosystem, the strategic significance of MetaMask launching mUSD goes far beyond a product update. It is not only a systematic exploration in token economics but also a key part of Consensys' construction of a comprehensive DeFi service matrix.

The "little fox" is also transforming from a simple wallet tool to a comprehensive financial services platform. In today's increasingly mature Web3 experience, MetaMask is no longer content to be just a simple entry point, but aspires to accompany Web3 users throughout the entire on-chain cycle as a "super app."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

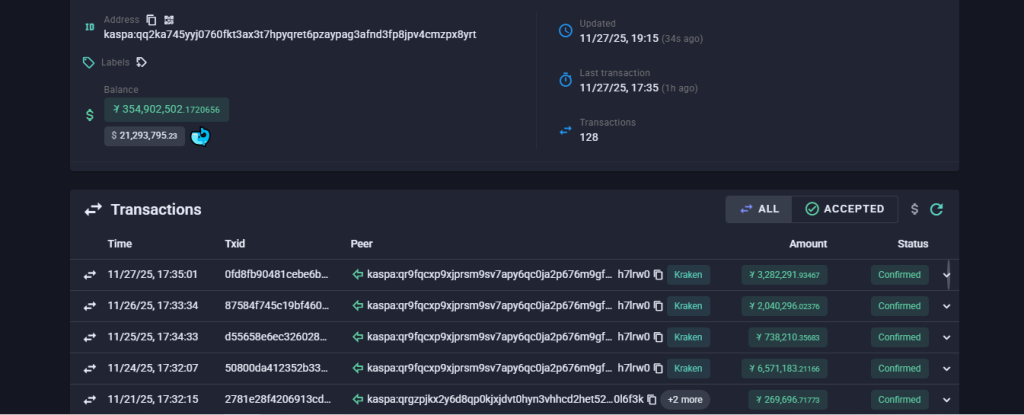

KAS Price Jumps 66%: Can Momentum Push Kaspa Toward December’s Bigger Targets?

VIRTUAL Price Jumps 17% as Falling Wedge Breakout Signals December Upside

Pi Network News: Can the CiDi Games Partnership Push Pi Beyond $1?

Charles Hoskinson Reveals When Altcoins Like ADA, XRP and ETH Will Hit New All-Time Highs