RealT Revolutionizes Real Estate Investment with Blockchain

The tokenized real estate takes on a new dimension with RealT, an innovative platform that disrupts traditional rental investment codes. By fractionating American real estate properties into digital tokens on blockchain, this company based in Florida and Delaware opens the doors of international real estate to all investors, regardless of their financial capacity.

In brief

- RealT makes real estate accessible from $50.

- Attractive yields from 7 to 20% with weekly incomes.

- Liquidity and transparency thanks to blockchain tokenization.

What is RealT: real estate tokenization explained

RealT merges the terms “real” (real estate) and “token” (digital token) to create a revolutionary investment ecosystem. The platform offers simplified real estate investments with the mission to democratize access to real estate investment opportunities, selected by a team of professionals.

The principle is based on blockchain tokenization: each property is owned by a specific limited liability company (LLC), whose shares are issued as digital tokens called RealTokens. These tokens, deployed on Ethereum (ETH) and Gnosis Chain, represent a fraction of real estate ownership with all associated rights.

Tokenizing real estate via blockchain offers not only increased transparency but also liquidity in transactions, allowing investors to buy, sell, and trade their shares with unprecedented ease.

RealT’s economic model

The disruption operated by RealT revolves around several major axes . First, extreme fractionalization: where traditional real estate requires significant capital, one RealT token costs about 50 dollars, the industry’s lowest minimum investment amounts compared to traditional competitors requiring 5,000 to 10,000 dollars.

Second, execution speed radically transforms the user experience. RealT has reduced property acquisition time from a minimum of 30 days with many intermediaries to just 30 minutes via smartphone or computer. This process optimization represents a considerable time gain for modern investors.

Improved liquidity is the third pillar of this revolution. By turning real estate into digital tokens, properties become accessible to a much larger number of potential buyers, thanks both to fractionalization and the reach of internet markets. This democratization mechanically increases liquidity, a historic challenge in the real estate sector.

Technical operation and legal structure

RealT’s technical architecture relies on smart contracts deployed on blockchain, ensuring transparency and process automation. Pioneering since 2019, RealT already offered its first house fractionated into digitized shares on Ethereum before migrating to the much less costly Gnosis Chain blockchain.

The legal structure is organized around companies dedicated to each property. RealTokens represent digital ownership shares in the LLC (or INC for certain tokenized properties between 2021 and 2024) that holds the title deed. Each property on RealT has its own set of unique RealTokens. This approach ensures clear asset segregation and optimal legal protection for investors.

The simplified investment process includes five steps: registration on realt.co, identity verification, selection and purchase of property, signing the electronic purchase contract, then receiving tokens within 24 hours maximum after signing the contract depending on document processing speed.

Geographical accessibility and restrictions

RealT is available to all European, Asian, and African residents with a minimum investment of 50 dollars. However, certain geographical restrictions apply for regulatory compliance reasons.

Yields and performance: financial analysis

RealT’s financial performance proves particularly attractive in the current economic context. The rental properties offered provide annual yields generally between 7% and 20%, with incomes transferred every week to investors’ wallets.

This weekly distribution of rental incomes is a major competitive advantage, enabling regular and predictable cash flow. Investors enjoy an average yield of 10% by easily accessing international real estate , a remarkable performance in the current low-rate environment.

RealT’s pricing structure remains transparent: the platform charges 10% fees when listing on the “Our Projects” page, then 2% on rental income. All displayed yields are net of these fees. An innovative mechanism: when RealT waives the 10% listing fee, governance tokens (REG) are issued to compensate investors.

Liquidity and secondary market

The RealT ecosystem offers two distinct acquisition modes. On the official realt.co website, only whole tokens are available for purchase. On the secondary market (DEX or OTC market), investors can acquire fractions of tokens, offering even finer investment granularity.

Significant liquidity allows selling tokens on the secondary market, providing flexibility rarely available in traditional real estate. This feature fundamentally transforms the historically illiquid nature of real estate investment.

Comparison with traditional real estate and SCPI

RealT positions itself favorably against traditional investment vehicles. Compared to SCPIs (real estate investment companies), RealT offers superior liquidity, lower entry fees, and blockchain transparency. Yields of 7-20% far exceed average performances of French SCPIs (4-5%).

Compared to direct rental investment, RealT eliminates management constraints, geographic selection, and high entry tickets. American geographic diversification offers exposure to a dynamic real estate market without administrative complexities of international acquisition.

While traditional platforms maintain a minimum entry ticket of 1000 to 2000€ minimum, RealT democratizes access by slicing properties into smaller shares, revolutionizing investment accessibility.

The future of RealT and tokenized real estate

The RealT ecosystem continues to evolve with constant innovations . The platform surpassed the symbolic threshold of 100 tokenized properties, accompanying this milestone with a collector NFT offered to investors, demonstrating its capacity for innovation and growth.

The “Abstract Account/Walletless” solution developed by RealT further simplifies the user experience, removing technical barriers related to crypto wallet management for newcomers. This user-friendly approach accelerates mainstream adoption of real estate tokenization.

Future geographic expansion, notably the upcoming opening to American investors, will multiply the user base and token liquidity. Development of new real estate markets (Colombia, Panama, UAE) will diversify the offer and reduce geographic risks.

What it changes for the modern investor

RealT fundamentally redefines the approach to real estate investment. For individual investors, this means democratized access to a sector historically reserved for significant capital. Facilitated diversification allows spreading 1000€ across 20 different properties rather than concentrating on a single asset.

Passive management removes traditional constraints: no tenant search, no claims management, no repairs. Automated weekly incomes transform real estate into a pure yield investment.

For crypto-native investors, RealT offers a gateway to the real economy, combining blockchain advantages (transparency, liquidity, fractionalization) with the stability of physical real estate assets.

RealT FAQ

The minimum amount is 50 dollars per token, approximately 45€ depending on the exchange rate.

Incomes are distributed automatically every week to your crypto wallet, in USDC or xDAI.

Yes, via RealT’s OTC secondary market or DEXs, offering liquidity superior to traditional real estate.

10% listing fee (compensated by REG tokens) and 2% on net rental income.

Yes, France is among the eligible countries to invest on the RealT platform .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[100% Win Rate Whale] Adds Another 140 BTC, Becomes [Heavy Holder Whale]!

![[100% Win Rate Whale] Adds Another 140 BTC, Becomes [Heavy Holder Whale]!](https://img.bgstatic.com/multiLang/image/social/4a63a919063f3087e47ea7968a76880e1762143848305.png)

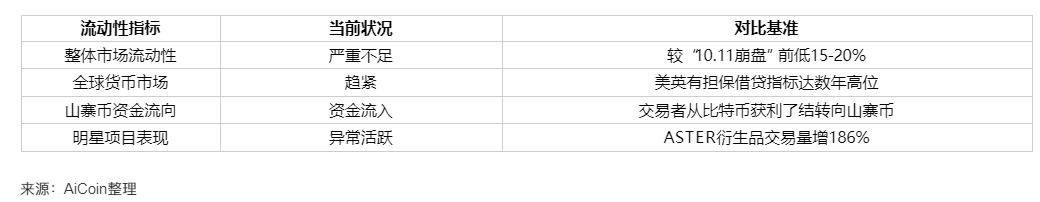

AiCoin Daily Report (November 3)

CZ openly builds a $2 million position and calls for ASTER, reigniting the battle in the decentralized derivatives arena

CZ has publicly disclosed his personal investment activities for the first time, purchasing 2.09 million Aster (ASTER) tokens, which drove the price up by 30%. As a decentralized perpetual contract exchange, Aster has quickly risen thanks to its technological advantages and CZ’s support, leading to fierce competition with Hyperliquid. Summary generated by Mars AI. This summary is produced by the Mars AI model; the accuracy and completeness of its generated content are still being iteratively improved.