Recently, OpenAI and Anthropic have successively released core user reports on ChatGPT and Claude. These documents are not merely performance showcases, but reveal a crucial trend in the current artificial intelligence industry: the two leading models are evolving along distinctly different paths, with significant divergence in market positioning, core application scenarios, and user interaction patterns.

To this end, Silicon Rabbit, in conjunction with its Silicon Valley expert team, conducted a comparative analysis of the two reports, distilled the hidden industry signals behind them, and explored their profound implications for future technology routes, business models, and related investment strategies.

The data from both reports clearly demonstrate the different emphases of ChatGPT and Claude in terms of user base and core functions, which is the starting point for understanding their long-term strategic divergence.

ChatGPT: Market Penetration in General-Purpose Application Fields

OpenAI’s report confirms ChatGPT’s status as a phenomenal application. As of July 2025, its weekly active users have exceeded 700 millions. The user structure presents two key characteristics:

First, the user group has successfully expanded to a broader population. The early user profile, mainly composed of technical personnel, has shifted to a highly educated, cross-professional white-collar group;

Second, the gender ratio is becoming more balanced, with female users rising to 52%.

In terms of application scenarios, ChatGPT’s core functions are concentrated in three areas: practical guidance, information inquiry, and document writing, which together account for nearly 80% of total conversations.

Users mainly use it to assist with daily life and routine office tasks. Notably, the report clearly points out that the proportion of usage for professional technical assistance such as programming has dropped significantly from 12% to 5%.

Overall, ChatGPT’s strategic path is to become a general-purpose AI assistant serving a broad user base. Its core barriers lie in its massive user base and the resulting network effects, as well as its high penetration rate in users’ daily information processing workflows.

Claude: Focusing on Enterprise-Level and Professional Automation Scenarios

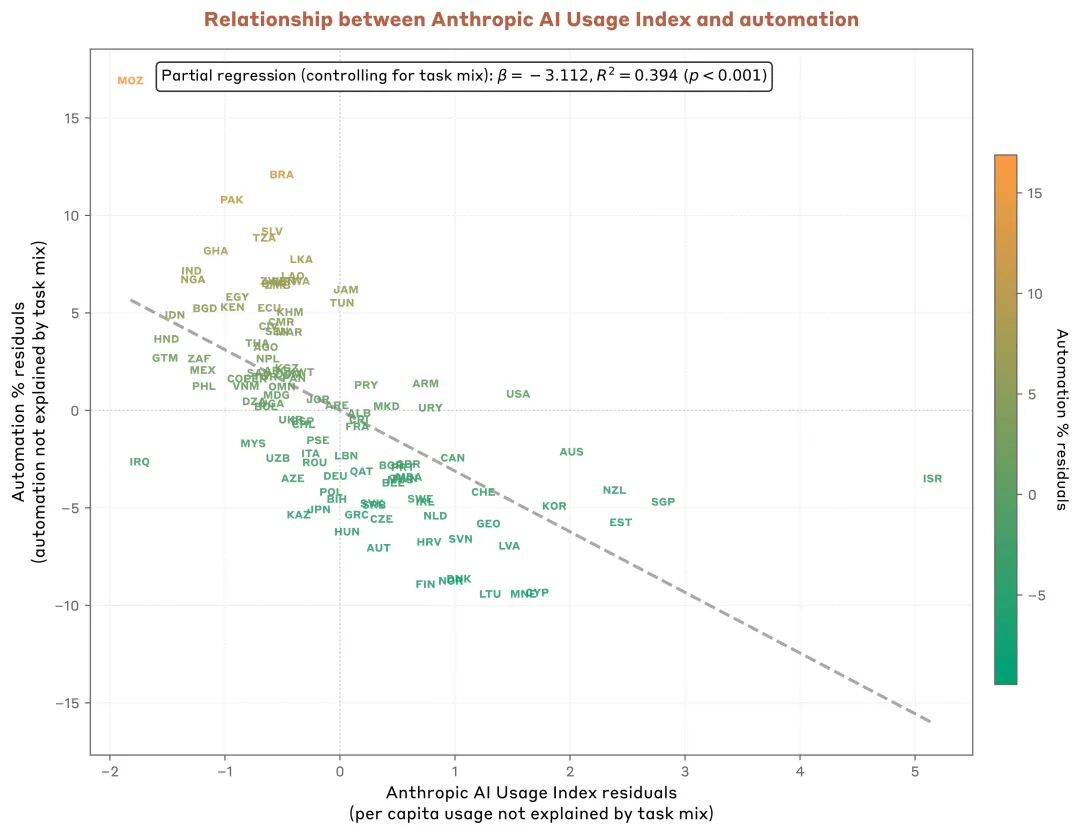

Anthropic’s report paints a completely different picture. Claude’s user distribution shows a strong positive correlation with the region’s economic development level (per capita GDP), indicating that its main user group consists of knowledge workers and professionals in developed economies.

Its core application scenarios are highly focused. The report data shows that software engineering is the primary application field in almost all regions, with related tasks accounting for a stable 36% to 40%, forming a stark contrast with ChatGPT’s application trend in this field.

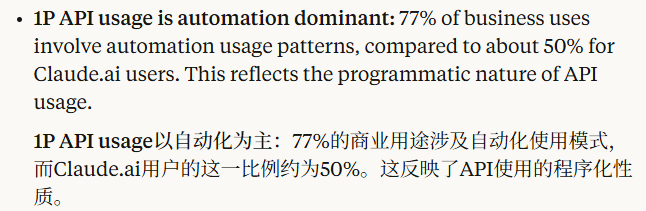

The most striking data in the report is reflected in the proportion of “automation” tasks. In the past eight months, the share of “instruction-based” automation tasks—where users directly issue commands and AI independently completes most of the work—has risen sharply from 27% to 39%.

Among enterprise-level users of the paid API, this trend is even more pronounced: as much as 77% of conversational interactions exhibit an automation pattern, and the vast majority are “instruction-based” automation with minimal human intervention.

Therefore, Claude’s strategic positioning is very clear: to become a professional-grade productivity and automation tool deeply integrated into the core workflows of enterprises. Its competitive advantage lies in deep optimization for specific professional fields (especially software development) and the ultimate pursuit of task execution efficiency.

Based on the above strategic divergence, Silicon Rabbit and its Silicon Valley expert team cross-compared the data from the two reports and distilled three forward-looking industry insights for investors.

1. “Programming Applications” Diverge, Heralding the Rise of the Specialized AI Tools Market

The ebb and flow of ChatGPT and Claude in programming applications does not reflect market demand fluctuations, but rather the upgrade of user needs toward “specialization” and “integration.”

General-purpose conversational interfaces can no longer meet the deep needs of professional developers in complex workflows. What they need are AI functions that can seamlessly connect with integrated development environments (IDEs), code version control systems, and project management software.

This trend signals the emergence of an important market opportunity: “AI-native toolchains” designed for specific industries (such as software development, financial analysis, legal services) and deeply bound to existing workflows.

This requires AI not only to possess model capabilities, but also to have a profound understanding of the industry. For related investments, assessing whether the target has the ability to build such “deep integration” will become a key consideration.

2. “77% Automation Rate” Quantifies the Acceleration of Enterprise Task Automation

The “77% enterprise API automation rate” in the Anthropic report is a very strong signal, indicating that at the forefront of commercial applications, AI’s role is rapidly shifting from “human assistance” to “task execution.”

This data requires us to reassess the speed at which AI impacts enterprise productivity, organizational structure, and cost models. In the past, the market generally focused on AI’s “efficiency enhancement” value, but now the “substitution” value must be incorporated into the core analytical framework.

Investment logic needs to expand from evaluating “how AI assists human employees” to “in which knowledge-based work fields can AI independently complete standardized tasks with higher efficiency and lower cost.”

Areas such as financial statement generation, contract preliminary review, and market data analysis—process-driven and high labor cost fields—will be the first to see significant economic benefits from AI automation technology.

3. Differences in “Collaboration and Automation” Models Reveal the Evolution Path of AI Business Models

An unintuitive data point in the report is: in regions with higher per capita Claude usage, users are more inclined toward the “collaboration” model; conversely, regions with lower usage rates are more inclined toward the “automation” model.

This may reveal the evolutionary relationship between AI business models and user maturity. In the early stage of market penetration, users tend to use AI as a simple efficiency tool to perform independent tasks in a substitutive manner (automation).

However, when users (especially professional users) have a deeper understanding of AI’s capability boundaries and interaction methods, they begin to explore how to collaborate with AI to accomplish more creative tasks that were previously difficult to achieve (collaboration).

This raises new considerations for AI’s long-term business model. In addition to reducing costs through automation substitution (SaaS model), creating new value and improving decision quality through human-machine collaboration may give rise to more advanced business models, such as performance-based payment or decision support subscriptions. When evaluating AI projects, investors should consider their development potential on both the “automation” and “collaborative creation” paths.

The above analysis based on public reports is only the starting point of the decision-making process. A complete decision also needs to answer deeper key questions about “how to achieve” and “who will achieve it,” such as:

In the field of “AI-native toolchains,” what are the technical architecture, team composition, and market validation status of the most promising startups?

Within leading technology companies, what are the real technical paths, deployment costs, and specific data on return on investment (ROI) for achieving a high proportion of task automation?

For companies like Apple, what is the underlying technical logic and commercialization path of their AI strategy, especially for their proprietary large models within a closed-loop ecosystem?

This information cannot be obtained from public reports; it comes from frontline industry practice. To truly understand the current dynamics of the AI industry, direct dialogue with the core figures defining these technologies and products is required.

For example, to conduct in-depth research on the industry frontlines, our financial clients have recently had in-depth exchanges with the following two experts:

A ML/DL/NLP scientist and technical lead from Apple’s machine learning department. As a core member who trained Apple’s proprietary large language model (LLM) from scratch, he can directly reveal the technical challenges faced by tech giants in building core AI capabilities, the real training costs, and the strategic considerations reported directly to top management.

A technical lead (Engineer Lead) from Meta’s generative AI organization. As a founding engineer, he not only deeply participated in LLM development, but more importantly, led the integration of GenAI technology with core business engines such as ad ranking and recommendation systems. Conversations with him can clearly outline the transformation path from model capability to business ROI, as well as his investment observations on cutting-edge AI startups in North America.

Insights from such experts can turn the macro trends in public reports into granular tactical information that can guide specific decisions. In an industry environment where information iterates rapidly, gaining deep insights beyond public information is fundamental to building cognitive advantages and making precise decisions. If you wish to further discuss the above topics, we welcome you to contact us to arrange expert exchanges in the relevant fields.

When your team is embroiled in debates over technical routes, when your investment decisions are pending, when your product strategy is shrouded in uncertainty... remember, the confusion you face may be a journey that some expert has already traversed. At Silicon Rabbit, we believe: authentic first-hand experience always comes from those who are driving industry transformation themselves.