Dogecoin breakout is a confirmed bullish reversal after DOGE cleared a year-long descending trendline, trading at $0.285 and pushing toward the $0.30 resistance. Key catalysts include the launch of a Dogecoin ETF, anticipated rate cuts, and large purchases by Dogecoin DATs, signaling renewed demand and momentum.

-

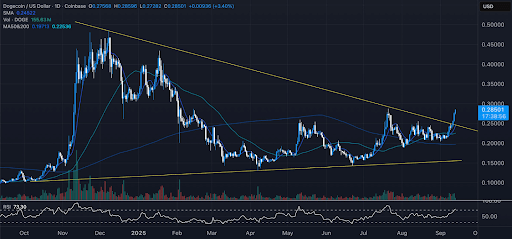

Dogecoin cleared a one-year descending trendline, indicating a trend reversal.

-

Daily gains near 3.4% with RSI at 73.30 and moving averages converging, reinforcing bullish momentum.

-

Catalysts include the Dogecoin ETF launch, expected rate cuts, and DATs buying ~5% of supply, driving investor interest.

Dogecoin breakout: DOGE trades at $0.285 as momentum builds toward $0.30 resistance—follow updates and analysis from COINOTAG now.

What is the Dogecoin breakout?

Dogecoin breakout refers to DOGE breaching a year-long descending trendline, marking a shift from prolonged consolidation to bullish momentum. The breakout is confirmed by increased volume, RSI momentum (73.30), and converging moving averages, positioning $0.30 as the next meaningful resistance for short-term targets.

How did DOGE break the trendline and what drove the move?

DOGE broke the descending triangle that capped prices since November 2024, according to analyst Unipcs (shared on X). The move coincided with higher trading volume and sustained buying pressure. Primary drivers include the first Dogecoin ETF launch, macro expectations for rate cuts, and Dogecoin DATs purchasing a reported ~5% of supply. These factors combined to push buyers back into the market and shift structure from bearish to bullish.

Correction and Consolidation Phase

Between November 2024 and February 2025, Dogecoin underwent a prolonged correction, falling nearly 66% from a peak near $0.50 to lows around $0.15. That decline formed a clear descending trendline that limited rallies for almost ten months.

Source: Unipcs

Support coalesced in the $0.15–$0.17 band in March–April, creating a base that prevented further declines. Volume spikes during the bottoming process and the subsequent rally confirmed buyer interest. The RSI moving above 70 (73.30) signals strong short-term momentum following this consolidation.

Breakout and Technical Indicators

By September 2025, DOGE cleared the key barrier near $0.25 and extended toward $0.285 at press time, a 3.40% daily advance. Converging 50-day and 200-day moving averages near current prices support the technical validity of the breakout.

Candlestick patterns in recent sessions show sustained buying pressure. Market structure has shifted from bearish to neutral and now leans bullish. The immediate resistance cluster sits at $0.30; a decisive close above that zone would likely open higher targets in subsequent sessions.

What are the key catalysts supporting this Dogecoin breakout?

- Dogecoin ETF launch: The ETF introduces institutional access and positive sentiment toward DOGE.

- Macro rate-cut expectations: Lower rates typically support risk assets and memecoin flows.

- DATs accumulation: Reported purchases of ~5% of supply by Dogecoin DATs increase scarcity and demand.

Frequently Asked Questions

How high can Dogecoin go after this breakout?

Short-term upside depends on momentum continuation and macro conditions. A successful close above $0.30 would likely target higher resistance zones, but size and speed of the move will depend on volume and catalyst follow-through.

Should traders buy the breakout?

Traders should assess risk management: consider position sizing, stop placement below recent support ($0.25–$0.27), and confirm volume and RSI behavior before adding to positions.

Key Takeaways

- Trend change confirmed: DOGE broke a year-long descending trendline with supporting volume and momentum.

- Catalysts aligned: ETF launch, rate-cut expectations, and DATs accumulation are boosting demand.

- Next steps: Watch $0.30 resistance; use volume and RSI to confirm continuation and manage risk with defined stops.

Conclusion

Dogecoin breakout momentum positions DOGE for further upside after a prolonged consolidation. Technical indicators and multiple catalysts support a bullish thesis, with $0.30 as the near-term key level to watch. For ongoing coverage and trade updates, follow COINOTAG reporting and updates.