The Kalshi lawsuit alleges the platform offered unlicensed sports wagering in Massachusetts by categorizing bets as “event contracts.” Kalshi says it is federally regulated by the CFTC and will defend its business model in Suffolk County Superior Court as a protected prediction market innovation.

-

Kalshi lawsuit alleges unlicensed sports wagering under Massachusetts law

-

Kalshi states it is regulated by the Commodity Futures Trading Commission (CFTC) at the federal level.

-

Massachusetts claimed 75%+ of Kalshi’s volume was sports-related as of May 2025, higher than some established operators.

Kalshi lawsuit: Massachusetts accuses Kalshi of unlicensed sports wagering; read concise legal analysis, regulatory context, and what investors should watch next — learn more.

What is the Kalshi lawsuit?

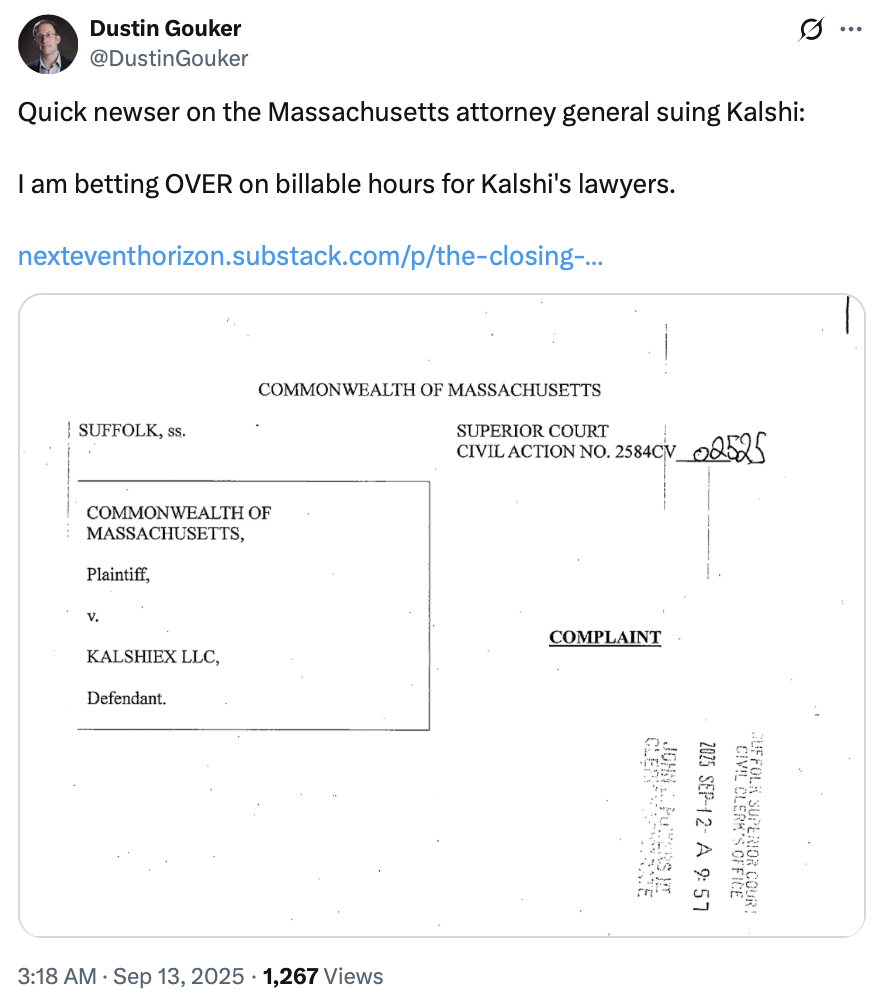

The Kalshi lawsuit is a civil action filed by the Commonwealth of Massachusetts alleging that Kalshi offers unlicensed sports wagering to state residents by listing sports-related event contracts. The suit seeks to enforce Massachusetts gambling statutes against Kalshi while Kalshi maintains it falls under federal CFTC oversight.

How does Massachusetts say Kalshi violated state law?

Massachusetts’ complaint, filed in Suffolk County Superior Court, argues Kalshi masks sports bets as “event contracts” to evade the state’s sports wagering regulations. The filing cites internal volume figures and market composition data, asserting sports-related trading dominates Kalshi’s platform activity.

In comments to Cointelegraph, Kalshi claimed that Massachusetts is “trying to block Kashi’s innovations by relying on outdated laws.”

Prediction market operator Kalshi announced it will defend the platform against the Massachusetts lawsuit, saying the complaint misunderstands the nature of federally regulated event contracts.

“We are proud to be the company that has pioneered this technology and stand ready to defend it once again in a court of law,” a Kalshi spokesperson told Cointelegraph in prior comments. The company adds that prediction markets represent modern financial innovation and should be accessible under appropriate federal oversight.

Why does Kalshi argue the CFTC regulates these markets?

Kalshi argues that its event contracts are within the Commodity Futures Trading Commission’s (CFTC) federal jurisdiction, not subject to state gambling enforcement. The company points to prior CFTC guidance and federal authority over derivatives-style contracts as the basis for its defense.

What precedents and related actions exist?

Kalshi has previously received cease-and-desist orders from multiple states, including Arizona, Montana, Ohio, and Illinois. Regulators and companies in this sector frequently reference federal guidance from the CFTC and state gambling laws when assessing jurisdiction.

Source: Dustin Gouker

The Massachusetts filing stated that as of May 2025, more than three-quarters of Kalshi’s trading volume was related to sports, a proportion the state said exceeded comparable shares at some established operators. Kalshi disputes the legal framing and emphasizes federal regulatory channels.

How does this case relate to other market entrants like Polymarket?

Industry developments include activity by other blockchain-based prediction platforms. Polymarket has announced plans to explore a U.S. return, with public statements referencing CFTC engagement. Business Insider reported on funding interest and market valuation conversations in the sector, while Polymarket’s leadership has referenced CFTC approvals in social posts.

Frequently Asked Questions

Question 1: How will the court decide jurisdiction?

The court will evaluate statutory definitions, comparable federal authority, and precedents distinguishing derivatives from state-regulated gambling. Expect focused legal briefs on the nature of event contracts and federal preemption arguments.

Question 2: What does this mean for users in Massachusetts?

Practically, users should monitor court rulings; state enforcement could affect access or platform features for Massachusetts residents. Companies may restrict state access during litigation to limit legal exposure.

Key Takeaways

- Legal conflict: Massachusetts claims Kalshi offered unlicensed sports wagering; Kalshi disputes state jurisdiction.

- Regulatory focus: The case centers on whether the CFTC’s federal oversight preempts state gambling statutes.

- Market impact: Outcomes may influence how prediction markets operate in the U.S. and how other platforms engage with regulators.

Conclusion

This legal dispute places Kalshi at the center of a broader regulatory debate over prediction markets and sports wagering in the U.S. The case will test lines between state gambling laws and federal CFTC authority. Stakeholders should follow court developments and official regulator statements for implications on market access and compliance.

Published: 2025-09-08 | Updated: 2025-09-08