Hedera’s HBAR Climbs 15%, But Diverging Flows Suggest Bulls May Tire Soon

Hedera Hashgraph’s native token, HBAR, has recorded a sharp upswing of nearly 15% over the past week, signaling strong short-term momentum in the market.

However, readings from its daily chart show that a key momentum indicator has formed a bearish divergence with HBAR’s climbing price, raising concerns that the recent gains could be running out of steam.

Hedera’s HBAR Climbs, But Weak Money Flows Threaten the Rally

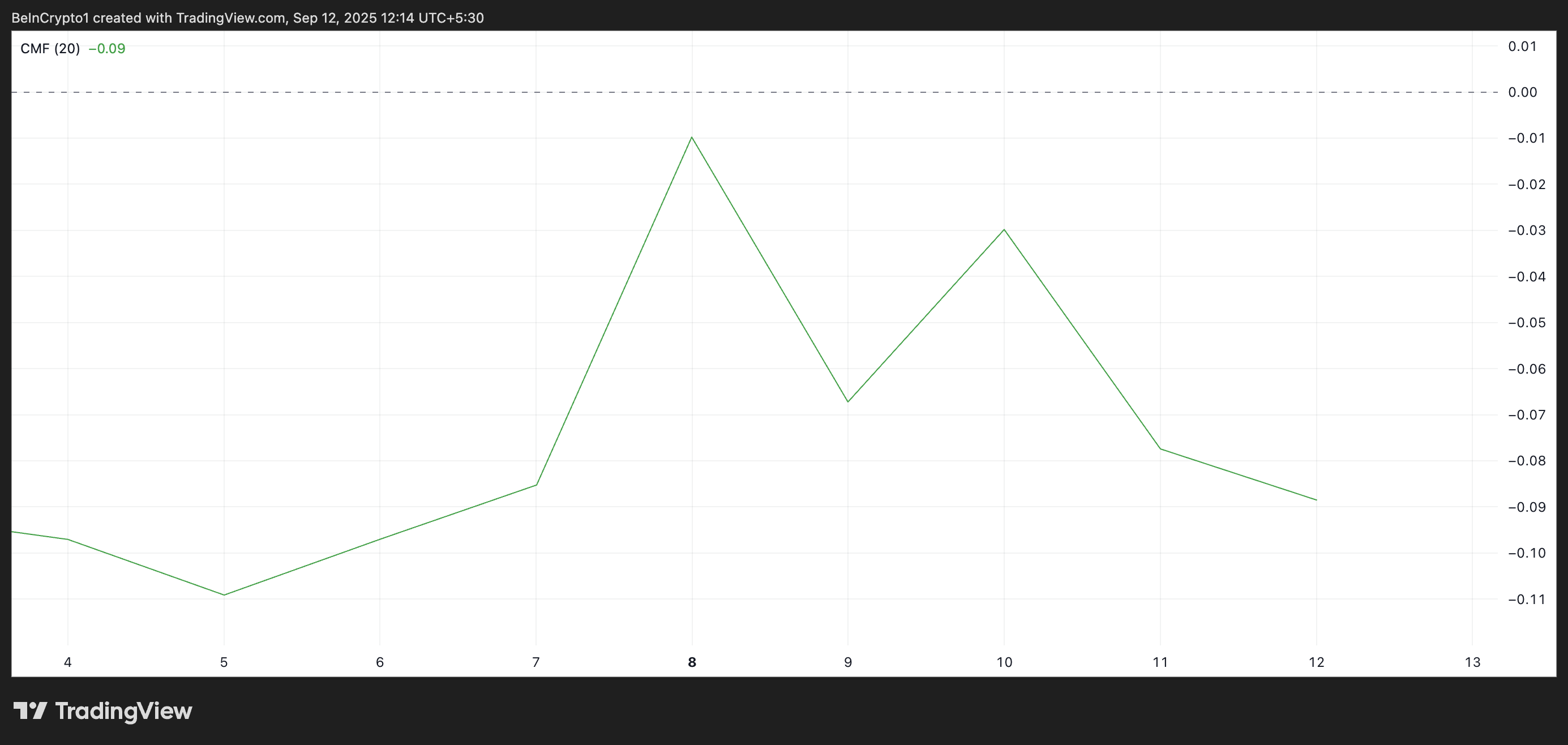

An assessment of the HBAR/USD daily chart shows the Chaikin Money Flow (CMF) trending downward and slipping below the zero line. This comes even as HBAR’s price has climbed nearly 15% over the past week.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The CMF indicator measures how money flows into and out of an asset. This disconnect between rising prices and weakening money flow points to a bearish divergence, indicating that the buying momentum is not fully backing the recent rally.

HBAR’s falling CMF suggests that capital inflows are shrinking despite the price increase. This indicates weakening demand and raises the probability of a near-term pullback, as rallies without strong support are often unsustainable.

Furthermore, HBAR continues to trade below its super trend indicator, adding to the bearish outlook. As of this writing, the super trend line forms dynamic resistance above the token’s price at $0.2527, indicating that sell-side pressure is still dominant.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

When an asset’s price trades below its super trend indicator, selling pressure dominates the market. This could make it harder for HBAR bulls to extend the current rally without a significant breakout.

HBAR Faces Crossroads: Support at $0.2368 or Breakout Above $0.2527?

Once buyer exhaustion sets in, HBAR’s upward momentum could weaken, with a reversal toward the $0.2368 support level likely. A breakdown below this floor could open the way for a deeper decline to $0.2156.

Conversely, if fresh demand enters the market and sustains the rally, HBAR could attempt to break above the dynamic resistance of its super trend indicator at $0.2527. A successful breakout would clear the path for further gains toward $0.2669.

The post Hedera’s HBAR Climbs 15%, But Diverging Flows Suggest Bulls May Tire Soon appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market in "Extreme Fear" as Market Braces for Bitcoin to Drop Towards $80,000

The cryptocurrency market is crowded with investors who have suffered such deep losses that they cannot continue buying in, yet are unwilling to cut their losses.

Arthur Hayes’ New Article: BTC May Drop to 80,000 Before Kicking Off a New Round of “Money Printing” Rally

The bulls are right; over time, the money printer will inevitably go “brrrr.”

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.