Sub-Saharan Africa crypto adoption is rising rapidly, driven by stablecoin flows and real-world retail use amid currency devaluation. Chainalysis reports $205 billion in onchain value (Jul 2024–Jun 2025), with Nigeria and South Africa leading institutional and retail momentum.

-

Stablecoins fuel cross-border and institutional transfers

-

Retail use is focused on payments and dollar access rather than speculative yield

-

Onchain value received reached $205 billion, up 52% year-over-year

Sub-Saharan Africa crypto adoption surges with $205B onchain value and rising stablecoin flows — read how institutions and retail users are adapting. Learn more now.

Published: 2025-09-10 | Updated: 2025-09-10 | Author: COINOTAG

What is driving Sub-Saharan Africa crypto adoption?

Sub-Saharan Africa crypto adoption is driven by a mix of economic pressures and practical use cases: persistent inflation, limited dollar access and a large unbanked population. Stablecoins and peer-to-peer transfers offer real-world solutions, producing rapid onchain growth and increasing institutional interest.

How are stablecoins and institutions shaping crypto adoption in Africa?

Stablecoins account for a rising share of high-value transfers and institutional flows. Chainalysis data shows significant million-dollar stablecoin movements between Africa, the Middle East and Asia.

Nigeria led the region with $92.1 billion in value received over the 12-month reporting period. South Africa’s clearer regulatory framework has encouraged institutions to move from exploration to custody, product offerings and formal market engagement.

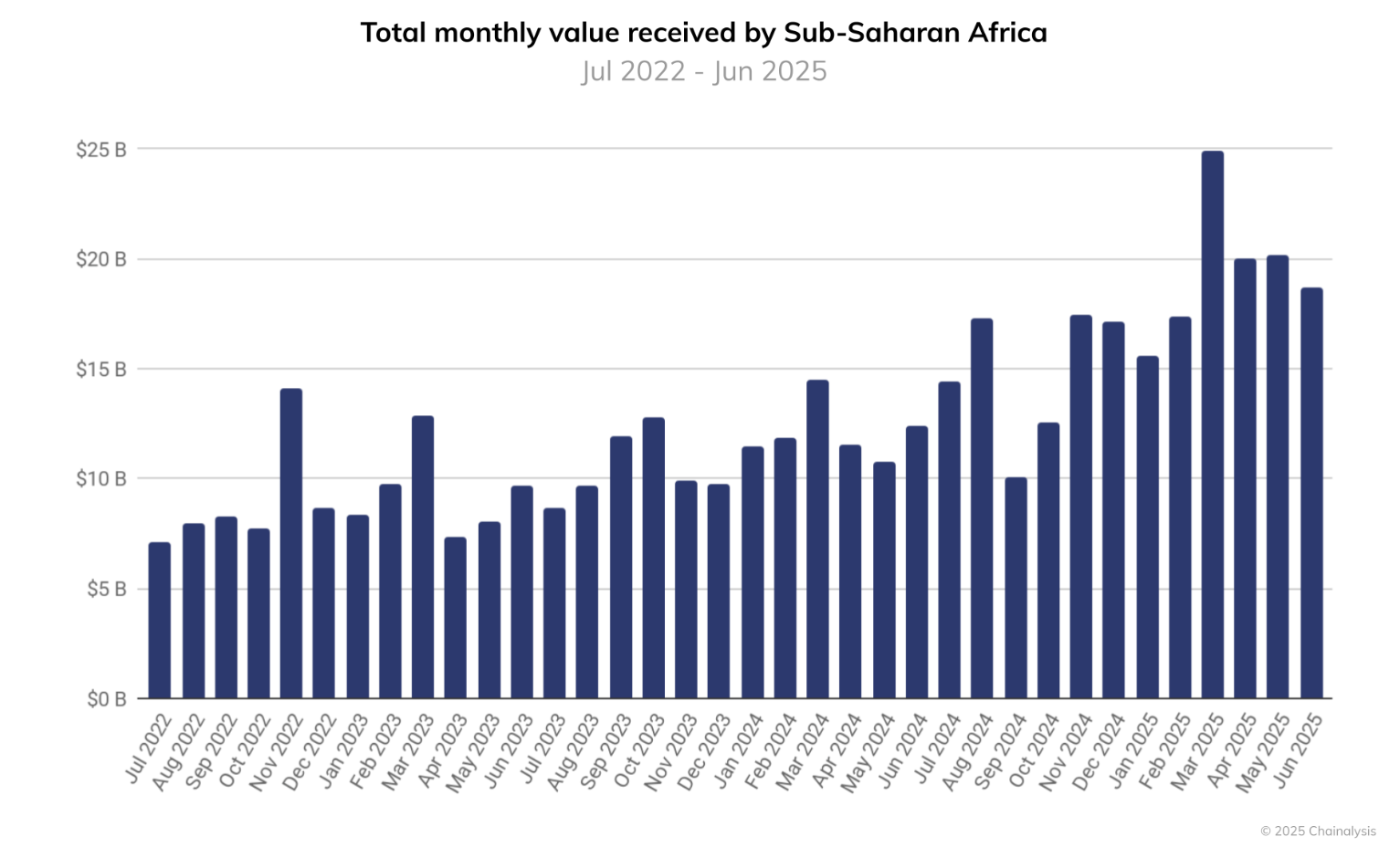

Monthly crypto value received in Sub-Saharan Africa. Source: Chainalysis

Monthly crypto value received in Sub-Saharan Africa. Source: Chainalysis

Regional onchain growth was marked by $205 billion received between July 2024 and June 2025. That figure represents a 52% increase versus the prior year and places Sub-Saharan Africa as the third-fastest growing region for crypto adoption globally.

Why is retail adoption centered on real-world use cases?

Retail crypto use in Sub-Saharan Africa emphasizes practical needs. Over 8% of transfers were $10,000 or less in the reporting period, compared with 6% elsewhere. This highlights a stronger focus on payments, remittances and stablecoin access to dollars.

Local conditions — widespread unbanked populations, volatile local fiat and scarce dollar reserves — make US-pegged stablecoins an attractive tool for everyday transactions and savings protection.

What role do specific countries play in regional momentum?

Nigeria: high population, tech-native youth and currency pressures drove the country to receive $92.1 billion onchain in the year. South Africa: an advanced regulatory framework has accelerated institutional adoption, custody solutions and tailored financial products.

Other markets show growing retail traction with use cases beyond investment, including payments and non-financial blockchain applications such as energy and identity projects.

Frequently Asked Questions

How big is crypto adoption in Sub-Saharan Africa compared to other regions?

Sub-Saharan Africa is the third-fastest growing region for crypto adoption, behind Asia-Pacific and Latin America, driven by a 52% increase in onchain value year-over-year.

What are the most common retail crypto use cases in the region?

Retail users primarily use crypto for payments, remittances and accessing dollar-pegged stablecoins to hedge against local currency volatility.

Key Takeaways

- Rapid growth: $205B onchain value (Jul 2024–Jun 2025), up 52%.

- Stablecoins lead: Drive institutional cross-border flows and retail dollar access.

- Country divergence: Nigeria leads in volume; South Africa leads in regulated institutional markets.

Conclusion

Sub-Saharan Africa crypto adoption is advancing through a mix of stablecoins, institutional interest and pragmatic retail use. Chainalysis data confirms strong onchain growth and distinct regional dynamics. Watch for regulatory developments and product innovation as the market matures.

Source references: Chainalysis report covering July 2024–June 2025; commentary from StarkWare co-founder Eli Ben‑Sasson (quotes and observations). Related: African economies show high potential for digital asset adoption (plain text reference).