Worldcoin’s 110% Rally Faces Cooldown as Market Shows Signs of Exhaustion

Worldcoin’s explosive 110% rally faces cooling risks as overbought signals and surging futures interest warn of looming volatility.

WLD, the cryptocurrency linked to OpenAI CEO Sam Altman, has surged 110% over the past week. The rally follows its recent listing on the Korean exchange Upbit and growing interest from a newly established digital asset treasury, which has poured fresh capital into the token.

However, this dramatic uptick in demand has pushed the market into overheated territory, raising the risk of buyers’ exhaustion. It also suggests that WLD may be at risk of shedding some of its recent gains.

WLD Climbs Fast, But Overbought Indicators Could Trigger Pullback

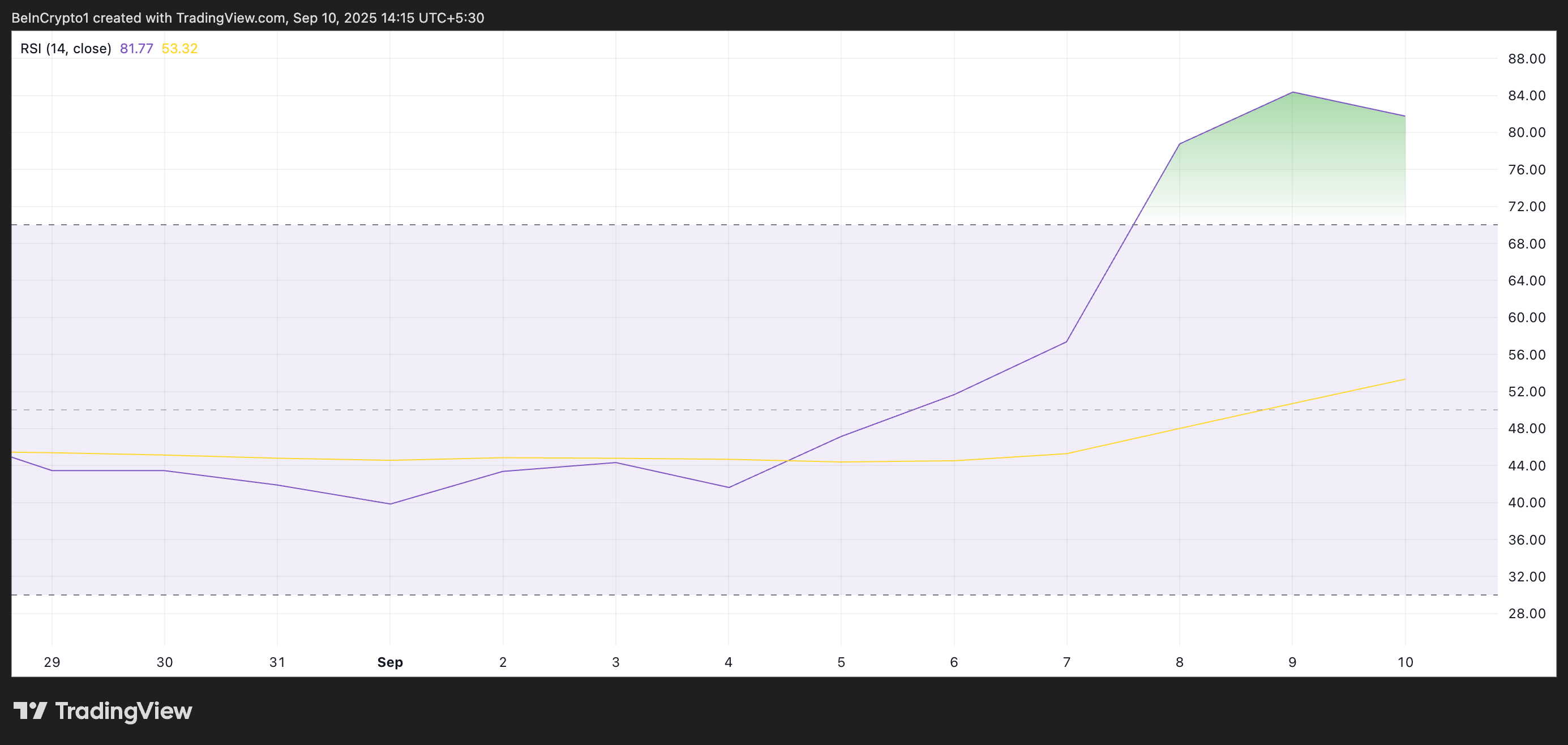

WLD’s Relative Strength Index (RSI), observed on a one-day chart, shows that the asset is overbought, a precursor to short-term pullbacks. At press time, this momentum indicator stands at 81.77.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

WLD RSI. Source:

TradingView

WLD RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

Therefore, WLD’s current Relative Strength Index (RSI) reading signals that the asset faces a potential short-term pullback or consolidation phase, as early investors may take profits and new buyers become hesitant at elevated prices.

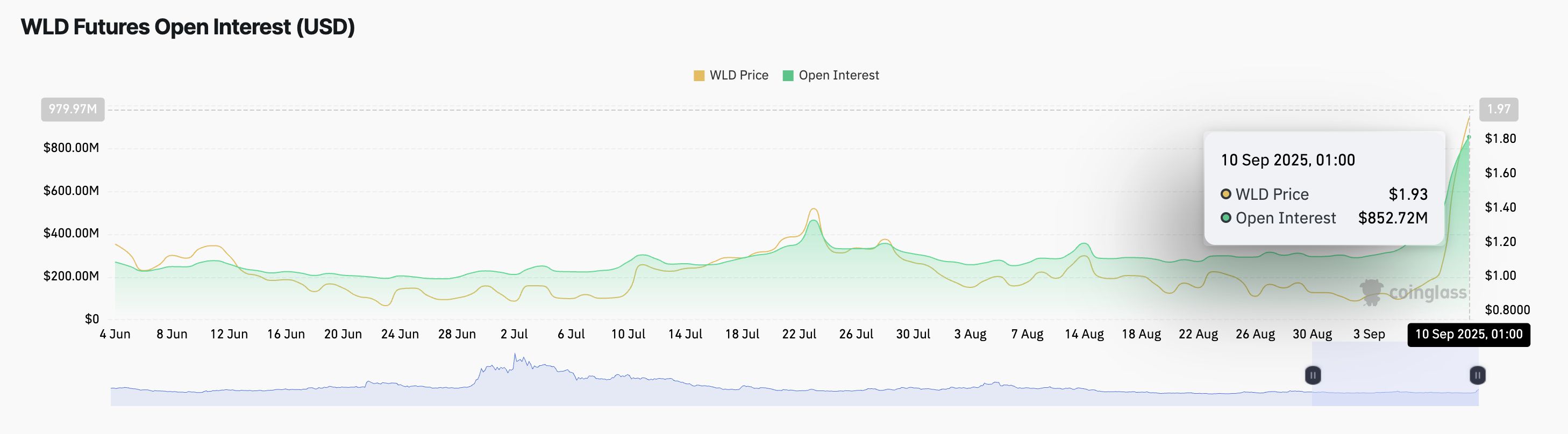

Further, the token’s climbing futures open interest adds to this caution. Per Coinglass, this sits at an all-time high of $852 million, rocketing 18% in the past 24 hours alone. This indicates that speculative activity is intensifying, and the market could be vulnerable to a sharp correction.

WLD Futures Open Interest. Source:

Coinglass

WLD Futures Open Interest. Source:

Coinglass

An asset’s open interest measures the total number of outstanding futures contracts that have not yet been settled, gauging market participation and trader commitment. When it spikes like this, traders are taking everaged positions in the market.

While this can fuel short-term rallies, it also raises the risk of heightened volatility. If WLD traders’ sentiment shifts, the resulting liquidations could make the market vulnerable to a sharp correction.

WLD Climbs Fast, But Bears Could Drag Price to $1.34

Any pullback in WLD’s rally could result in a decline to the support floor at $1.59. Should this level fail to hold, WLD could extend its dip and fall further to $1.34.

WLD Price Analysis. Source:

TradingView

WLD Price Analysis. Source:

TradingView

On the other hand, if demand deepens and buyers gain more strength, they could drive WLD’s price above $1.95 and toward $2.38.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot Weekly Report | Polkadot Hub launches user growth plan! Hydration TVL surpasses $250 millions!

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.