NYDIG Issues Warning on Crypto Treasury Companies, Says ‘Bumpy Ride’ May Be Approaching – Here’s Why

Digital asset investment management firm NYDIG is warning that “a bumpy ride may be ahead” for many crypto treasury companies.

Greg Cipolaro, the global head of research at NYDIG, says in a new analysis that the market conditions of many crypto treasury companies may “deteriorate before they improve” due to share unlocks and narrowing premiums between share prices and the underlying net asset values.

Digital asset treasury companies are publicly-traded companies with a strategy to hold Bitcoin ( BTC ) or other crypto assets on their balance sheets.

“A number of Bitcoin-focused DATs (Digital Asset Treasury companies) still have outstanding mergers or incomplete equity and debt financings. Completing these steps is often a necessary requisite for registering shares, which in turn allows unrestricted public trading of the shares. In many cases, over 95% of the new outstanding shares are tied to these transactions, raising the prospect of a substantial wave of selling once registrations are effective.”

NYDIG also says that the share prices at time of fundraising are lower than the current share values of multiple Bitcoin treasury companies, indicating there may be sell pressure once the shares become tradable without restrictions.

“Complicating matters is the fact that the share prices of these DATs are trading at or even below the price of recent fundraises. Twenty One (CEP) shares are trading below their $21 PIPE (Private Investment in Public Equity) from June (but above their $10 PIPE in April), Nakamoto (NAKA) is trading below their $5 additional PIPE (but above its $1.12 PIPE). ProCap/Columbus Capital (CEP) is trading just above its SPAC (Special Purpose Acquisition Company) and preferred equity raise price and Bitcoin Standard Treasury Co/Cantor Equity Partners (CEPO) is trading just above the price of its equity PIPE. We could easily see shares slip below these key price levels, which might exacerbate selling once shares are freely tradeable.”

Featured Image: Shutterstock/your/S-Design1689

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell admits that a rate cut in December is hard to determine, with officials remaining divided.

The probability of a Federal Reserve rate cut in December remains uncertain, with officials expressing both hawkish and dovish views. This meeting is filled with suspense!

Latin America's Crypto Gold Rush: Seizing Opportunities in Web3 On-Chain Digital Banking

From the perspective of traditional digital banking, Web3 on-chain banks built on blockchain and stablecoin infrastructures will, in the future, meet user needs and serve those populations that traditional financial services cannot reach.

Even major short sellers have started paid groups

Real opportunities only circulate quietly within closed circles.

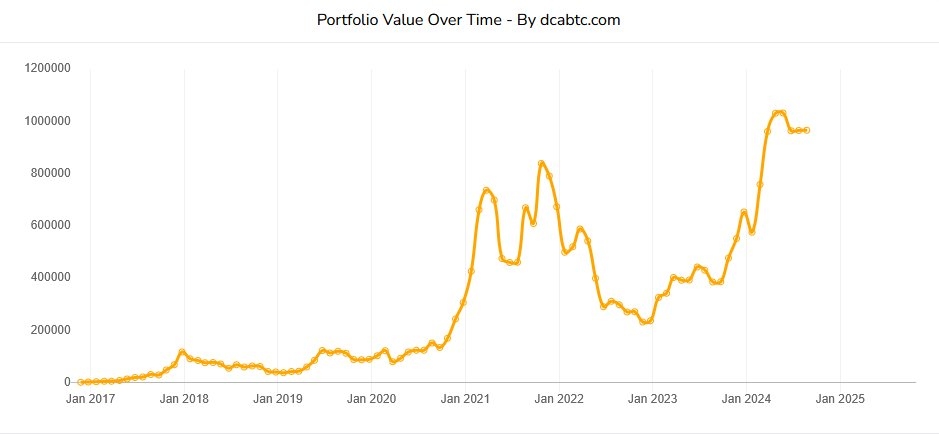

How to Survive the Bitcoin Winter? Investment Strategies, Advice, and Bottom Identification

Bitcoin is an outstanding savings technology for patient investors, but for those who lack patience or are excessively leveraged, it becomes a "wealth-destroying" tool.