World’s ( WLD) Unworldly Price Rally Risks A Pullback, Here Is Why It Could Be A Healthy One

WLD price has rallied sharply, but signals now point to a likely pullback. Profit-taking and overheated RSI warn of cooling, yet strong dip buying and a possible golden cross hint that the correction could remain healthy instead of turning into a full reversal.

Worldcoin (WLD) price sits at $1.85, up 45% in the past 24 hours and over 110% this week. Three-month gains now stand at 50%, lifting yearly returns by 26% after a long stretch of negative performance.

Such rapid gains rarely come without a pause. The signs suggest a pullback is imminent, but other signals point to it being a healthy breather rather than a trend reversal.

Profit-Taking Puts Pressure on the Rally

One red flag comes from the percentage of supply in profit. Between September 7 and 8, the share of WLD in profit jumped from 62.3% to 79.3%. This means nearly 80% of holders are sitting on gains — a setup that usually invites profit-taking.

Exchange flows confirm this: retail and short-term wallets have sent tokens to exchanges, pushing exchange balances up by 2.23%. At $1.83 per token, that rise represents roughly $11 million in potential sell pressure.

Total WLD Supply In Profit Surges:

Santiment

Total WLD Supply In Profit Surges:

Santiment

Meanwhile, whales have been adding. Their holdings climbed from 7.30 million to 7.93 million WLD, a net increase worth about $1.15million.

When compared, the inflows to exchanges exceeded the whale accumulation, resulting in a net selling pressure of over $9.5 million. And that too without taking smart money and top 100 addresses into consideration, as both these cohorts have also dumped over the past 24 hours.

This imbalance explains why the WLD price could stall in the short term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

WLD Buying Pressure Is Fading:

Nansen

WLD Buying Pressure Is Fading:

Nansen

The Relative Strength Index (RSI) adds weight to this view. RSI, which measures whether an asset is overbought or oversold, is now the most overheated since early 2024. That makes a correction likely, though we’ll explore the RSI implications further in the price section below.

Dip Buying Shows Why This Could Be a Healthy Correction

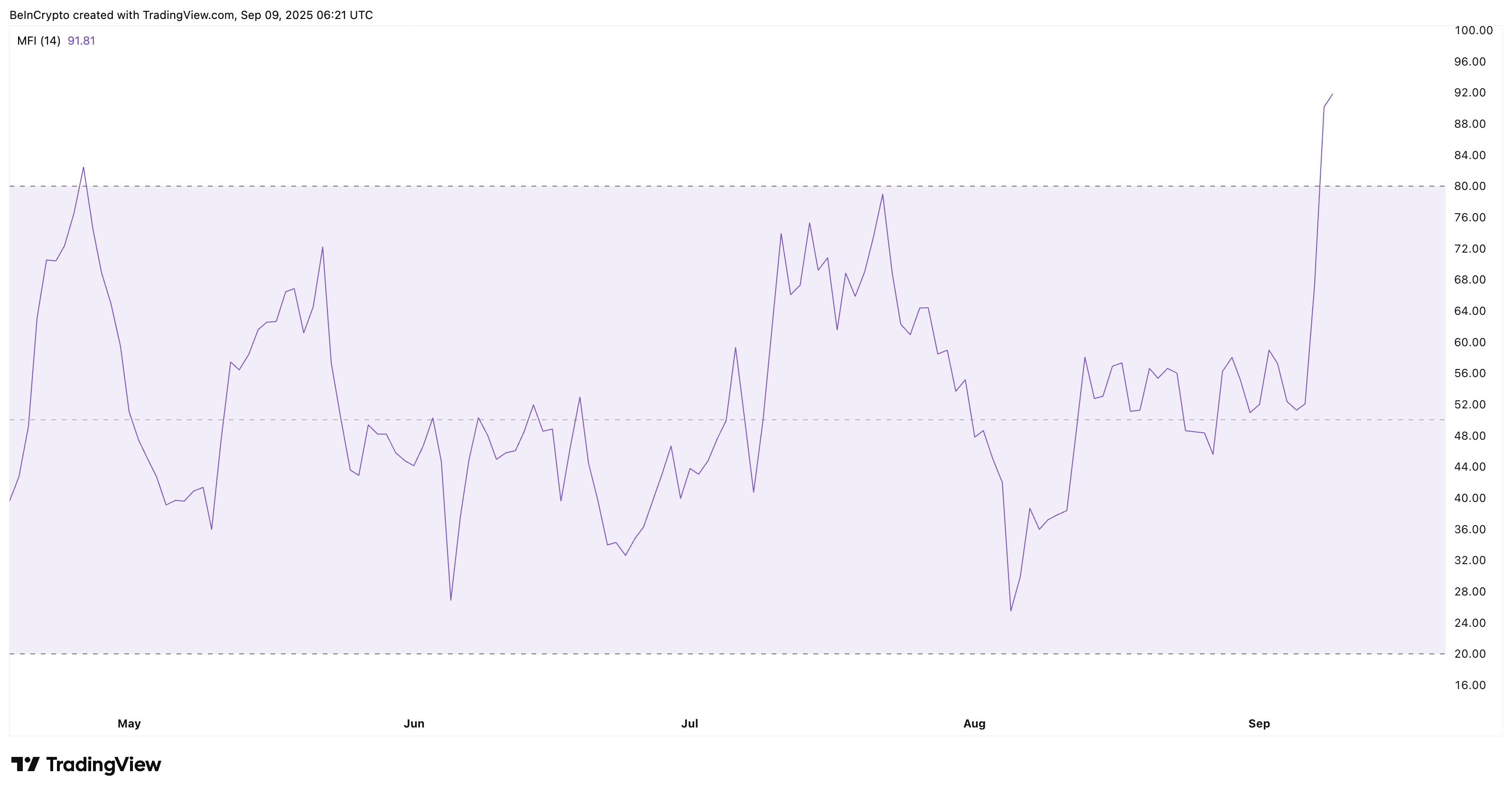

Despite the selling pressure, demand is not absent. The Money Flow Index (MFI), which tracks whether inflows outweigh outflows, has surged to its highest level since early 2024. A rising MFI while price consolidates suggests that buyers — particularly whales — are absorbing every small dip.

Worldcoin Dip Buying Continues

. Source:

TradingView

Worldcoin Dip Buying Continues

. Source:

TradingView

This is important because MFI strength often signals that corrections are shallow. When profit-taking sparks a pullback, dip buyers typically step in quickly to limit downside.

In WLD’s case, this steady inflow means that even if the price cools after its unworldly rally, the correction may not deepen into a collapse. Instead, it looks more like a pause before testing higher levels.

WLD Price Chart Validates a Healthy Pullback

The WLD price chart supports this balanced outlook. As noted earlier, RSI is stretched (in the overbought territory), confirming that a near-term dip is due. However, WLD continues to trade in a bullish setup, as its moving averages are flashing strength.

WLD Price Analysis:

TradingView

WLD Price Analysis:

TradingView

The 50-day Exponential Moving Average (EMA) or the orange line, which reacts faster to price changes, is closing in on the slower 100-day EMA (sky blue line). If the 50-day crosses above, it would form a “golden cross” — a signal often tied to extended bullish trends. Multiple golden crosses in past rallies have preceded days of upside, making this a key structure to watch.

The expectations of the bullish crossover forming during the pullback could add to the “healthy correction” narrative.

For levels, $1.38 remains the nearest strong support. If that breaks, the correction could deepen to $1.06. On the upside, a clean daily close above $1.94 would cancel the pullback scenario altogether, likely pushing the WLD price toward fresh highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot Weekly Report | Polkadot Hub launches user growth plan! Hydration TVL surpasses $250 millions!

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.